For retirees across the United States, Social Security is more than a government program. It is the monthly income that pays for groceries, rent, utilities, and medication. Recently, officials confirmed that reviews inside the benefits system are uncovering past calculation mistakes.

Because of these corrections, Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected, and the update is getting attention from seniors, disability recipients, and financial planners alike. The possibility that Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected is especially important for people living on fixed incomes where even a small increase can ease financial pressure. In 2026, the Social Security Administration has stepped up its record audits and benefit recalculations. The agency is checking historical earnings reports and matching them with benefit formulas used to calculate monthly payments. Some beneficiaries were underpaid without ever realizing it. Others qualified for higher benefits but never received them because of outdated records or processing backlogs. Now those errors are finally being corrected, and long overdue payments may follow.

The development that Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected is not a new stimulus program and it is not a temporary relief check. Instead, the Social Security Administration is fixing mistakes tied to earnings histories and benefit calculations. When discrepancies appear, payments are recalculated and beneficiaries may receive back pay along with a permanent increase to future monthly checks. For retirees, widows, and disability recipients, this could mean a deposit covering months or even years of missed benefits. In most situations, people will not need to file a new application because the agency is identifying eligible cases automatically.

Table of Contents

Social Security Cash Return Sooner

| Category | Information |

|---|---|

| Agency | Social Security Administration |

| Issue | Underpaid benefits due to record or calculation errors |

| Affected Groups | Retirees, disability beneficiaries, survivors, public pension workers |

| Payment Type | Retroactive lump sum and increased monthly benefit |

| Estimated Amount | Hundreds to several thousand dollars |

| Notification Method | Official SSA letter by mail |

| Application Required | Usually no |

| Start Period | Rolling corrections during 2026 |

| Risk | Scam calls pretending to be SSA |

The update that Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected is not a bonus payment and not a temporary relief check. It is money beneficiaries were already entitled to receive. Many retirees spent years unknowingly receiving less than they earned through decades of work. If you receive Social Security, review your earnings history and watch for official letters. You may not need to take any action at all. But if a notice arrives or your payment increases, it likely means a long-standing calculation error has been corrected. For many Americans, that correction could bring real financial relief and renewed confidence in the retirement system.

Why Payments Went Missing in the First Place

- Many people assume Social Security calculations are automatic and always accurate. In reality, benefits depend on wage records that may go back 40 or even 50 years. When the system relied heavily on paper reporting, mistakes were far more common than most people realize.

- One major problem was incomplete earnings history. If an employer reported wages incorrectly or a record was lost, the system calculated a lower average lifetime income. That directly lowered the monthly benefit amount.

- Another issue involved complicated rules affecting certain workers, especially public employees. Teachers, police officers, and firefighters sometimes qualified for benefits but had reductions applied incorrectly due to outdated formulas or mismatched data.

- The pandemic also played a role. During those years, Social Security offices worked through a large backlog of claims. Some applications were processed quickly to avoid delays, but errors were not always caught immediately.

- Because of these factors, analysts say Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected as the agency reviews old files using modern digital systems that can finally detect inconsistencies.

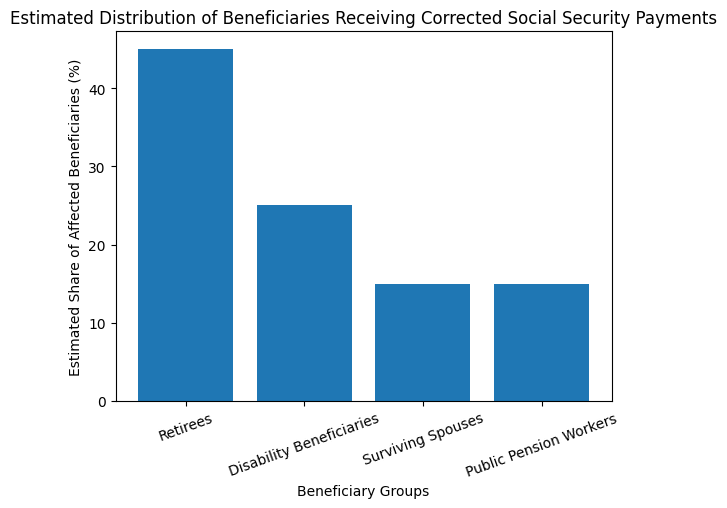

Who Could Be Eligible for Social Security Cash Return Sooner

Not every beneficiary will receive a payment. However, certain groups are more likely to qualify once records are corrected.

