FTC Begins January 2026 Refund Payments: The FTC begins January 2026 refund payments after major settlements, and this isn’t just another headline — it’s real money coming back to Americans who were misled, overcharged, or outright tricked by companies that thought they could get away with it. From tech giants like Amazon to financial service firms and telemarketers, the Federal Trade Commission (FTC) is flexing hard this year — putting cash back in consumers’ wallets and setting a gold standard for enforcement in 2026. Whether you’re a stay-at-home parent who canceled Prime three times or a compliance officer tracking consumer law — this article is for you.

Table of Contents

FTC Begins January 2026 Refund Payments

The fact that the FTC begins January 2026 refund payments after major settlements isn’t just a headline — it’s a watershed moment. From Amazon to insurance providers and beyond, regulators are finally holding companies accountable. Whether you’re getting $51 back or simply cheering on from the sidelines, this is proof that consumer protection is alive and well — and if you’ve ever felt powerless against big business, this one’s for you.

| Topic | Details |

|---|---|

| Main Keyword | FTC begins January 2026 refund payments after major settlements |

| Total Refund Value (Q1 2026) | Estimated $2.9 billion+ |

| Largest Case | Amazon Prime ($2.5 billion settlement) |

| Other Active Cases | NGL, First American Payment Systems, NextGen, ABCmouse |

| Refund Methods | Mailed check, PayPal, Direct Deposit |

| Scam Warning | FTC does not request fees or bank login credentials |

| Eligibility Criteria | Based on case — varies by service dates, transactions |

| Official Site | FTC.gov/refunds |

Why FTC Begins January 2026 Refund Payments Now?

Every year, the Federal Trade Commission investigates companies for unfair, deceptive, or fraudulent practices. When they win cases or negotiate settlements, the court often orders the company to pay back the people they harmed.

These are called consumer redress payments, and they aren’t just symbolic — they’re literal dollars refunded to the people who deserve them.

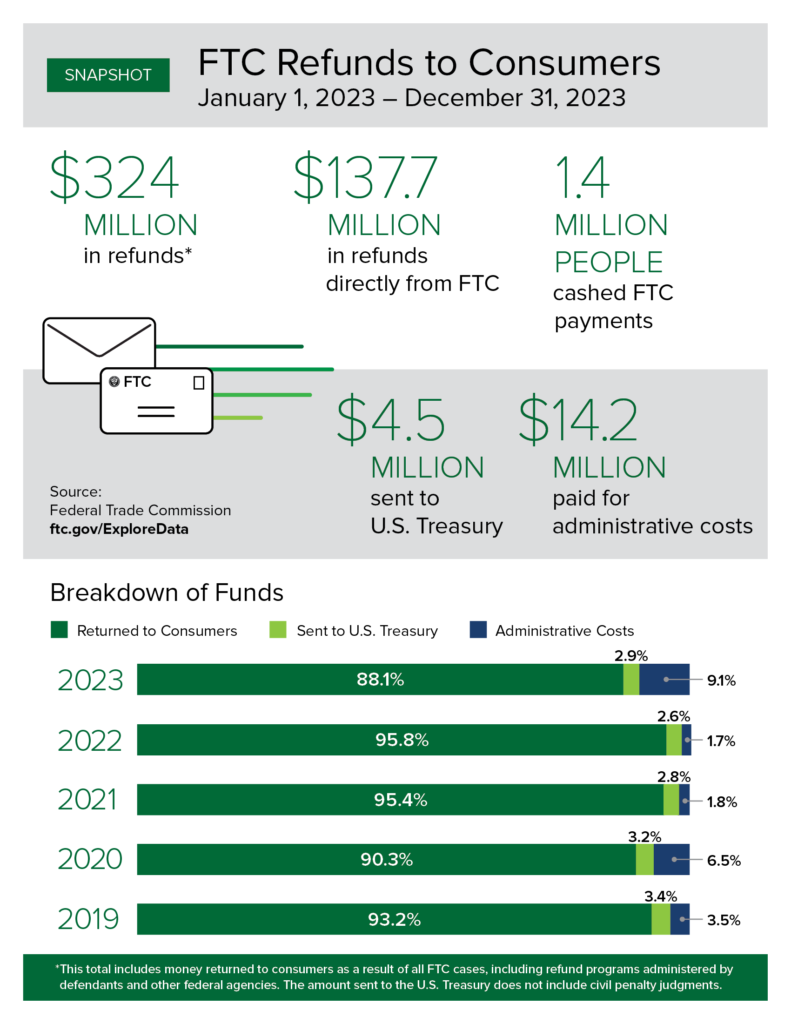

In 2025 alone, the FTC returned over $1.2 billion to more than 10 million consumers. Now, in early 2026, they’re back at it again — with refund payments kicking off in January for several major cases.

