Text Message Lawsuit Settlement: is one of the most important consumer protection opportunities currently available to Americans who received unwanted marketing texts. If you were sent promotional messages after you opted out, you may qualify for compensation from a $10.5 million class action settlement. The deadline to file a claim is February 12, 2026, and missing it could mean leaving money on the table. Let’s break this down in plain, everyday language. We’re talking about federal law, consumer rights, corporate compliance, and real cash payments — but I’m going to explain it in a way that makes sense whether you’re a seasoned legal professional or a regular working American who just wants to know, “Do I qualify?”

This settlement involves Kaiser Foundation Health Plan Inc., commonly known as Kaiser Permanente, and alleged violations of the Telephone Consumer Protection Act (TCPA). The TCPA is a federal law passed in 1991 to protect Americans from unwanted telemarketing calls and automated messages. Even though it was written decades ago, courts have consistently applied it to modern SMS marketing. If a company sends you marketing texts after you’ve clearly opted out — for example, by replying “STOP” — that can be a violation of federal law.

Table of Contents

Text Message Lawsuit Settlement

The Text Message Lawsuit Settlement provides compensation to consumers who allegedly received marketing texts after opting out. With a February 12, 2026 filing deadline, eligible individuals may receive up to $75 per qualifying message from a $10.5 million fund. Rooted in the federal TCPA, this case highlights both consumer protection and corporate accountability. Filing is straightforward, free, and takes only minutes — but waiting could cost you your share.

| Category | Details |

|---|---|

| Settlement Name | Kaiser Permanente TCPA Text Message Settlement |

| Total Settlement Fund | $10.5 Million |

| Governing Law | Telephone Consumer Protection Act (TCPA) |

| Eligible Time Period | January 21, 2021 – August 20, 2025 |

| Claim Deadline | February 12, 2026 |

| Estimated Payment | Up to $75 per qualifying text (pro-rated) |

| Proof Required | No documentation required; records verified by administrator |

| Official Website | https://www.kaisertcpasettlement.com |

Understanding the Legal Foundation: What Is the TCPA?

The Telephone Consumer Protection Act (TCPA) (47 U.S.C. § 227) restricts telemarketing communications, including automated calls and text messages sent to mobile phones. It is enforced by the Federal Communications Commission (FCC).

Under the TCPA:

- Companies must obtain prior express written consent before sending marketing texts.

- Businesses must honor opt-out requests immediately.

- Each violation may carry statutory damages of $500 per message, and up to $1,500 per message if the violation is willful.

These statutory damages are the reason companies take these lawsuits seriously. When multiplied across thousands — or millions — of messages, potential liability can skyrocket.

Why This Text Message Lawsuit Settlement Matters in Today’s Digital World?

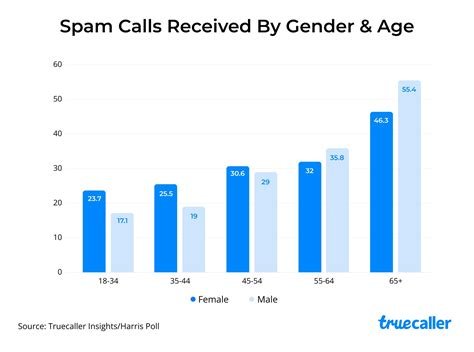

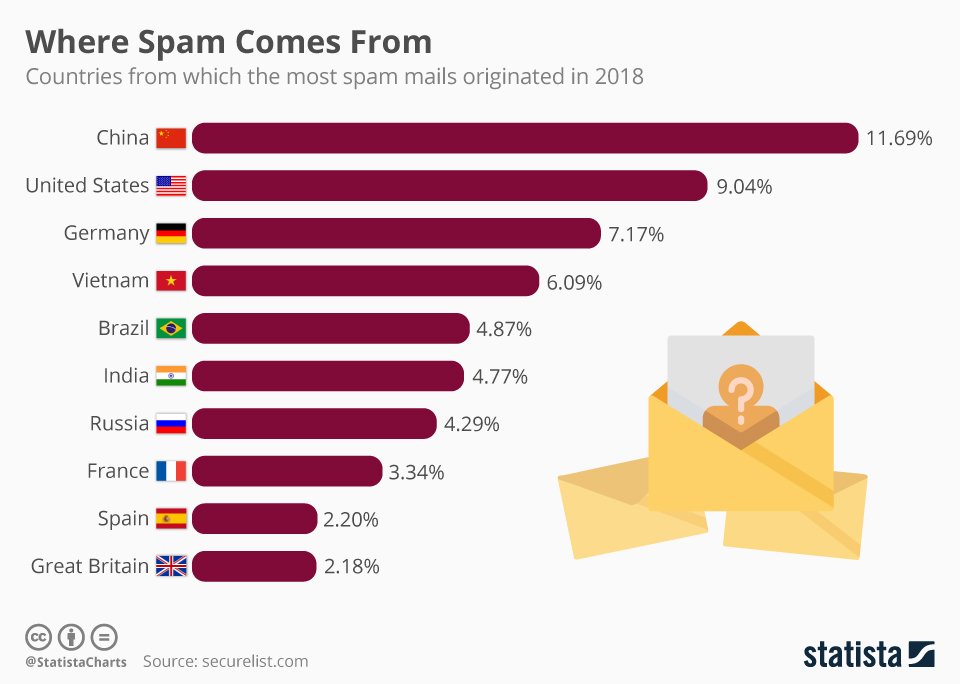

Americans are flooded with text marketing. According to data compiled by the Federal Trade Commission (FTC), consumers reported losing more than $330 million to text message scams in 2022 alone, more than double the amount reported in 2021.

