90-Year-Old Lost $814,000 to Forged Checks: is more than a dramatic headline. It is a real example of how financial systems, legal rules, and human vulnerability can collide. A 90‑year‑old American man, Irving Rosenberg of Southern California, discovered that his life savings — approximately $814,000 — had disappeared through forged checks. The situation triggered national debate about bank responsibilities, fraud detection systems, and how the United States protects elderly citizens. This story matters because many Americans believe their bank automatically protects them from obvious fraud. In reality, banks follow strict legal frameworks, and if customers do not report suspicious transactions quickly enough, they may be held responsible — even when they clearly did not write the checks.

Table of Contents

90-Year-Old Lost $814,000 to Forged Checks

The case of a 90‑Year‑Old Lost $814,000 to Forged Checks — The Fraud Case Raises Questions illustrates a complicated reality: banks, laws, and customers all share responsibility in preventing financial crime. However, aging Americans face challenges the legal framework did not fully anticipate. The lesson is not that banks are unsafe. The lesson is that safety requires active oversight. Financial protection today is not passive — it is collaborative between families, institutions, and technology. By setting up safeguards early, monitoring accounts regularly, and understanding the legal rules governing check fraud, families can significantly reduce risk and protect a lifetime of savings.

| Topic | Details |

|---|---|

| Victim | Irving Rosenberg, age 90 |

| Fraud Type | Forged paper checks |

| Amount Lost | $814,000 |

| Bank | Wells Fargo Official Website |

| Key Issue | Missed 60‑day reporting window |

| Final Outcome | Bank reimbursed funds after investigation and public attention |

| U.S. Elder Fraud Losses | $3.1 billion annually (FBI Internet Crime Complaint Center) |

| Relevant Law | UCC Article 4 & Regulation E |

| Who Is at Risk | Seniors, disabled individuals, and inactive account holders |

What Actually Happened?

Rosenberg kept a large savings account that he used primarily as a long‑term nest egg. According to family members, he rarely wrote checks and almost never used online banking. At some point in 2025, someone gained access to his account number and began issuing paper checks using forged signatures.

Over several weeks, dozens of checks were written in unusually large amounts. Instead of a small test withdrawal, the fraudster went big — draining the account in chunks.

Here is what made the case unusual:

- The signatures did not match

- The withdrawals were out of character

- The account had minimal prior activity

- The victim had health limitations

Despite those warning signs, the transactions were processed.

The theft was not discovered immediately because Rosenberg depended on mailed bank statements and had hearing loss and early cognitive decline. By the time family members reviewed the statements, the reporting deadline had passed.

90-Year-Old Lost $814,000 to Forged Checks: Why the Bank Initially Denied the Claim

To understand the bank’s response, we need to talk about a rule many Americans have never heard of.

The 60‑Day Reporting Rule

Most U.S. bank accounts operate under the Uniform Commercial Code (UCC) Article 4. This law governs paper checks. It states that a customer must review statements and report unauthorized checks quickly — typically within 30–60 days after the statement is issued.

If the customer does not report it in time, the bank may legally refuse reimbursement.

This rule exists because banks process millions of checks every day. The legal system assumes customers are the first line of defense in spotting fraud.

In Rosenberg’s case, the bank argued:

- Statements were mailed

- Fraud was not reported within the timeframe

- Therefore liability shifted to the account holder

The problem, critics say, is that the rule does not consider elderly customers who cannot reasonably monitor accounts on their own.

