The $1000 Average Tax Refund Confirmed For 2026 widely discussed online does not represent a new federal payment. Instead, analysts expect the typical refund issued by the U.S. Internal Revenue Service (IRS) during the 2026 tax filing season to be higher than last year due to inflation adjustments, expanded deductions, and tax-credit calculations affecting 2025 tax returns.

Table of Contents

$1000 Average Tax Refund

| Key Fact | Detail |

|---|---|

| Payment type | Refund of overpaid taxes, not a stimulus check |

| Refund timing | Most refunds issued within ~21 days after e-filing |

| Main drivers | Inflation-adjusted tax brackets, credits, and withholding |

What the “$1000 Average Tax Refund Confirmed For 2026” Actually Means

The phrase gained traction after social media posts suggested a guaranteed government payout. However, the IRS clarifies that refunds are not universal payments. They are reimbursements of excess tax collected during the year.

Throughout the year, employers withhold federal income tax from workers’ paychecks. When taxpayers file annual returns, the IRS compares the amount withheld to actual tax owed. If more was paid than required, the government sends a refund.

In official guidance, the IRS notes that refunds depend on multiple variables including income, filing status, deductions, and credits claimed.

Tax economists explain that the “$1000” figure is not a set payment but an estimated change in the average refund amount compared with the previous filing season.

Why Refunds May Increase in 2026

Inflation Adjustments to the Tax Code

Each year, the U.S. Treasury Department adjusts federal tax brackets and the standard deduction to account for inflation. This prevents taxpayers from being pushed into higher tax rates simply because wages rose alongside prices.

For the 2025 tax year — filed in 2026 — the standard deduction increased again. A higher deduction lowers taxable income, which reduces the total tax owed.

Workers whose employers continued withholding similar amounts throughout the year could therefore receive larger refunds.

Expansion of Credits

Refundable credits remain a central driver of refunds. These include:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Education-related tax credits

The Tax Policy Center reports that refundable credits often provide the largest refund amounts for working families with children.

A refundable credit is particularly significant because taxpayers can receive money back even if their tax liability reaches zero.

Payroll Withholding Behavior

The Government Accountability Office (GAO) has found many workers rarely update withholding forms after changing jobs, getting married, or having children. As a result, some employees consistently overpay taxes.

If deductions rise but withholding does not change, refund amounts increase automatically.

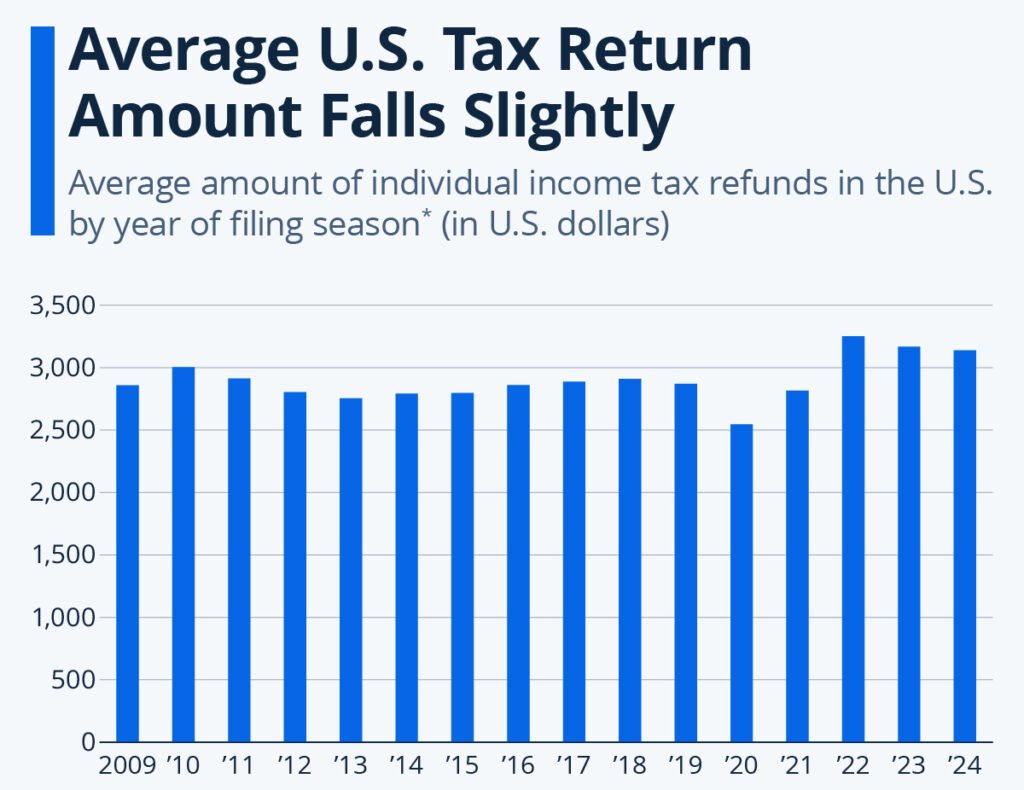

Historical Context: How Refunds Have Changed

Tax refunds have fluctuated over decades due to economic cycles and tax law changes.