Beyond outright scams, there’s the constant stream of promotional texts from companies. Some are welcome. Some are not. The law doesn’t ban marketing texts — but it requires consent and compliance.

This settlement is a reminder that businesses must respect consumer choices.

For professionals in compliance, healthcare administration, telecommunications, and marketing, this case reinforces the importance of strict opt-out management and documentation systems.

Who Is Eligible for the Text Message Lawsuit Settlement?

You may qualify if:

- You received one or more marketing text messages from Kaiser Permanente.

- The texts were sent after you opted out (for example, by replying STOP).

- The messages were sent between January 21, 2021 and August 20, 2025.

Not all texts qualify. Appointment reminders, billing notifications, or administrative messages may not fall under marketing classifications.

The key issue is whether the texts were promotional and sent after an opt-out request.

If you’re unsure whether you qualify, you can still file a claim. The settlement administrator will verify phone numbers against company records.

How Much Money Could You Receive?

Eligible claimants may receive up to $75 per qualifying text message. However, payments are not guaranteed to be exactly $75 per text because the settlement operates on a pro-rata distribution system.

Here’s how that works:

- The settlement fund totals $10.5 million.

- Attorney fees and administrative costs are paid from the fund.

- The remaining balance is divided among approved claimants.

- If more people file claims, individual payments decrease proportionally.

- If fewer people file, payments increase — up to the capped amount per message.

This structure is standard practice in federal class action settlements.

Step-by-Step Guide to Filing Your Claim

Step 1: Visit the Official Website

Go directly to:

https://www.kaisertcpasettlement.com

Do not rely on third-party claim websites. Always use the official administrator’s site to protect your personal information.

Step 2: Access the Claim Form

Click the “File a Claim” link. You’ll be prompted to provide:

- Full legal name

- Current mailing address

- Email address (if applicable)

- Phone number(s) that received the messages

The form is straightforward and typically takes less than 10 minutes to complete.

Step 3: Certify the Information

You will affirm under penalty of perjury that:

- The information provided is accurate.

- You received marketing texts after opting out.

Honesty is critical. Submitting fraudulent claims can result in legal consequences.

Step 4: Submit Before the Deadline

The claim must be submitted online or postmarked by February 12, 2026.

Late submissions are not accepted.

What Happens After You File?

After the deadline passes:

- The settlement administrator reviews claims.

- Phone numbers are verified against company data.

- The court grants final approval (if not already finalized).

- Payments are issued via check or electronic distribution.

This process can take several months, depending on court scheduling and whether any appeals are filed.

Why No Proof Is Required?

Many class action settlements do not require proof if the defendant maintains sufficient records.

In this case, the administrator will cross-reference submitted phone numbers with internal company databases. This streamlines the claims process and increases accessibility for consumers.

However, retaining personal records — such as screenshots — is always a good practice.

Broader Implications for Businesses and Professionals

From a compliance perspective, this settlement highlights several key risk areas:

- Automated marketing systems must suppress opted-out numbers immediately.

- Vendors and third-party messaging platforms must be audited regularly.

- Healthcare entities are not exempt from TCPA liability.

- Internal compliance audits should be conducted annually.

In professional practice, I’ve observed that most TCPA violations stem from system errors, poor vendor oversight, or outdated opt-out databases rather than intentional misconduct. However, courts do not excuse negligence.

Companies that ignore compliance frameworks risk significant financial exposure.

AT&T Reveals Timeline for $7500 Settlement Payments in 2026

Capital Health Settlement Could Pay Up to $5000 — Why Some Claims Drop to $100

FTC Begins January 2026 Refund Payments After Major Settlements

Protecting Yourself From Future Text Message Violations

Consumer awareness is key.

The Federal Trade Commission (FTC) recommends:

- Register your phone number on the National Do Not Call Registry at https://www.donotcall.gov

- Report unwanted messages at https://reportfraud.ftc.gov

- Avoid clicking suspicious links

According to FTC reports, text-based fraud continues to rise year over year, reinforcing the need for vigilance.

Why Deadlines Matter in Class Actions

Class action settlements operate under strict judicial timelines. Once the claims window closes, unclaimed funds may revert to alternative distribution methods approved by the court.

Failure to file means:

- You waive your right to payment.

- Your legal claims are resolved as part of the class.

In simple terms: no claim equals no compensation.

Final Thoughts

Text Message Lawsuit Settlement — Steps to Claim Your Share Before February 2026 is an opportunity for eligible Americans to assert their consumer rights under federal law. Backed by the Telephone Consumer Protection Act, this $10.5 million settlement underscores the importance of opt-out compliance and responsible marketing practices.

For consumers, the message is simple: if you qualify, file before February 12, 2026.

For professionals, the lesson is clear: regulatory compliance is not optional in today’s automated communication landscape.

Act now, verify your eligibility, and protect your rights.