The February And March Payments issued by the Social Security Administration (SSA) in early 2026 arrived sooner than many beneficiaries expected. The adjustment affected recipients of Supplemental Security Income rather than retirees and was triggered by the federal calendar, not new legislation or expanded benefits. Officials say the move ensures eligible Americans have funds available at the start of each benefit month.

Table of Contents

February And March Payments

| Key Fact | Detail |

|---|---|

| Program affected | Supplemental Security Income (SSI) |

| February benefit | Paid January 30, 2026 |

| March benefit | Paid February 27, 2026 |

| Cause | Month began on weekend |

| Benefit change | None (timing only) |

What the February And March Payments Change Means

The February And March Payments adjustment applies to one of the nation’s core social welfare programs. The Social Security Administration administers retirement, disability insurance, and SSI benefits for more than 70 million Americans.

SSI benefits schedule rules require payments on the first day of each month. When that day falls on a weekend or federal holiday, the payment moves to the previous business day.

In 2026:

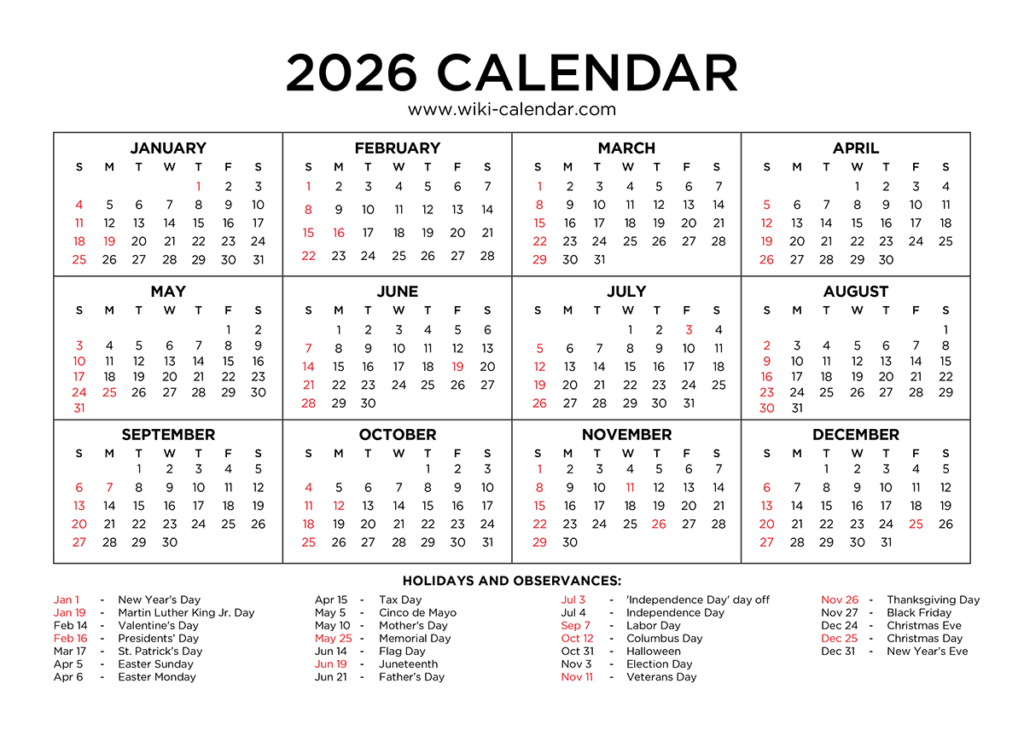

- February 1 fell on Sunday

- March 1 fell on Sunday

Because banks do not process federal payments on weekends, deposits were sent in advance. According to SSA operational procedures, the policy ensures recipients are not left without essential income.

An agency representative said the shift “occurs several times each decade and reflects longstanding Treasury payment processing rules rather than policy changes.”

SSI vs. Social Security Retirement Benefits

A major source of confusion surrounding the February And March Payments was the assumption that retirees received a bonus.

They did not.

SSI differs fundamentally from Social Security checks.

Supplemental Security Income (SSI)

- Needs-based program

- Funded by federal tax revenue

- Helps seniors and people with disabilities with very limited income

Social Security Retirement Insurance

- Earned benefit

- Funded by payroll taxes

- Based on work history and contributions

The retirement payment schedule remains unchanged.

| Birthday | Payment Day |

|---|---|

| 1–10 | Second Wednesday |

| 11–20 | Third Wednesday |

| 21–31 | Fourth Wednesday |

Why the Government Pays Early

The U.S. Treasury’s payment regulation requires federal benefits to be accessible on the first eligible business day. If that day is not a working banking day, agencies must advance funds.

Economists emphasize the distinction between early SSI deposit and extra benefits.

Kathleen Romig, a Social Security policy specialist at the Center on Budget and Policy Priorities, explained in a public briefing:

“Beneficiaries sometimes think they received two checks in one month. In reality, the second deposit belongs to the following month.”