A Closer Look: Amazon Prime $2.5 Billion Settlement

Let’s dive deeper into the largest and most high-profile case on the FTC’s refund roster: Amazon Prime.

What Did Amazon Do Wrong?

The FTC accused Amazon of:

- Enrolling users into Amazon Prime without clear consent

- Designing a “dark pattern” cancellation process — intentionally confusing and difficult

- Charging repeat subscription fees without easy opt-out

This violated Section 5 of the FTC Act, which prohibits deceptive practices in commerce.

The Settlement

In late 2025, Amazon agreed to a historic $2.5 billion settlement. The terms included:

- $1.5 billion earmarked for refunding affected consumers

- $1 billion in civil penalties

- Improved disclosure and cancellation procedures going forward

Who Qualifies?

You may be eligible if:

- You were signed up for Amazon Prime between 2016 and 2023

- You were charged without clear consent

- You attempted to cancel but were trapped in confusing menus

Refunds will range up to $51 per eligible user. Some users have already received automatic refunds, while others will get email or mail notifications directing them to a secure claim portal.

Other Major FTC Begins January 2026 Refund Payments Cases Active

While Amazon makes headlines, several other companies are also refunding millions under FTC scrutiny:

1. First American Payment Systems

- Allegation: Trapped small businesses in long-term processing contracts with hidden fees.

- Settlement: $65 million refund program underway.

- Impact: Thousands of SMBs nationwide receiving checks.

2. NGL Group (National Guardian Life)

- Allegation: Misleading marketing of final expense insurance to seniors.

- Settlement: $120 million in refunds to policyholders.

- Refund Method: Check mailed with detailed letter.

3. NextGen Telemarketing

- Allegation: Unlawful robocalls and deceptive sales tactics.

- Refunds: Payouts vary by consumer complaint record.

4. ABCmouse (Age of Learning Inc.)

- Allegation: Failed to disclose auto-renewal terms.

- Settlement: $10 million refund and subscription transparency mandates.

Step-by-Step: How to Check If You’re Eligible and Claim Your Refund

Step 1: Watch for an Email or Letter

FTC or its refund administrator will contact you via:

- Official email (e.g., ending in

@ftc.govor case-specific domain) - Mailed letter with refund instructions and ID code

Pro Tip: Save that letter — it contains your Refund ID.

Step 2: Visit the Official Portal

Head over to:

https://www.ftc.gov/enforcement/refunds

Verify the case name, payment status, and instructions for filing.

Step 3: Submit Your Claim

- Enter your Refund ID

- Confirm your identity and mailing info

- Choose payment method (Direct Deposit, PayPal, or Check)

Step 4: Wait for Your Refund

Processing usually takes 3–8 weeks. You’ll receive an email once your payment is issued.

Real Story: Marcus Gets His $51 Back

Marcus, a freelance designer from Detroit, didn’t think much about a refund when he got the email.

“Honestly, I thought it was spam. But it was from

@ftc.gov, so I checked. Turns out I was charged for Amazon Prime three years ago without agreeing to it. I submitted my claim and got $51 in PayPal. It’s not life-changing, but it’s justice.”

Stories like Marcus’s are popping up nationwide — a sign that government enforcement is working.

