2026 Direct Deposit Rule Changes: The phrase “2026 Direct Deposit Rule Changes Could Quietly Shift When Your Tax Refund Arrives” sounds like dry government policy talk — but in real life, it means something simple: your refund might not show up when you expect it. Not because the IRS is slow, not because your tax preparer messed up, and not because you owe more tax — but because the payment system itself changed. I’ve helped folks file returns at community tax clinics and small accounting offices for years. Every season, I hear the same thing: “I ain’t worried about taxes — I just want my refund.” Around the U.S., refunds pay for car repairs, rent deposits, daycare bills, and sometimes groceries for the next month. So when the money shows late, panic starts fast. The 2026 rule changes don’t reduce refunds, but they absolutely can move your payday.

Table of Contents

2026 Direct Deposit Rule Changes

The 2026 Direct Deposit Rule Changes Could Quietly Shift When Your Tax Refund Arrives represents a payment system upgrade, not a tax increase. The IRS is moving from a mailing-based refund system to a verification-based digital system. That means the speed of your refund now depends less on when you file and more on how accurate your information is. The fastest refund in 2026 won’t go to the earliest filer. It will go to the filer who prepared carefully. Get your numbers right, verify your identity, and your refund will come quick. Miss a detail — and you could be waiting a month wondering what happened.

| Topic | What Changed | Why It Matters |

|---|---|---|

| Direct Deposit Policy | IRS verifies banking info before releasing refund | Prevents fraud but can freeze payment |

| Incorrect Account Info | Refund paused instead of mailed automatically | 4–6 week delay possible |

| Average Refund Time | 21 days (e-file + valid deposit) | Fastest refund method |

| EITC/ACTC Credits | Mandatory federal hold | Refund after mid-February |

| Identity Verification | Some taxpayers must verify identity online | Prevents stolen refunds |

What Are 2026 Direct Deposit Rule Changes?

Before 2026, a rejected direct deposit was treated like a mailing error. The IRS would automatically send a paper check.

Now the system works differently:

If your bank rejects the deposit, the IRS freezes the refund.

They no longer automatically print and mail a check right away. Instead, they wait for you to update your banking information.

That means your return may be approved — yet your money isn’t moving.

Why the IRS 2026 Direct Deposit Rule Changes?

The short answer: identity theft tax fraud.

Refund fraud exploded after the stimulus payment years. Criminals filed fake returns using stolen Social Security numbers and directed refunds to prepaid cards and digital banks.

So the IRS upgraded its system.

Now, wrong banking information is treated as a potential fraud signal.

It’s basically the IRS saying:

“We’d rather delay your refund than let a criminal steal it.”

