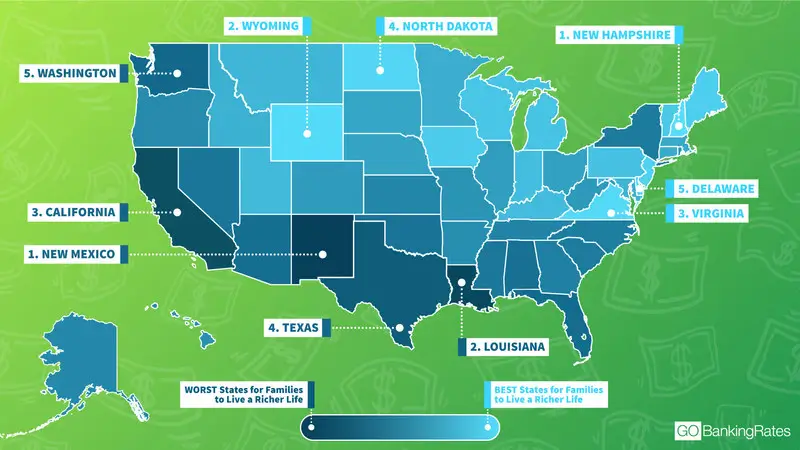

Choosing where to spend your later years is one of the most important financial and lifestyle decisions you will ever make. The best and worst states for retirement can dramatically affect how long your savings last, how easily you access healthcare, and even how happy you feel day-to-day. Many people assume retirement planning ends with a pension or 401(k), but location often matters just as much as money.

The best and worst states for retirement differ in taxes, housing prices, insurance costs, and climate and those differences can quietly add or subtract thousands of dollars every year. In 2026, retirees are moving more than ever before. Rising living costs in big cities and higher property taxes are pushing older Americans toward more affordable states. At the same time, better telehealth access and improved infrastructure mean retirees are no longer limited to major metropolitan areas. Understanding which places offer comfort and financial stability can help you avoid costly mistakes and enjoy a truly stress-free retirement lifestyle.

When experts evaluate retirement locations, they don’t just look at sunshine and beaches. A proper comparison examines taxes on retirement income, cost of housing, healthcare quality, and overall affordability. A good retirement state stretches fixed income further while still providing hospitals, social opportunities, and manageable weather. A poor retirement state typically drains savings through property taxes, insurance, or expensive everyday living costs. These retirement living comparisons also consider safety, access to doctors, and availability of senior communities. The goal is simple: identify places where retirees can live comfortably without constantly worrying about expenses.

Table of Contents

Best and Worst States for Retirement

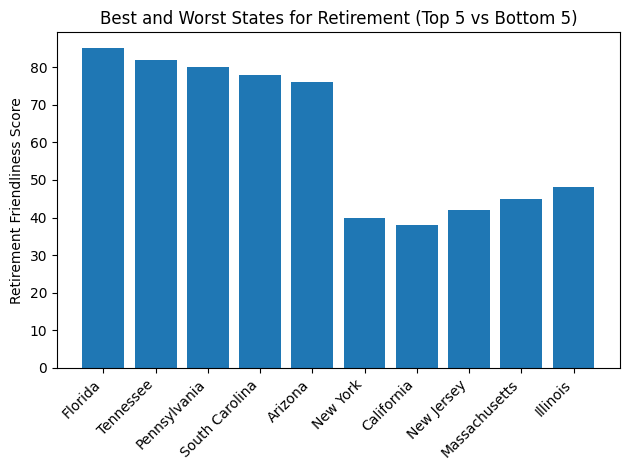

| Category | State | Major Advantage | Retirement Income Taxes | Affordability | Healthcare Access |

|---|---|---|---|---|---|

| Top 1 | Florida | No state income tax | None | Moderate | Strong |

| Top 2 | Tennessee | Low housing cost | None on wages | Low | Average |

| Top 3 | Pennsylvania | No tax on retirement income | None | Moderate | Strong |

| Top 4 | South Carolina | Low property tax | Low | Low | Good |

| Top 5 | Arizona | Active lifestyle climate | Moderate | Moderate | Good |

| Bottom 1 | New York | High living cost | High | Very Expensive | Excellent |

| Bottom 2 | California | Housing prices | High | Very Expensive | Excellent |

| Bottom 3 | New Jersey | Property tax burden | High | Expensive | Strong |

| Bottom 4 | Massachusetts | Cost of living | High | Expensive | Excellent |

| Bottom 5 | Illinois | Tax pressure | High | Moderate | Average |

The best and worst states for retirement are not only about beaches or scenery. They are about financial stability, access to doctors, and everyday comfort. A state with lower taxes and reasonable housing allows retirees to focus on hobbies, family, and travel instead of bills. Relocating after retirement may feel overwhelming, but many retirees discover that moving to a more affordable state significantly improves quality of life. A well-chosen location turns retirement from a budgeting exercise into a genuinely enjoyable chapter of life.

