Alaska Approves $1,000 PFD Dividend: Alaska Approves $1,000 PFD Dividend for 2026, and the announcement has sparked conversations from Anchorage to Utqiaġvik. Whether you’re a new resident still figuring out what the Permanent Fund Dividend actually is, or a seasoned Alaskan who files every single year like clockwork, this complete guide breaks down everything you need to know. The goal here is to keep things friendly and conversational, with that down-to-earth Alaska vibe, while still delivering accurate, professional, and trustworthy information.

The Permanent Fund Dividend (PFD) is one of the defining features of life in Alaska. It represents the idea that Alaska’s vast natural resources belong to its people — and that everyone who calls the state home should receive a share of its wealth. For 2026, the dividend is officially set at $1,000 per eligible resident, paid out during the 2026 calendar year based on the 2025 dividend period. While the amount isn’t the highest in state history, it remains a meaningful boost to households across the region. Before diving into the nitty-gritty details, here’s a quick, WordPress-friendly summary of what you’ll find in this guide.

Table of Contents

Alaska Approves $1,000 PFD Dividend

The 2026 Alaska Permanent Fund Dividend of $1,000 remains a significant benefit designed to help families, support local economies, and maintain Alaska’s tradition of sharing its natural resource wealth. Whether you’re budgeting carefully, putting money into savings, or using it to cover seasonal expenses, understanding the application process and eligibility criteria ensures you get your dividend smoothly. By applying early, keeping your information accurate, and staying on top of communication from the PFD Division, you set yourself up to receive the payment on time without complications.

| Category | Details |

|---|---|

| Dividend Amount (2026) | $1,000 per eligible resident |

| Application Window | Jan 1 – Mar 31, 2026 |

| Payout Dates | Jan 15, Feb 19, Mar 19 (2026) |

| Residency Requirement | Must have lived in Alaska for all of 2024 |

| Established | 1982 |

| Administered By | Alaska Department of Revenue – PFD Division |

| Official Website | https://pfd.alaska.gov |

The Permanent Fund Dividend is rooted in Alaska’s unique history. Back in the 1970s, when the Trans-Alaska Pipeline was being constructed, oil revenue surged dramatically. State leaders recognized that this wealth wouldn’t last forever, so they amended the Alaska Constitution to create a financial savings account — the Alaska Permanent Fund. The idea was simple: save and invest a portion of oil revenue so that future generations benefit long after oil fields decline.

By 1982, the state decided that a portion of the investment earnings should be shared directly with residents. That’s how the first PFD checks — $1,000 each — were born. Decades later, the program is still going strong and has paid out more than $30 billion in total. For many families, that annual check is woven into financial planning, holiday budgets, and even debt management.

The 2026 dividend amount of $1,000 might seem modest compared to the record-breaking $3,284 of 2022, but it reflects economic realities like market performance, state budget constraints, and long-term sustainability considerations. Understanding why the amount changes each year helps residents appreciate the balancing act the state performs.

The payout is calculated using a method called the Percent of Market Value (POMV) formula. In simple terms, the state looks at the average market value of the Fund over five years and allows a withdrawal of around 5 percent of that value. That pot of money is then divided between government services, savings, and the PFD. When markets are strong, the Fund grows. When markets cool down, the payout often stabilizes or shrinks. Legislative decisions also influence how much goes toward dividends vs. state programs.

Who Qualifies for the 2026 Alaska Approves $1,000 PFD Dividend?

Eligibility rules sound complicated at first, but they make sense once you break them down. To qualify:

You must have lived in Alaska for the entire 2024 calendar year. Residency must be continuous and well-documented.

You must intend to stay in Alaska indefinitely. This doesn’t mean you’re banned from moving. It just means that at the time you filed, your intent was genuine.

You must be physically present in Alaska for at least 72 consecutive hours during 2023–2024. This requirement helps verify genuine ties to the state.

Your absences in 2024 must be allowable. Examples include military service, college attendance, medical travel, or other approved reasons.

You must not claim residency elsewhere. If another state or country considers you a resident, that’s an automatic disqualifier.

Certain felony convictions may impact eligibility. The rules are strict but transparent.

Children qualify, too. Parents or guardians file on behalf of minors, and every eligible child receives the full $1,000.

When Will the Alaska Approves $1,000 PFD Dividend Be Paid?

Payment is not made on one single day. Instead, the state uses staggered payout waves depending on application status. For 2026, the scheduled dates are:

- January 15, 2026

- February 19, 2026

- March 19, 2026

To be included in a payout wave, your application must reach the “Eligible – Not Paid” status by the cut-off date listed on the PFD website. If your application needs additional review or you submit documents late, don’t panic — you’ll simply land in a later wave.

How to Apply for $1,000 PFD Dividend?

Though applying is straightforward, doing it right avoids delays. Here’s a clean, step-by-step guide.

1. Apply between January 1 and March 31, 2026.

This is a strict deadline — missing it means no PFD for the year.

2. Gather your information ahead of time.

You’ll need:

- Your Social Security number

- Alaska ID or driver’s license

- Address and contact info

- Absence and residency dates

- Supporting documents for special circumstances

3. File online for the fastest results.

The official portal is https://pfd.alaska.gov.

4. Create or update your myPFD account.

This dashboard helps you monitor progress, submit additional information, and receive notifications.

5. Choose direct deposit.

Payments arrive faster and more securely.

6. Track your status regularly.

Statuses include:

- Received

- Under Review

- Eligible – Not Paid

- Paid

A status change from “Under Review” to “Eligible – Not Paid” is the last step before your payment is scheduled.

