For many households, the first days of the month come with one familiar routine: checking the bank account early in the morning. A large number of seniors and disabled individuals organize their entire monthly budget around one deposit.

The $967 Social Security Payment going out today is more than just another government benefit for some people, it is the difference between stability and financial stress. Rent payments, electricity bills, and even necessary medications often depend on that single monthly transfer. The $967 Social Security Payment has become increasingly important in 2025 as everyday living costs continue to rise. Food prices, healthcare expenses, and housing costs have increased faster than many fixed incomes. Because of that, programs like Supplemental Security Income help people who have little or no earnings stay financially afloat. Still, confusion remains about who actually qualifies and why some recipients receive the full amount while others do not.

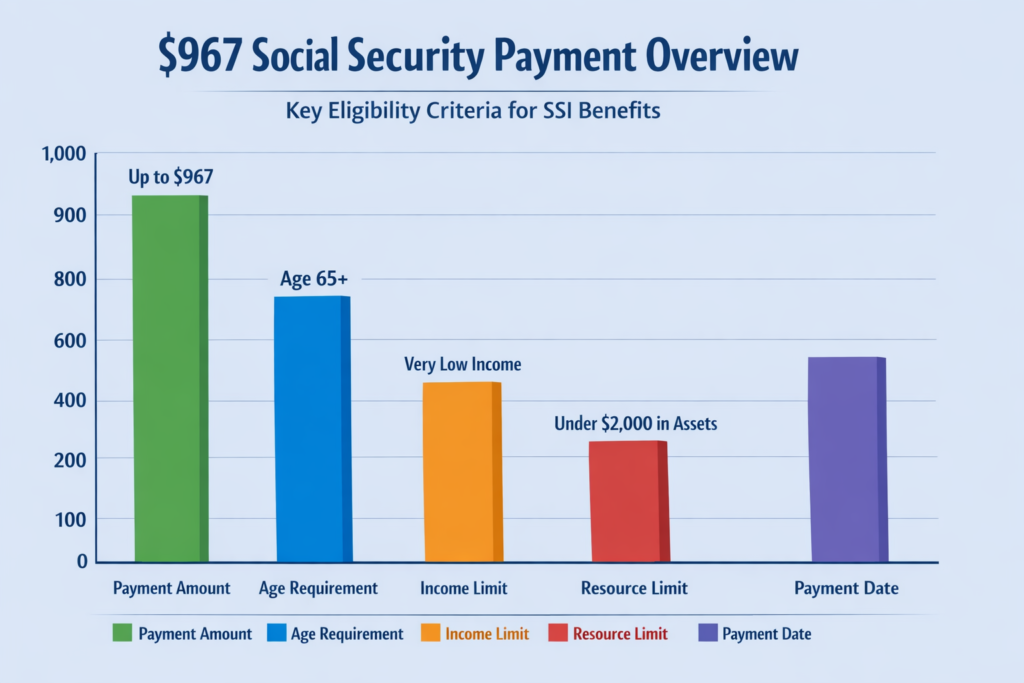

The $967 Social Security Payment represents the maximum monthly Supplemental Security Income benefit an individual can receive this year under federal guidelines. It is not a retirement benefit and does not depend on work history. Instead, it is a needs-based program managed by the Social Security Administration. The amount a person receives depends on income, living situation, and available financial resources. If you are expecting the $967 Social Security Payment, the money is usually delivered through direct deposit or a Direct Express debit card at the beginning of the month.

Table of Contents

$967 Social Security Payment

| Key Detail | Information |

|---|---|

| Payment Amount | Up to $967 monthly |

| Program | Supplemental Security Income (SSI) |

| Agency | Social Security Administration |

| Eligibility | Low-income seniors (65+), blind, or disabled individuals |

| Resource Limit | $2,000 individual / $3,000 couple |

| Payment Method | Direct deposit, Direct Express card, or check |

| Payment Date | Typically 1st of each month |

| Purpose | Basic living support such as food, shelter, and clothing |

The $967 Social Security Payment going out today provides essential financial support for people who need it most. Although the maximum payment is fixed, each recipient’s amount depends on income, resources, and living situation. Understanding how the system works helps avoid confusion and ensures you receive the correct benefit. If your payment is late, do not panic. Most issues are resolved quickly once your bank information and eligibility details are confirmed. By keeping your records updated and reporting life changes promptly, you can continue receiving benefits without interruption.

Who Qualifies for the $967 Social Security Payment

The $967 Social Security Payment comes from the Supplemental Security Income program, commonly known as SSI. This program is very different from retirement Social Security benefits. Retirement payments depend on how long you worked and how much you paid into payroll taxes. SSI, on the other hand, focuses on financial need.