How We Ranked the States

To identify the best and worst states for retirement, analysts compared five practical factors retirees deal with daily:

- State taxes on Social Security and pensions

- Median home prices and rent

- Healthcare availability and hospital quality

- Utility and insurance costs

- Weather comfort and livability

Recent migration reports show retirees are prioritizing affordability more than climate. Over the past year, more retirees moved to southern states than coastal urban states, largely because fixed incomes struggle to keep up with inflation and rising housing costs.

The Top 5 Best States for Retirement

1. Florida

- Florida consistently appears in every best and worst states for retirement analysis for a simple reason: no state income tax. Social Security, pensions, and retirement withdrawals remain untouched. That alone can save retirees several thousand dollars annually.

- Healthcare access is also strong because nearly a quarter of residents are over age 65. Senior communities, walkable neighborhoods, and year-round outdoor activities make it easy to stay active. Insurance costs have increased in coastal regions, but inland cities still remain affordable retirement destinations.

2. Tennessee

- Tennessee is increasingly popular among retirees leaving expensive northern states. Housing prices are significantly lower than the national average, and everyday costs — groceries, utilities, and transportation — are manageable.

- Another advantage is minimal taxation on retirement income. The mild climate and slower pace of life attract retirees looking for financial comfort without isolation. Many relocation experts now list Tennessee as one of the most affordable retirement states in the country.

3. Pennsylvania

- Pennsylvania is one of the most overlooked locations in the best and worst states for retirement comparison. The state does not tax retirement income, including Social Security and pensions.

- In addition, retirees benefit from excellent hospital systems and small cities where housing remains affordable. Winters are colder, but lower taxes often outweigh the seasonal weather concerns.

4. South Carolina

- South Carolina offers a coastal retirement lifestyle without coastal-state prices. Property taxes are low, and retirees receive tax deductions on retirement income.

- The climate is warm but not extreme, making it comfortable for most of the year. Many retirees from the Northeast relocate here because they can sell expensive homes and purchase property outright, eliminating mortgage payments entirely.

5. Arizona

- Arizona remains a favorite in retirement relocation guides. The dry climate is comfortable for people with arthritis and respiratory conditions, and the state offers abundant recreation opportunities.

- Although housing costs have risen, they remain reasonable compared to western coastal states. Active adult communities and strong healthcare networks make Arizona a practical retirement choice.

The Bottom 5 Worst States for Retirement

1. New York

- New York ranks poorly in many best and worst states for retirement studies due to high housing and property taxes. Even modest homes carry heavy yearly tax bills.

- While healthcare and cultural opportunities are outstanding, retirees on fixed incomes often find expenses difficult to manage.

2. California

California offers perfect weather but extremely high living expenses. Housing, transportation, and insurance costs strain retirement budgets. Unless retirees already own property, maintaining financial stability here can be challenging.

3. New Jersey

New Jersey’s property tax rates are among the highest in the United States. Retirees frequently relocate after leaving the workforce because maintaining a home becomes expensive.

4. Massachusetts

Massachusetts has world-class hospitals, but daily living costs are high. Heating costs during long winters also raise monthly expenses. For retirees without significant savings, affordability becomes a major concern.

5. Illinois

Illinois struggles with tax pressure and rising property costs. Retirees often leave because they can maintain the same lifestyle elsewhere at a lower cost.

Key Factors Retirees Should Consider

When evaluating the best and worst states for retirement, keep these realities in mind:

- Taxes: States taxing retirement income reduce annual savings quickly.

- Healthcare proximity: Being near hospitals becomes more important with age.

- Housing flexibility: Downsizing works best in states with affordable property.

- Climate: Comfortable weather improves both health and social activity.

Choosing wisely can extend retirement savings by 5–10 years in some cases.

FAQs on Best and Worst States for Retirement

1. What state is the most tax-friendly for retirees?

Florida and Pennsylvania are considered highly tax-friendly because they do not tax retirement income such as Social Security benefits.

2. Why do retirees move south?

Warmer weather, lower property taxes, and affordable housing attract retirees to southern states.

3. Is healthcare more important than climate in retirement?

Yes. Access to hospitals and specialists usually matters more than weather, especially after age 70.

4. Should I relocate immediately after retirement?

Many experts recommend waiting 6–12 months after retiring before relocating to ensure financial stability and lifestyle clarity.