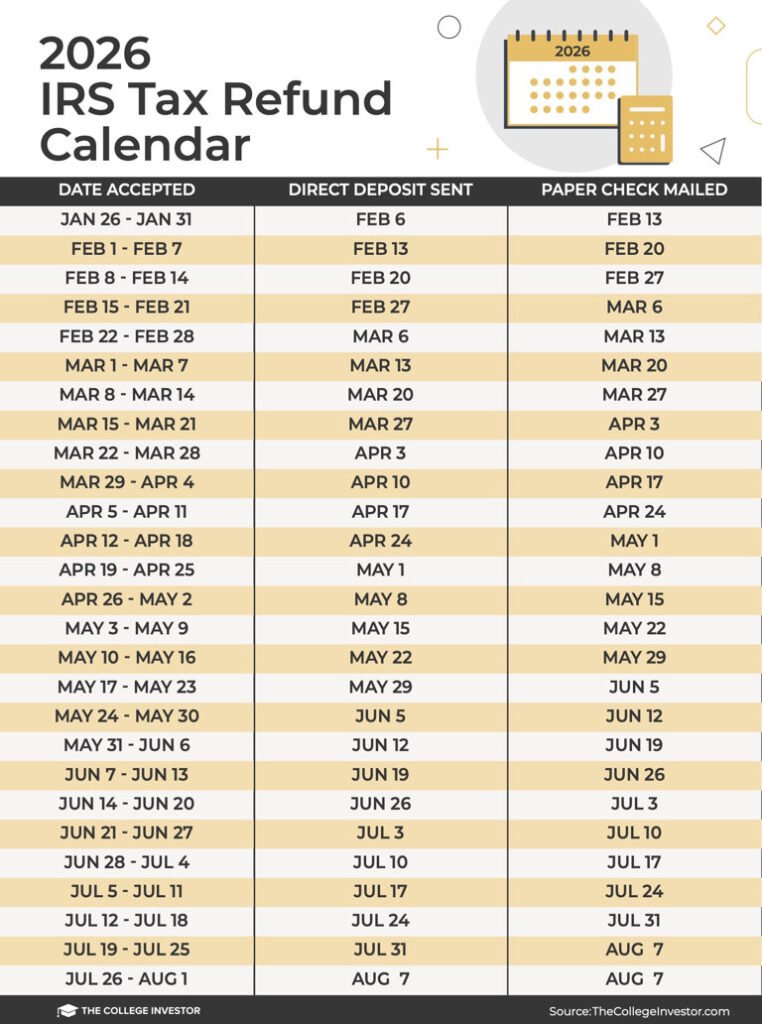

The New Refund Timeline (Realistic Calendar)

If Everything Is Correct

- E-file return

- Correct bank account

- No flags

Refund: about 21 days

If Banking Info Is Wrong

Refund: 4–6+ weeks

If Claiming Child Tax Credits (Very Common)

Refund: late February or early March due to federal law review.

How You Know Your Refund Is Frozen?

Watch for these warning signs:

- “Refund Sent” but no bank deposit

- IRS notice CP53E

- IRS website shows “Processing” for over 21 days

- Bank says deposit rejected

The Biggest Mistake Americans Will Make in 2026

Using a temporary bank account.

This includes:

- prepaid tax refund cards

- closed accounts

- Cash App / app-based accounts that changed routing numbers

- switching banks after filing

One wrong digit in your routing number can delay your refund a month.

Step-By-Step Guide to Get Your Refund Fast

Step 1 — E-File

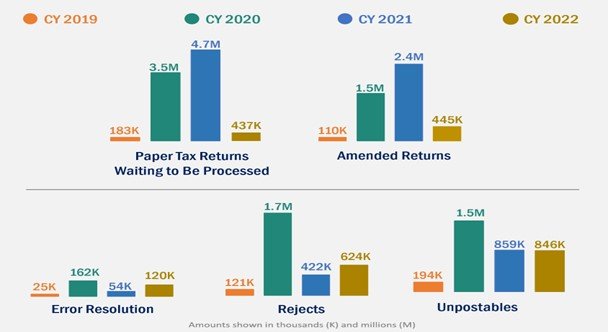

Paper returns take 6–9 weeks.

Step 2 — Verify Your Bank Account

Open your bank app.

Copy the routing number directly.

Do NOT reuse last year’s info.

Step 3 — Match Your Name Exactly

The account holder name must match your tax return.

Step 4 — File Early

January filers get processed faster. March filers wait longer because IRS workload spikes.

Step 5 — Track Daily

The IRS updates refund status overnight.

Identity Verification — The New 2026 Reality

Some taxpayers will receive a letter asking them to verify identity.

You must confirm at:

https://www.idverify.irs.gov

Until you do, the IRS will not release your refund.

This is the #1 reason refunds are delayed in recent years.

State Refunds May Also Be Delayed

Many states copy IRS systems.

So if your federal refund is frozen, your state refund might pause too.

Examples:

- California

- New York

- Illinois

State agencies often wait for IRS confirmation before paying.

Advice for Tax Professionals & Preparers

If you’re a tax preparer, start telling clients:

“Refund date depends on banking accuracy now.”

Best practices:

- verify routing numbers

- confirm account ownership

- warn about prepaid cards

- avoid splitting deposits

This one change will generate most client complaints in 2026.

Financial Planning: What to Do With the Refund

Instead of spending immediately, consider the “50-30-20 refund rule”:

- 50% necessities (rent, debt)

- 30% savings/emergency fund

- 20% wants

Even $300 saved can prevent payday loan dependence later.

New IRS Rules Could Change How Millions Claim Tax Benefits in 2026

IRS Tax Refund 2026 Step By Step Tracking Guide Payment Dates And Timeline

IRS Signals Exceptionally Large Tax Refunds This Year — Why Millions Could See Bigger Checks