Millions of Americans receive federal benefits each month through Direct Benefit Transfer, an electronic payment method that deposits government funds directly into personal bank accounts. The system, managed by the U.S. Treasury and federal agencies, has largely replaced paper checks to reduce fraud, lower administrative costs, and speed delivery of Social Security payments, tax refunds, and veterans’ benefits.

Table of Contents

Direct Benefit Transfer

| Key Fact | Detail |

|---|---|

| Main payer | U.S. Treasury Bureau of the Fiscal Service issues payments |

| Delivery method | Automated Clearing House electronic bank network |

| Largest program | Social Security retirement and disability payments |

What Is Direct Benefit Transfer?

The term Direct Benefit Transfer describes the electronic deposit of government payments into a recipient’s bank account without intermediaries. In the United States, federal agencies authorize payments, but the money is released centrally by the U.S. Department of the Treasury’s Bureau of the Fiscal Service.

The Treasury disburses several trillion dollars every year on behalf of federal programs, including Social Security, veterans’ compensation, tax refunds, and federal salaries. Instead of printing and mailing checks, the department sends digital payment instructions into the national banking system.

Officials state electronic transfers improve reliability. A Treasury public guidance document explains that electronic payments are “faster, safer, and more dependable than paper checks,” which can be delayed by weather, theft, or postal errors.

Historical Background: From Paper Checks to Digital Deposits

Before the 1990s, nearly all U.S. government benefits arrived by mail. Retirees often waited days for postal delivery. Missing checks were common, and replacing them could take weeks.

The shift began when banks introduced payroll direct deposit in the private sector. Policymakers recognized the same technology could modernize federal payments.

Key milestones:

- 1970s–1980s: Banks expand electronic payroll deposits

- 1996: U.S. Congress passes electronic funds transfer law encouraging federal adoption

- 2000s: Social Security promotes voluntary direct deposit

- 2011: Treasury requires most federal payments to be electronic

The policy marked a major modernization of government finance. Economists say it transformed the relationship between citizens and public institutions because benefits could now reach recipients instantly across the country.

How Payments Actually Travel

Step 1: Benefit Approval

A citizen applies for a program such as Social Security retirement, disability insurance, or veterans’ benefits. The applicant provides:

- Bank routing number

- Account number

This identifies both the financial institution and the specific account.

Government agencies verify identity, eligibility, and benefit amount before payment authorization.

Step 2: Treasury Issues Payment

After approval, the agency sends instructions to the Treasury.

The Bureau of the Fiscal Service schedules the payment and generates an electronic transaction record. Each record contains:

- Recipient identity code

- Payment amount

- Payment date

- Bank destination

Treasury sends the payment in batches. Millions of payments may be issued simultaneously.

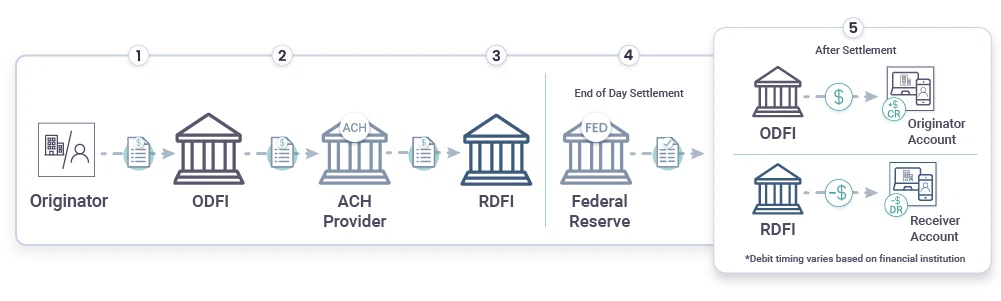

Step 3: The ACH Network (electronic payments)

The payment moves through the Automated Clearing House (ACH) network — a nationwide electronic banking infrastructure operated jointly by the Federal Reserve and private clearing associations.

ACH functions like a national financial highway. It routes payments between banks overnight.

According to Federal Reserve educational materials, the network processes tens of billions of transactions annually, including salaries, utility bills, insurance premiums, and government benefits.

Banks receive the Treasury instruction overnight. On the payment date, funds appear automatically in the recipient’s account, often early morning.

Why the U.S. Government Shifted Away From Checks

Paper checks once dominated federal payments. But policymakers identified multiple risks.