Retirees

Workers who had multiple employers over their lifetime, especially before electronic payroll reporting, may have missing wage years. Even one unreported year can noticeably reduce benefits.

Disability Beneficiaries

Some people receiving disability benefits previously worked for many years before their disability began. If earlier earnings were recorded incorrectly, their payment amount could have been understated.

Surviving Spouses

Widows and widowers receive benefits based on a spouse’s work history. If that earnings record was incomplete, survivor benefits were also lower than they should have been.

Public Pension Workers

Government employees with separate pensions often faced complicated benefit offsets. Recalculations in these cases are a key reason Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected.

How The Review Process Works

- The Social Security Administration is not launching a new financial aid program. Instead, it is correcting past payment calculations.

- The process follows several steps. First, the agency reviews an individual’s earnings record. Next, it compares that record with the formula used to determine the monthly benefit. If the system identifies an underpayment, the benefit is recalculated. Finally, the beneficiary receives a notice and any back pay owed.

- After recalculation, two things may happen. A lump sum may be issued for past underpayments. In addition, the monthly benefit amount may permanently increase. Since reviews are ongoing, Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected gradually rather than on one single date.

When People May Receive The Money

Payments will arrive in phases throughout 2026. Some beneficiaries may see adjustments soon after receiving notification, while others may wait longer depending on the complexity of their records.

- In general, beneficiaries may experience one of two outcomes.

- A retroactive payment covering past months or years of underpaid benefits.

- An increased monthly payment going forward.

Financial experts note that even modest adjustments can matter. An increase of $80 to $150 per month may cover prescription costs or utilities for many retirees. That is why the possibility that Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected is being widely discussed.

What You Should Do Right Now

- The review is mostly automatic, but there are still practical steps you should take.

- Check your Social Security earnings statement online and make sure your work history looks accurate. Missing years should be reported.

- Confirm your mailing address and bank information are up to date so you do not miss official notices.

- Keep any past tax returns or W-2 forms if you have them. They can help verify your employment record if the agency requests documentation.

- Do not file duplicate claims unless instructed. Most individuals affected by the situation where Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected will be contacted directly by mail.

Possible Tax Consequences

- Receiving a retroactive payment can affect taxes. A lump sum payment counts as income for the year it is received, although certain rules allow portions to be attributed to previous years for tax calculations.

- It may also influence Medicare premium brackets and eligibility for assistance programs.

- Speaking with a tax professional after receiving payment can help you plan ahead and avoid unexpected tax bills.

Beware Of Scams

Whenever a major payment story circulates, scammers attempt to take advantage. Criminals often pretend to be government representatives.

Remember a few important facts.

- The Social Security Administration does not charge fees to release benefits.

- It will never request payment using gift cards or cryptocurrency.

- Official communication usually starts with a mailed letter.

Scammers are already referencing news that Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected to trick seniors into revealing personal information. Always verify before responding to calls or messages.

Why This Matters

- For millions of households, Social Security provides the majority of retirement income. In many cases, it represents more than half of total monthly earnings. When payments are incorrect, daily life becomes difficult. Medical care, housing, and food all depend on reliable benefits.

- Correcting these errors restores fairness. Workers paid payroll taxes throughout their careers and earned these benefits. The current corrections also show how updating government data systems can uncover problems that remained hidden for decades. The reason Millions Could See Long-Missing Social Security Cash Return Sooner Than Expected is simple. The agency is finally reconciling older wage records using modern technology.

FAQs on Social Security Cash Return Sooner

1. Do I need to apply for the back payment

No. Most eligible cases are being identified automatically. The Social Security Administration will contact you if your benefits change.

2. How much money could I receive

Amounts vary. Some beneficiaries may receive a few hundred dollars while others could receive several thousand depending on the length of the underpayment.

3. How will I know if I qualify

You will receive an official mailed notice explaining the recalculation and new payment amount.

4. Will my monthly Social Security check increase permanently

In many cases yes. After recalculation, future monthly payments may be higher.