Common Mistakes Applicants Make — And How to Avoid Them

Every year, people accidentally delay their own payments by making avoidable mistakes. Here are the most common issues:

Guessing on travel dates.

Incorrect absence reporting is the leading cause of review delays. Always double-check the dates before submitting.

Not updating addresses.

If the state can’t send you correspondence, your application may be flagged.

Incorrect minor applications.

Each child must have accurate parental or guardian information.

Late responses to document requests.

If the PFD Division asks for additional proof and you wait weeks to respond, your payout will be pushed to a later cycle.

Assuming you don’t qualify because you traveled.

Absences are allowed for many legitimate reasons. Always verify instead of assuming you’re disqualified.

How the $1,000 PFD Dividend Impacts Alaska’s Economy?

The PFD does more than just put a smile on residents’ faces. Economists and policy experts have long studied its financial impact. Studies show the dividend injects anywhere from $700 million to over $1 billion into Alaska’s economy annually. This spending benefits local businesses, increases retail activity, and supports seasonal employment.

In rural regions — where travel costs are high and supply chains limited — the PFD plays an even more significant role. Families often use their dividend for heating oil, fuel, bulk groceries, medical travel, and outdoor gear essential for subsistence lifestyles. In urban areas, the PFD boosts retail sales and supports small businesses through the fall season.

Professionally, the PFD acts as a predictable yearly economic stimulus. Financial planners even factor it into local spending forecasts, recognizing how reliably the annual payout influences consumer behavior.

A Deeper Look at How the PFD Is Calculated

To help both kids and professionals understand this better, imagine Alaska’s Permanent Fund as a giant savings-and-investment account. The state deposits money earned from oil royalties into this account, then invests it worldwide. When the investments do well, the Fund grows. When markets dip, the Fund slows but still earns.

The state reviews the Fund’s value over the past five years, calculates a safe percentage to withdraw (around 5 percent), and allocates part of that to the annual dividend. This process ensures the Fund lasts for future generations.

Legislative decisions also influence the final amount. Lawmakers must balance the dividend with budget needs, especially in years when oil revenue drops or state services cost more.

How the PFD Compares to Other State Programs?

Alaska’s PFD is completely unique. No other U.S. state distributes a yearly payment to residents based on natural resource wealth. Some states offer tax rebates or surplus refunds, but none have a program quite like the PFD. This uniqueness gives Alaska a cultural and financial identity unmatched anywhere else in the U.S.

The dividend also serves as a draw for new residents and families seeking financial stability. Many newcomers are surprised to learn that even children receive the full amount.

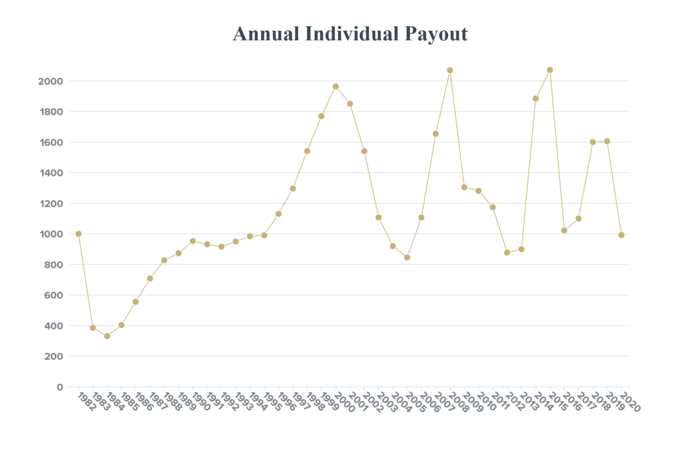

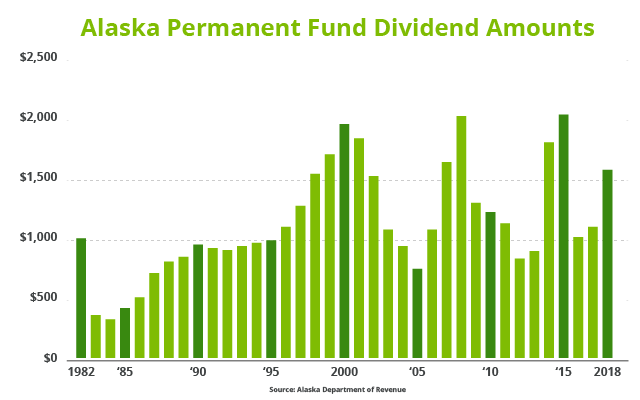

A Brief History of Dividend Fluctuations

The PFD hasn’t always been consistent. Some years the payout was above $2,000; other years dipped below $1,000. A few notable years include:

- 1982: First-ever dividend — $1,000

- 2008: A large payout totaling $3,269, including a special energy rebate

- 2015–2017: Payout reductions due to budget deficits

- 2022: A historic payout of $3,284

These fluctuations reflect the state’s shifting economic landscape, political priorities, and market realities.

Looking Ahead: What About the 2027 Dividend?

Experts say the 2027 PFD could rise slightly if the markets remain stable. However, oil production levels, state budget negotiations, and global economic factors all influence the final amount. Some analysts predict dividends may hover around $1,000–$1,400 over the next few years unless oil prices surge or lawmakers revise the POMV formula.

Social Security Releases 2026 Payment Schedule — Find Your Deposit Week

TSA Is Quietly Changing Airport Security in 2026 — What Travelers Will Notice

Is a $200 Social Security Increase Really Coming in 2026? The Math Tells a Different Story