Government accountability reports showed:

- Checks were more likely to be stolen

- Replacement checks required manual processing

- Mailing costs were high

Printing and mailing a paper check costs several times more than sending an electronic payment. Electronic transfers save taxpayers hundreds of millions of dollars over time.

Fraud reduction was another factor. Stolen checks could be altered or cashed illegally. Electronic payments, by contrast, leave a traceable digital record.

Which Programs Use Direct Benefit Transfer?

The system supports many major U.S. public programs:

- Social Security retirement and disability payments

- Veterans Affairs compensation

- Federal employee pensions

- Income tax refunds

- Supplemental Security Income assistance

The Internal Revenue Service (IRS) says direct deposit refunds usually arrive faster than paper checks because they avoid postal delays and manual handling.

Payment Timing and Scheduling

Different programs follow fixed payment schedules.

Social Security payments are distributed based on birth dates. Veterans benefits usually arrive monthly. Tax refunds are sent after returns are processed.

Banks often post funds at midnight or early morning on the scheduled date, meaning recipients can access money immediately.

What If Someone Does Not Have a Bank Account?

To include people without traditional banking access, the government introduced the Direct Express prepaid debit card.

The card allows recipients to:

- Withdraw cash at ATMs

- Make purchases

- Pay bills electronically

Officials say the system ensures benefits reach low-income individuals who might otherwise rely on costly check-cashing services.

Security and Fraud Prevention

Electronic payment systems still face cyber risks, but experts consider them safer than checks.

Security measures include:

- Identity verification

- Banking encryption

- Transaction tracking

- Fraud monitoring algorithms

Every payment leaves a digital audit trail. Authorities can trace unauthorized transfers more easily than stolen paper checks.

Financial security researchers note electronic benefits systems significantly reduce impersonation fraud, especially schemes targeting elderly recipients.

Economic Impact

Direct deposits do more than deliver benefits — they influence the broader economy.

Economists say predictable monthly payments stabilize household spending. Recipients often use funds immediately for rent, groceries, and healthcare.

During economic crises, governments can distribute relief quickly. For example, pandemic stimulus payments reached millions of Americans within days because banking details were already on file.

Analysts at economic research institutions note electronic payments increase the speed at which government stimulus enters the economy, supporting consumption and preventing deeper recessions.

Comparison With Other Countries

Many countries now use similar systems.

| Country | System | Key Identifier |

|---|---|---|

| United States | ACH direct deposit | Social Security Number |

| India | DBT via banking network | Aadhaar identification |

| United Kingdom | BACS payments | National Insurance number |

Public finance experts say electronic benefits have become a global standard because they improve transparency and reduce corruption risks.

Challenges and Criticism

Despite its benefits, the system faces concerns.

Digital exclusion: Some elderly citizens struggle with online banking.

Cybersecurity risks: Banks must protect against identity theft and account takeover.

Data accuracy: Incorrect banking details can delay payments.

Consumer advocacy groups also warn scammers sometimes impersonate government agencies to obtain banking information.

Officials advise recipients never to share account details through unsolicited phone calls or emails.

Future Developments

Government financial technology is evolving. Policymakers are exploring faster payment systems that could deliver funds instantly rather than overnight.

The Federal Reserve has launched new real-time payment infrastructure, and some analysts believe future benefits could be deposited within seconds.

Experts also discuss the possibility of digital government wallets or central bank digital currencies, though no nationwide plan currently exists.

Broader Context

The United States adopted electronic payments earlier than many countries, but the concept is part of a broader global shift toward digital public finance.

Researchers say direct deposit has improved government accountability because payments can be tracked, audited, and verified electronically.

Public policy scholars often describe electronic benefits as one of the most significant administrative reforms in modern welfare systems.

What Happens Next?

Federal agencies continue encouraging electronic payments and limiting paper checks. Officials expect digital transfers to remain the primary delivery method for federal money.

A Treasury guidance note states the objective is straightforward: payments should arrive “securely, on schedule, and directly to the rightful recipient.”

FAQs About Direct Benefit Transfer

Q: Is Direct Benefit Transfer mandatory in the U.S.?

Most federal payments must be electronic, with limited hardship exemptions.

Q: How long does a payment take?

ACH transfers usually arrive on the scheduled payment date.

Q: Is it the same as a bank transfer?

Yes. It is a government-initiated electronic bank transfer.