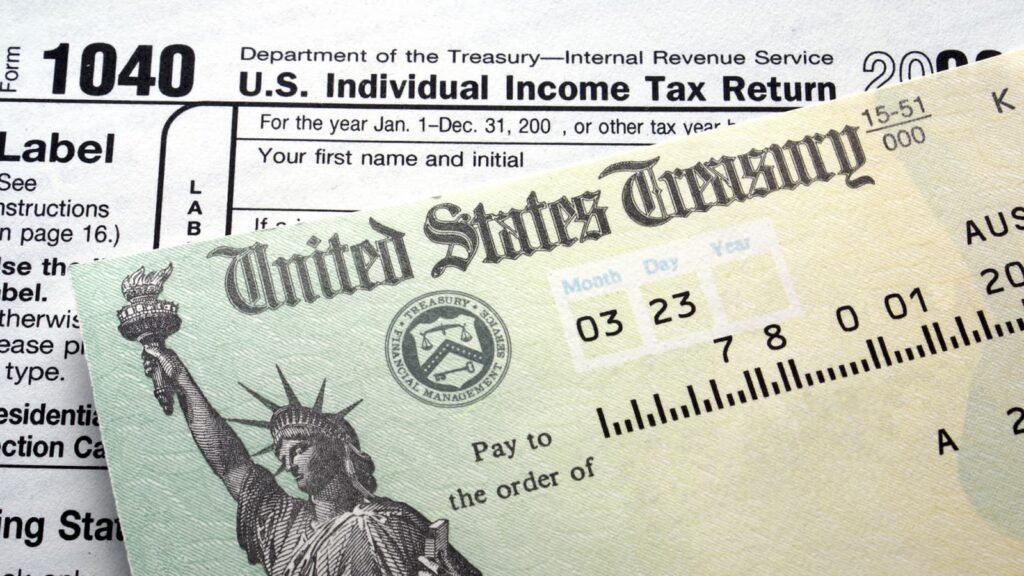

Early government figures show the average IRS tax refund has increased by about 10.9% in the opening weeks of the 2026 U.S. tax filing season, according to preliminary statistics released by the Internal Revenue Service (IRS). Analysts say the rise mainly reflects tax credits and withholding adjustments rather than higher incomes, though it may still affect household finances and consumer spending nationwide.

Table of Contents

Average IRS Tax Refund

| Key Fact | Detail / Statistic |

|---|---|

| Early average refund | About $2,290 |

| Year-over-year change | ~10.9% increase |

| Economic effect | Potential short-term spending boost |

What the Average IRS Tax Refund Increase Shows

The IRS publishes weekly filing season updates tracking returns, refunds, and processing times. Early data this year indicates refunds are larger than at the same stage last year.

Tax professionals caution that the figures should be interpreted carefully.

“A refund is simply a reconciliation,” said Mark Luscombe, principal federal tax analyst at Wolters Kluwer Tax & Accounting. “It shows how much tax you prepaid compared with what you actually owed.”

In simple terms, a refund means a taxpayer paid too much during the year.

The early numbers can also be misleading because certain households — particularly those claiming family-related credits — tend to file later. Historically, the final seasonal average refund ends significantly higher than early estimates once millions of additional returns are processed.

Why Refunds Are Higher This Year

1. Tax Credits Expanded or Adjusted

Several elements of U.S. tax policy directly affect refund size:

- Child-related credits

- Earned Income Tax Credit eligibility

- Standard deduction thresholds

- Changes following recent federal tax legislation

According to the Tax Foundation, when tax law changes occur, payroll withholding systems do not always update immediately. Workers then pay slightly more tax than necessary throughout the year.

They receive that difference later as a refund.

2. Withholding Mismatch

Employers estimate taxes using withholding tables. But final tax liability depends on actual income, deductions, and credits calculated during filing.

Economist Erica York of the Tax Foundation explains the mechanism clearly:

“The refund isn’t a bonus from the government. It’s money taxpayers already earned but overpaid in withholding.”

A Seasonal Stimulus for the Economy

Economists closely track the average IRS tax refund because it influences short-term economic activity.

Millions of households receive payments within a few weeks. That creates a temporary injection of cash into the economy.

Research by the Federal Reserve Bank of Chicago shows lower-income households tend to spend refunds quickly on necessities such as:

- Rent

- Groceries

- Utility bills

- Car repairs

- Debt repayment

Retailers also monitor the period carefully. U.S. consumer spending often rises during late February through April, coinciding with refund deposits.

Financial analysts sometimes call this phenomenon a “refund season spending wave.”

A Real-World Example

Consider a worker earning $48,000 annually. Payroll withholding might deduct slightly more tax each month than necessary due to conservative withholding formulas.

At filing time, after credits and deductions are applied, the worker may receive a $2,500 refund.

Throughout the year:

- Monthly paycheck was lower than it could have been

- The government temporarily held the extra money

Economists therefore describe large refunds as a cash-flow timing issue, not a financial gain.

Why a Bigger Refund Isn’t Always Good News

Financial planners often encourage taxpayers to aim for a near-zero balance — neither owing money nor receiving a large refund.

A large refund means reduced income during the year.

“From a personal finance perspective, you want your money when you earn it,” said Greg McBride, chief financial analyst at Bankrate, in tax guidance commentary. “Otherwise, you’re lending money to the government interest-free.”

The IRS recommends taxpayers update withholding using Form W-4 after major life events, including:

- Marriage

- Birth of a child

- New job

- Significant pay increase

Processing Delays and Verification Checks

Refund timing varies widely. The IRS states most electronic returns with direct deposit are processed within about three weeks.