You may qualify if you fall into one of these groups:

- Adults age 65 or older with very limited income

- Individuals considered legally blind

- Adults with a long-term disability that prevents substantial employment

- Disabled children living in low-income households

A person does not need any work history to qualify. That surprises many people. Someone who never held a traditional job may still receive the $967 Social Security Payment if their medical and financial situation meets the requirements. The Social Security Administration reviews both medical documentation and financial records. Applicants must provide proof of disability or age and details about bank accounts, assets, and income sources. The process may take time, but once approved, payments become consistent each month.

Income And Resource Limits

The most important factor in SSI eligibility is financial need. The government uses strict limits to determine who receives benefits and how much they receive.

Resource limits are:

- $2,000 for an individual

- $3,000 for a married couple

Resources include savings accounts, investment accounts, and property other than your main residence. However, several important items are excluded. Your primary home is not counted. One vehicle is usually excluded. Personal belongings and household furniture are also ignored. Income matters just as much. The Social Security Administration evaluates both earned and unearned income. Wages from part-time work, pensions, unemployment benefits, or even consistent financial help from relatives can reduce your $967 Social Security Payment. For example, if you earn small wages from part-time employment, the SSA subtracts a portion of those earnings from the federal benefit amount. Instead of the full payment, you might receive $600 or $700. The program is designed to supplement income, not replace higher earnings.

Payment Schedule And Delivery

The $967 Social Security Payment follows a predictable schedule. SSI benefits are generally issued on the first day of every month. When that date falls on a weekend or federal holiday, the payment is sent on the last business day before it.

There are three ways to receive the payment:

- Direct deposit into a bank account

- Direct Express debit card

- Paper check through the mail

Direct deposit is by far the fastest option. Most recipients see the money appear early in the morning. Paper checks take longer and can be delayed due to postal delivery times. If you recently changed banks, your payment may take an extra day to appear while financial institutions process the update.

How The Amount Is Determined

Many people assume everyone receives the same payment, but the $967 Social Security Payment is only the maximum possible amount. The Social Security Administration calculates each recipient’s actual benefit individually.

The final payment depends on:

- Countable income

- Living arrangements

- Marital status

- State supplements

For instance, if someone else pays for your housing or meals, Social Security may reduce your benefit because your basic needs are partially covered. Some states also provide additional monthly assistance on top of federal SSI, which means your total benefit may be slightly higher than the base amount.

How To Check Your Payment Status

If you expected a deposit today but did not see it, there are simple ways to verify the situation.

- First, log into your online Social Security account. The portal shows payment history, deposit dates, and benefit amounts. Second, check your bank or debit card transaction history. Sometimes the deposit is pending rather than missing.

- You can also call the Social Security Administration directly. Representatives can confirm whether your $967 Social Security Payment was issued and whether there is any problem with your account details.

What To Do If You Don’t Receive It

Occasional delays happen. Banks sometimes process deposits at different times, and administrative reviews can slow payments.

Before contacting Social Security, take these steps:

- Wait one full business day

- Verify your bank information

- Contact your bank or card provider

If the payment still does not arrive, call Social Security. In many cases the issue is a recently changed bank account or identity verification review. The $967 Social Security Payment is rarely lost. Most missing payments are simply delayed.

Tips To Avoid Payment Delays

Recipients often forget they must report life changes. Keeping your information updated is essential to receiving benefits on time.

You should report:

- Address changes

- Marriage or divorce

- New employment

- Bank account changes

- Changes in living arrangements

Failure to update this information may temporarily suspend benefits. In some cases, Social Security may issue an overpayment notice, requiring repayment later. Reporting changes early helps your $967 Social Security Payment continue smoothly.

Why This Payment Matters

For many Americans, SSI is not supplemental income it is primary income. The payment covers everyday necessities. Without it, many recipients would struggle to meet even basic living costs.

The benefit commonly helps pay for:

- Rent and housing

- Utility bills

- Groceries

- Transportation

- Prescription medication

Rising inflation has made the $967 Social Security Payment even more critical in 2025. Seniors and disabled individuals often live on fixed incomes, meaning they cannot easily increase earnings to keep up with rising prices. This monthly benefit ensures a minimum level of financial security.

FAQs About $967 Social Security Payment

1. Who qualifies for the $967 Social Security Payment

Low-income seniors, blind individuals, and disabled adults or children who meet SSI income and resource requirements may qualify.

2. Is this the same as retirement Social Security

No. Retirement benefits are based on work history and payroll taxes, while SSI is a need-based assistance program.

3. Why did I receive less than $967

Your income, savings, housing support, or other financial help can reduce the monthly benefit.

4. When should I expect the payment each month

The deposit is typically issued on the first day of the month or the previous business day if the first falls on a weekend or holiday.