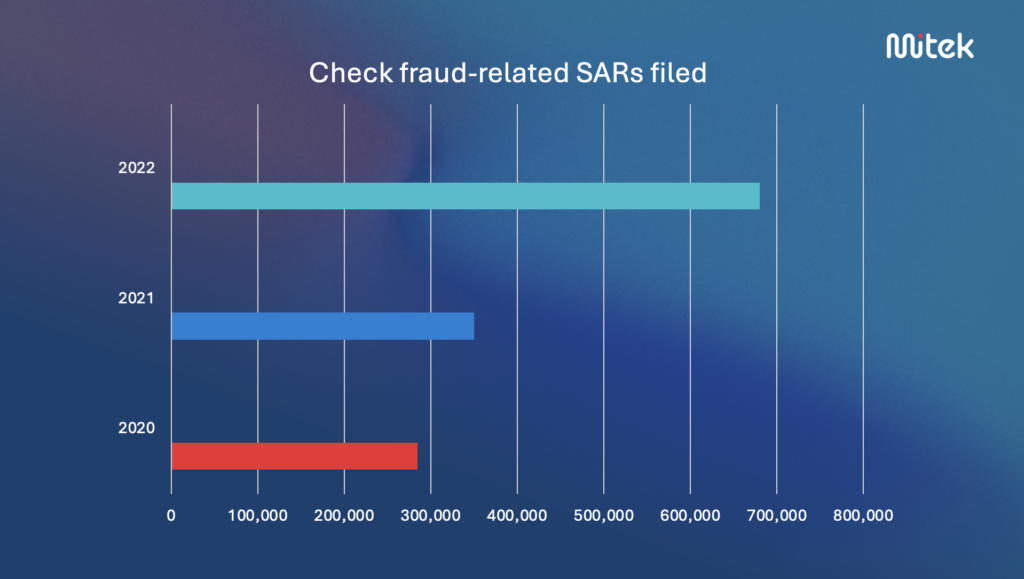

Why Forged Check Fraud Is Still Common?

Many people assume paper checks are outdated. Surprisingly, they are still widely used in the United States — especially among older adults.

Checks contain sensitive data:

- Routing number

- Account number

- Signature sample

- Address

Criminals can obtain checks through:

- Mail theft

- Trash collection (“dumpster diving”)

- Household workers

- Nursing home access

- Caregiver exploitation

Once a criminal has that information, they can print counterfeit checks that look legitimate.

Unlike debit card fraud, check fraud does not rely on digital authentication systems. Banks often rely on automated processing rather than manual signature verification.

Why Fraud Detection Sometimes Fails?

Banks do have fraud monitoring systems. However, they are designed to catch patterns — not always personal behavior.

A bank’s automated system usually flags:

- Foreign transactions

- Rapid card swipes

- Suspicious online logins

But paper checks are processed differently. High‑volume check clearing uses imaging technology and routing verification rather than handwriting comparison.

This means a forged signature may not trigger a system alert.

In Rosenberg’s case, experts noted that repeated high‑value checks from a historically inactive account should have raised concern. That became one of the public questions: how much responsibility should banks have to recognize unusual behavior?

Elder Financial Abuse in America

According to the FBI Internet Crime Complaint Center:

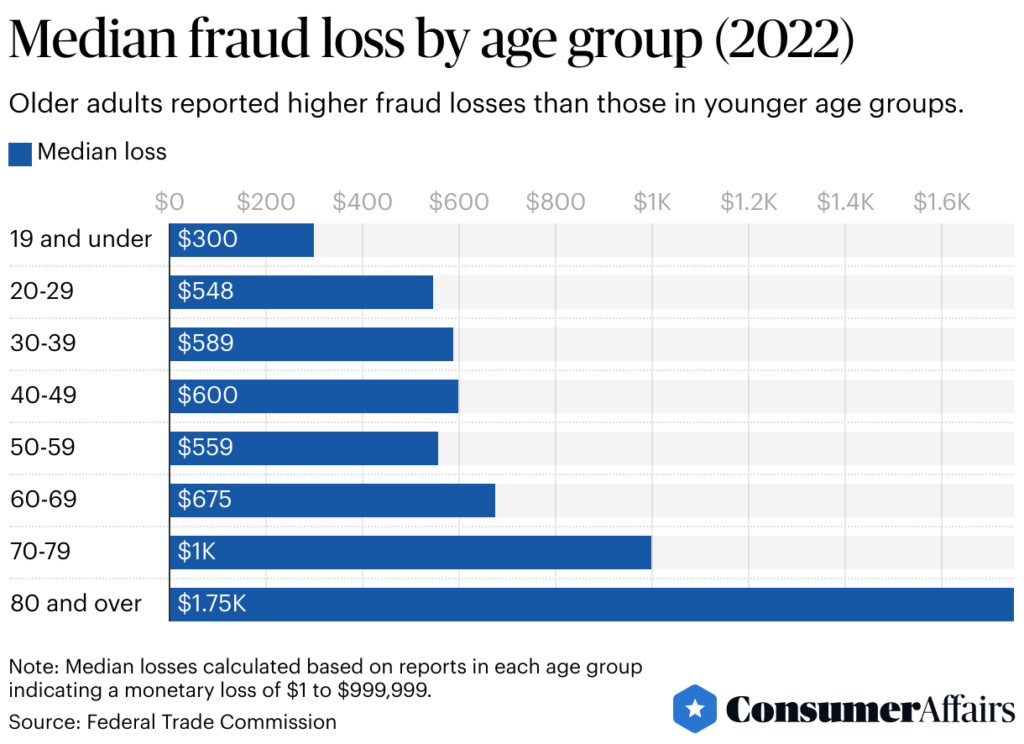

- Americans over 60 lose more than $3.1 billion each year to fraud.

- Average losses are higher than any other age group.

- Many cases go unreported.

The U.S. Department of Justice considers elder financial exploitation one of the fastest‑growing crimes in the country.

Why seniors are targeted:

- Savings accumulated over decades

- Lower familiarity with digital banking

- Isolation

- Trusting behavior

- Health or memory issues

The Legal Difference: Checks vs Electronic Fraud

This is extremely important.

Regulation E

Applies to debit cards and electronic transfers.

If reported within 2 business days, customer liability may be limited to $50.

UCC Article 4

Applies to paper checks.

Responsibility shifts heavily toward the customer if reporting deadlines are missed.

This difference surprises many victims. Two fraud cases involving the same account can have completely different legal outcomes depending on whether a debit card or a paper check was used.

How Families Can Prevent This: 90-Year-Old Lost $814,000 to Forged Checks

Financial professionals who work with elderly clients often recommend layered protection. Think of it like home security — not just one lock, but multiple safeguards.

1. Set Up Trusted Contact Authorization

Most banks allow customers to name a trusted person the bank can contact if suspicious activity occurs.

2. Establish a Power of Attorney Early

A durable financial power of attorney allows a trusted family member to act before problems escalate.

3. Activate Transaction Alerts

Enable:

- Check clearing notifications

- Large withdrawal alerts

- Balance change alerts

These can be sent to both the account holder and a caregiver.

4. Reduce Paper Check Use

Switch to:

- Automatic bill pay

- Direct deposit

- Debit card with spending limits

5. Monthly Statement Review System

Create a routine:

- One person reads statements

- Another verifies transactions

This dramatically increases early detection.

What To Do If This Happens?

If you discover forged checks, timing matters.

Immediately:

- Call the bank fraud department

- Freeze the account

- File a police report

- Submit written dispute

- File complaint with Consumer Financial Protection Bureau

Documentation is critical:

- Statements

- Copies of checks

- Medical evidence (if cognitive impairment is involved)

Why Media Attention Changed the Outcome?

After the family contacted a local investigative consumer reporter, the case received public scrutiny. The bank reopened the investigation and eventually reimbursed the funds.

This did not necessarily mean the original legal interpretation was wrong. Instead, it reflected a broader concept in consumer protection: reputational risk. Banks often reassess disputed cases when evidence of vulnerability appears.

Larger Policy Debate

This case contributed to ongoing discussions among lawmakers and regulators.

Key questions raised:

- Should elderly customers receive extended reporting deadlines?

- Should banks have a duty to detect unusual behavior?

- Should signature verification be mandatory for large checks?

- Should paper checks require stronger authentication?

Some consumer advocates propose a “vulnerable customer standard,” similar to protections used in investment brokerage accounts.

FTC Begins January 2026 Refund Payments After Major Settlements

AT&T Reveals Timeline for $7500 Settlement Payments in 2026

How Direct Benefit Transfer Sends Government Payments Straight to Your Account