The confusion arises because February shows two payments while March shows none.

How Much Beneficiaries Receive

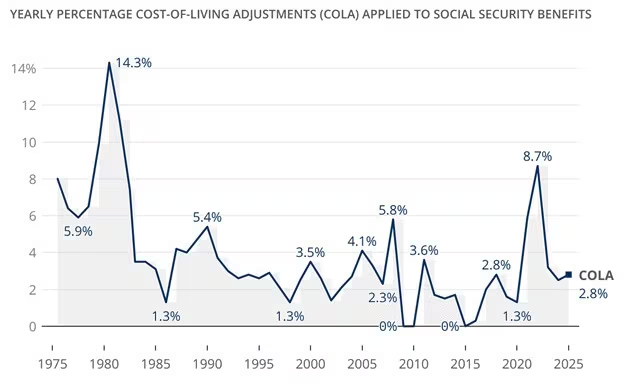

The COLA adjustment for 2026 increased payments by approximately 2.8%.

Maximum federal SSI payments:

- $994 per individual

- $1,491 per couple

The SSA bases adjustments on inflation measured by the Consumer Price Index (CPI-W), calculated by the U.S. Bureau of Labor Statistics.

Impact on Beneficiaries

For many households, SSI benefits are not supplemental — they are primary income.

Financial counselors warn early deposits can unintentionally disrupt budgeting. Recipients may spend February funds assuming another payment will arrive in March.

The nonprofit AARP advises beneficiaries to treat late-February deposits strictly as March income.

Advocacy groups note that nearly one-third of SSI households have less than one month of savings, making timing changes meaningful.

Broader Context: Why Payment Timing Matters

The Social Security system distributes over $1.4 trillion annually. For approximately 40% of older Americans, it supplies at least half of their income.

Even small timing changes can affect:

- rent payments

- medication purchases

- utility bills

Policy researchers say timing issues highlight the financial vulnerability of many beneficiaries.

Historical Background: This Has Happened Before

The February And March Payments situation is not unusual.

Similar early payments occurred in:

- 2021

- 2015

- 2010

Whenever the first day of a month falls on Saturday, Sunday, or a federal holiday, SSI deposits shift earlier.

In some years, beneficiaries may even receive three payments within a two-month period, followed by a month without deposits.

Experts say the recurring confusion demonstrates a communication challenge rather than a policy problem.

The Financial Planning Challenge

Budgeting specialists encourage recipients to track income monthly rather than by number of deposits.

Financial educator Mark Miller, author and retirement policy commentator, notes:

“The payment schedule hasn’t changed — only the calendar. But human psychology responds to what appears in the bank account.”

He recommends setting automatic bill payments to align with the actual benefit month, not deposit dates.

Policy Debate: Adequacy of Benefits

While the February And March Payments shift concerns timing, advocacy organizations used the moment to highlight a broader issue — benefit adequacy.

Many policy analysts argue SSI benefits remain below poverty thresholds in many states.

According to federal poverty guidelines, a single individual requires higher monthly income than the maximum SSI payment provides. Some states add supplemental payments, but amounts vary widely.

International Comparison

Comparable social pension programs exist worldwide:

- Canada: Old Age Security payments monthly

- United Kingdom: Pension Credit paid weekly or monthly

- Australia: Age Pension paid biweekly

Unlike the United States, some countries stagger payments to avoid confusion from calendar changes.

Researchers say U.S. reliance on a single fixed monthly date increases misunderstanding during weekend adjustments.

Banking and Payment Technology Factors

Electronic payments reduced delays but did not eliminate scheduling issues.

The U.S. Treasury sends benefits using the Direct Express system and Automated Clearing House (ACH) network. These networks operate only on business days.

Weekend processing limitations explain why payments cannot be sent on Sunday even though online banking is available.

FAQs About February And March Social Security Payments

Did beneficiaries receive extra money?

No. The February And March Payments are standard monthly benefits issued earlier.

Why were there two payments in February?

The February 27 payment was actually March’s SSI benefit.

Will there be a payment in March?

No. The March benefit was already deposited at the end of February.

Are retirement Social Security checks affected?

No. Only the SSI benefits schedule changed.

Will this happen again?

Yes. It recurs whenever the first of the month falls on a weekend or federal holiday.

Looking Ahead

The SSA publishes annual payment calendars to help beneficiaries anticipate future early deposits. Officials encourage recipients to rely on official schedules rather than bank notifications, which only show deposit dates.

Agency guidance advises contacting SSA offices only if a payment fails to appear within three mailing days of the expected date.

As retirement policy discussions continue in Congress, experts say the February And March Payments episode underscores a broader issue: millions of Americans depend on these benefits for daily living expenses, making even routine administrative timing changes nationally significant.