After the 2017 Tax Cuts and Jobs Act, withholding tables were redesigned. Many taxpayers initially saw smaller refunds but larger take-home paychecks. During the pandemic, stimulus payments added confusion, with some households mistaking relief payments for tax refunds.

Financial historians note that refunds have long served as a form of forced savings for American households. Surveys by consumer finance organizations show millions of families rely on refunds to pay large annual expenses.

Who Will Benefit Most

Refunds are not distributed evenly across the population.

Higher Refund Likelihood

Groups more likely to see higher refunds:

- Families with children

- Middle-income wage earners

- Workers eligible for refundable credits

Lower Refund Likelihood

Groups less likely:

- Independent contractors

- Gig-economy workers

- Individuals with multiple income streams

Freelancers often owe taxes because no employer withholding occurs during the year.

The IRS warns taxpayers not to assume they will receive a refund. Some may owe money if withholding was too low.

Is This a Stimulus Check?

No. The difference is critical.

Stimulus checks were direct government payments authorized by Congress to boost the economy during emergencies. A tax refund, by contrast, is simply the return of a taxpayer’s own money.

The Financial Industry Regulatory Authority (FINRA) describes large refunds as similar to an interest-free loan to the government because taxpayers could instead adjust withholding and keep more income in each paycheck.

Filing Season Timeline

The IRS typically opens the filing season in late January.

Processing speed depends on filing method:

Fastest:

- Electronic filing

- Direct deposit

Slowest:

- Paper returns

- Mailed checks

Certain credits require extra verification. Federal law delays refunds involving the Earned Income Tax Credit until mid-February to prevent fraud.

Economic Impact of Tax Refunds

Refund season has measurable effects on the U.S. economy.

The Federal Reserve Bank of Chicago has found households commonly use refunds to:

- Pay down debt

- Catch up on rent or utilities

- Purchase durable goods such as appliances

Retail spending often increases in February and March. Economists call this the “refund effect.”

Consumer finance analyst Mark Hamrick of Bankrate said refunds carry strong behavioral significance.

“For many households, it is the single largest payment they receive all year, so spending decisions often cluster around it.”

Risks: Tax Scams and Fraud

The IRS also warns that filing season brings scams.

Common schemes include:

- Fake IRS phone calls

- Phishing emails

- Social media misinformation about payments

The IRS states it does not initiate contact via text message or social media to request personal data. Victims of identity theft may face delayed refunds because the agency must verify returns.

Practical Guidance for Taxpayers

Experts recommend several steps to ensure accurate refunds:

Before Filing

- Gather W-2 and 1099 forms

- Confirm Social Security numbers

- Update banking details

While Filing

- File electronically

- Claim eligible credits

- Double-check deductions

After Filing

- Use the IRS “Where’s My Refund?” tracking tool

- Monitor bank account activity

Tax preparers also suggest adjusting withholding using the IRS withholding estimator to avoid large surprises next year.

International Comparison

Unlike the United States, many countries use automatic tax systems. In the United Kingdom and several Nordic nations, tax authorities pre-calculate tax obligations based on employer reporting.

As a result, large refunds are less common internationally. The U.S. relies more heavily on self-filed annual returns, which increases both refunds and balances owed.

FAQs About $1000 Average Tax Refund

Will everyone receive $1000?

No. It is an estimated average increase, not a fixed payment.

Why do refunds vary so much?

Refunds depend on income, withholding, tax credits, and deductions.

When will refunds arrive?

Most electronic filers receive refunds within about three weeks.

Can someone owe taxes instead?

Yes. Under-withholding during the year can result in a tax bill.

Looking Ahead

Final average refund figures will only be known after most taxpayers submit returns. The IRS advises Americans to rely on official guidance and financial records rather than viral claims when planning household budgets.

Tax officials emphasize that the best outcome is accurate withholding — not necessarily a large refund — because it means taxpayers kept more of their earnings throughout the year.