However, certain returns receive extra scrutiny.

Credits aimed at low-income families require fraud prevention checks. These safeguards can delay refunds even after acceptance.

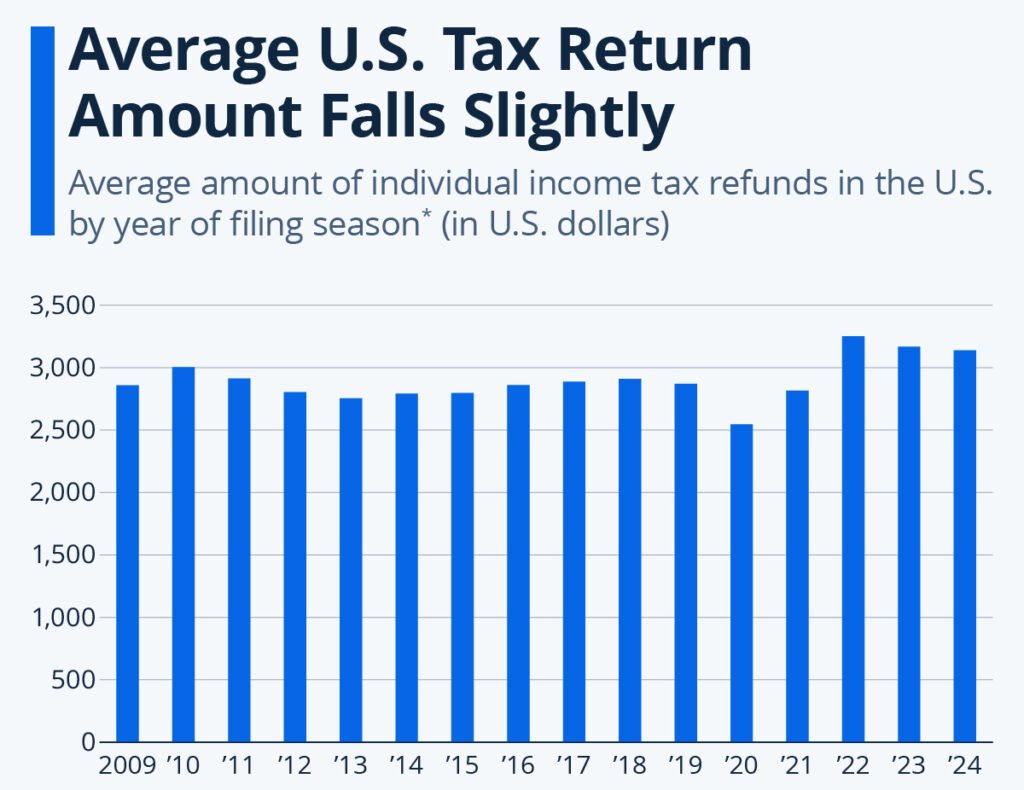

Historical Context: Refund Trends Over Time

The size of the average IRS tax refund fluctuates annually. It often changes due to:

- Inflation adjustments

- Tax legislation

- Pandemic-era relief policies

- Changes in employment

During the COVID-19 pandemic years, refunds increased sharply because of expanded tax credits and stimulus-related provisions. After those temporary measures expired, refunds declined, and now they are rising again due to updated tax thresholds.

Economists say these swings reflect policy changes more than economic strength.

International Comparison

The U.S. tax refund system differs from many other countries.

In several nations:

- Taxes are automatically calculated by government agencies

- Individuals rarely file returns

- Refunds are less common

The United States requires annual filing for most workers, which makes refunds more visible and financially significant.

For many households, the refund functions similarly to a forced savings account — though experts note it is an inefficient one.

Who Gets the Largest Refunds?

Refund size varies widely. Key factors include:

Income Level

Lower- and middle-income households often receive larger refunds relative to earnings because of refundable credits.

Family Status

Families with children frequently qualify for multiple credits.

Filing Method

Electronic filing with direct deposit typically speeds payment.

Withholding Accuracy

Incorrect withholding often produces very large refunds or tax bills.

Practical Advice for Taxpayers

The IRS and tax professionals recommend several steps:

1. Review withholding annually

Use the IRS withholding estimator tool.

2. File electronically

Reduces errors and speeds processing.

3. Use direct deposit

Paper checks significantly delay payment.

4. Beware of scams

The IRS never contacts taxpayers by text message or social media to request payment or personal data.

What the Data Means for Policymakers

Policymakers also monitor refund trends because they reveal how tax law interacts with payroll systems.

According to William Gale, senior fellow at the Brookings Institution:

“Refund data is a signal about tax administration efficiency. Large refunds often indicate withholding formulas are misaligned with real liabilities.”

Some tax policy experts argue that improving withholding accuracy could:

- Increase worker take-home pay

- Reduce financial stress

- Improve household budgeting

Looking Ahead

The April filing deadline remains the key milestone for the 2026 tax season. Final refund averages may change substantially as millions more returns arrive.

For now, economists expect the larger average IRS tax refund to temporarily boost consumer spending, especially in lower-income households.

Luscombe summarized the broader lesson:

“The goal isn’t to get the biggest refund possible. The goal is paying the correct tax amount during the year.”

FAQs About Average IRS Tax Refund

Why did the average IRS tax refund increase?

Because of updated credits, withholding adjustments, and tax law changes.

Does a bigger refund mean I paid less tax?

No. It usually means you paid more tax than required during the year.

When will refunds arrive?

Most e-filed returns with direct deposit are processed in about 21 days, though some credits delay payment.

Should I try to get a large refund?

Financial experts recommend accurate withholding instead.