How the FTC Protects You — Even If You’re Not Getting a Refund

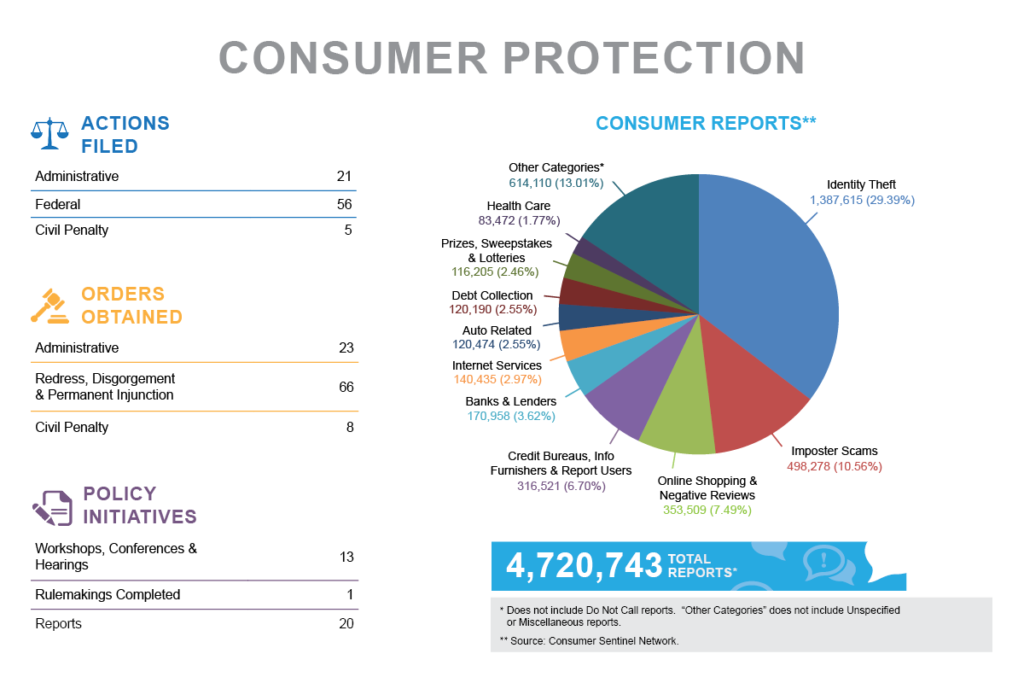

Not everyone will qualify for a refund, and that’s okay. The real value of these actions is that they:

- Set legal precedent: Other companies will think twice before using shady practices.

- Improve industry standards: Stronger rules and disclosures protect future consumers.

- Increase transparency: More scrutiny = fewer corporate secrets.

These cases are reminders that your complaints matter, and that regulators can and do take action.

Avoiding Refund Scams: What to Watch Out For

Whenever there’s money moving, scammers show up. Here’s how to stay safe:

Red Flags

- Texts or calls asking for bank info to “release your refund”

- Fake refund websites asking for Social Security numbers

- Emails claiming you need to pay a fee to unlock your refund

Safe Practices

- FTC will never ask for money

- Refunds are always free

- When in doubt, check with: https://reportfraud.ftc.gov

Glossary of Key Terms

| Term | Definition |

|---|---|

| FTC | Federal Trade Commission, a U.S. agency that enforces consumer protection laws |

| Settlement | A legal agreement to resolve a case, often involving refunds or penalties |

| Dark Pattern | A user interface trick designed to mislead or manipulate choices |

| Refund Administrator | A third-party company hired to manage refund processing |

| Refund ID | Unique code tied to your eligibility in a specific refund case |

Expert Tips for Professionals

For Legal & Compliance Pros:

- Use these settlements in training modules to teach ethical customer onboarding and billing practices.

- Watch for future cases involving subscription services, dark patterns, and AI usage in marketing.

For Small Business Owners:

- If you used First American Payment Systems, check for a refund notice.

- Review all merchant service agreements for early termination fees or auto-renewal traps.

For Policy Analysts:

- This marks a shift toward proactive FTC enforcement.

- Track settlements via the FTC Public Tableau Dashboard

What to Expect Next from the FTC in 2026?

As the digital economy grows, the FTC is ramping up enforcement in areas like:

- AI transparency and algorithmic bias

- Subscription and auto-renewal rules

- Children’s online privacy (COPPA updates)

- Data breach response and disclosure

Upcoming cases may involve more tech companies, healthcare marketers, and crypto platforms.

This isn’t a one-and-done year — it’s a new era of accountability.

AT&T Reveals Timeline for $7500 Settlement Payments in 2026

$6000 Dental Data Breach Claims — What Patients Need to Check Now

It’s Official: U.S. Issues Urgent Warning to Airlines Over Surging SpaceX Debris Threat