Social Security has always been more than just a government program. For millions of Americans, it represents stability, independence, and dignity after decades of work. That is why A New Social Security Bill Could Add $200 a Month in 2026, Here’s Why It’s Gaining Support has sparked so much attention nationwide.

At a time when everyday expenses continue to climb, retirees are paying close attention to any proposal that promises meaningful financial relief. The growing interest in A New Social Security Bill Could Add $200 a Month in 2026, Here’s Why It’s Gaining Support reflects a deeper concern shared by seniors, workers nearing retirement, and even younger generations. Many people feel that Social Security benefits have not kept up with the real cost of living. This bill, which proposes a permanent monthly increase, is being seen as a potential turning point in how retirement income is protected in the years ahead.

The proposal at the center of A New Social Security Bill Could Add $200 a Month in 2026, Here’s Why It’s Gaining Support aims to provide a flat $200 increase in monthly benefits beginning in 2026. Unlike annual cost of living adjustments, this would permanently raise the base benefit amount for eligible recipients. Supporters argue that this structure offers long term relief rather than short term fixes that lose value over time. What makes this proposal especially appealing is its simplicity. Instead of targeting only specific income groups, the increase would apply broadly to retirees, disabled workers, and qualifying dependents. For many households living on fixed incomes, an extra $200 each month could make the difference between barely getting by and having a small financial cushion.

Table of Contents

A New Social Security Bill Could Add $200 a Month in 2026

| Category | Details |

|---|---|

| Monthly Benefit Increase | $200 |

| Expected Start Year | 2026 |

| Eligible Recipients | Retirees disabled workers dependents |

| Type Of Increase | Permanent base benefit boost |

| Primary Goal | Address rising living costs |

| Funding Direction | Payroll tax changes for higher earners |

Why The Proposal Is Gaining Momentum

- One of the strongest reasons A New Social Security Bill Could Add $200 a Month in 2026 Here’s Why It’s Gaining Support is gaining traction is timing. Inflation may have slowed compared to recent peaks, but prices for essentials remain high. Seniors often spend a larger portion of their income on healthcare, housing, and utilities, areas where costs continue to rise steadily.

- Another factor driving momentum is public sentiment. Surveys consistently show that Americans across age groups support strengthening Social Security rather than reducing benefits. Lawmakers are increasingly aware that voters view Social Security as earned income, not welfare. This proposal aligns with that belief by reinforcing the program instead of trimming it.

How The $200 Increase Would Affect Retirees

- The practical impact of A New Social Security Bill Could Add $200 a Month in 2026 Here’s Why It’s Gaining Support becomes clear when looking at real world budgets. For someone receiving $1,600 per month, a $200 increase represents a noticeable improvement. Over a year, that amounts to $2,400 in additional income.

- This extra money could help retirees cover rising Medicare premiums, prescription drug costs, or property taxes. It may also reduce reliance on credit cards or savings. While the amount may seem modest at first glance, for fixed income households it can significantly ease financial stress.

The Cost Of Living Adjustment Problem

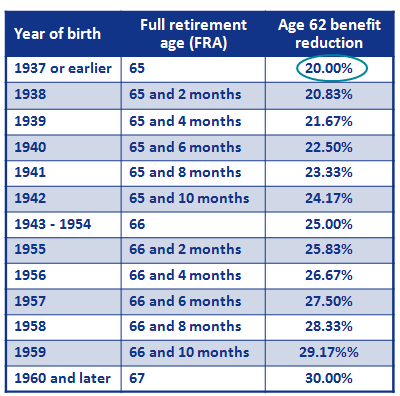

- One reason A New Social Security Bill Could Add $200 a Month in 2026 Here’s Why It’s Gaining Support resonates so strongly is dissatisfaction with current cost of living adjustments. COLAs are designed to protect benefits from inflation, but many retirees feel they fall short. The inflation index used does not fully capture senior spending patterns, especially healthcare expenses.

- As a result, benefits often lag behind actual costs. A permanent increase would reset benefit levels, giving future COLAs a stronger base. Supporters believe this approach addresses the root of the problem rather than applying temporary patches year after year.

How Lawmakers Plan to Pay for It

- Funding is the most debated aspect of A New Social Security Bill Could Add $200 a Month in 2026 ,Here’s Why It’s Gaining Support. Most proposals suggest adjusting payroll taxes for higher income earners. Currently, income above a certain threshold is not subject to Social Security taxes, which critics argue places an unfair burden on middle income workers.

- By modifying this cap, supporters believe the program could generate sufficient revenue to fund the increase while improving long term financial stability. While tax changes are always politically sensitive, polling suggests broad support for asking higher earners to contribute more to preserve Social Security.

Impact On Social Security’s Long-Term Stability

- Concerns about the trust fund naturally arise whenever benefits are expanded. Critics warn that A New Social Security Bill Could Add $200 a Month in 2026, Here’s Why It’s Gaining Support could strain finances if revenue projections fall short. Supporters counter that the proposed funding mechanisms are designed to offset the added costs.

- They also emphasize that doing nothing carries risks. Without reforms, future retirees could face automatic benefit reductions once reserves are depleted. From this perspective, the bill is viewed as a proactive step toward long term sustainability.

Public And Political Support

- Public backing plays a major role in why A New Social Security Bill Could Add $200 a Month in 2026 Here’s Why It’s Gaining Support continues to advance. Advocacy groups representing seniors, disabled individuals, and workers have voiced strong approval. Many Americans see the proposal as recognition that Social Security should provide a basic level of comfort, not just survival.

- Politically, the issue cuts across party lines. While disagreements exist over funding details, few lawmakers openly oppose strengthening benefits. This shared ground has helped keep the proposal alive in ongoing discussions.

What Happens Next After New Social Security Bill

- The future of A New Social Security Bill Could Add $200 a Month in 2026, Here’s Why It’s Gaining Support will depend on negotiations, revisions, and legislative priorities. The bill may be adjusted, delayed, or combined with other Social Security reforms before reaching a final vote.

- For beneficiaries and workers alike, staying informed is essential. Even if the final version differs from the current proposal, the momentum behind it signals a broader shift toward benefit protection.

Why This Proposal Matters For Future Retirees

- Beyond immediate relief, A New Social Security Bill Could Add $200 a Month in 2026, Here’s Why It’s Gaining Support carries implications for future retirees. Younger workers watching this debate are gaining insight into how Social Security may evolve. A stronger benefit structure today can set a precedent for continued improvements tomorrow.

- This proposal also reinforces the idea that Social Security should adapt to economic realities rather than remain static. As lifespans increase and retirement lasts longer, benefit adequacy becomes even more critical.

FAQs on A New Social Security Bill Could Add $200 a Month in 2026

Who Would Qualify for the $200 Monthly Increase

The proposal is designed to apply broadly. Eligible recipients would likely include retired workers, disabled individuals receiving Social Security Disability Insurance, and qualifying dependents.

When Would The $200 Increase Start

Current proposals point to 2026 as the target start year. However, the exact timing could change depending on legislative negotiations, funding decisions, and how quickly the bill moves through Congress.

Is This Increase the Same as A Cost-of-Living Adjustment

No, this proposal is different from an annual cost of living adjustment. The $200 increase would permanently raise the base benefit amount. Future cost of living adjustments would then be calculated on top of this higher base.

How Would the Increase Be Funded

Most versions of the proposal focus on adjusting payroll taxes for higher income earners. This could involve raising or modifying the income cap so that earnings above a certain level contribute more to Social Security funding.