Every year, millions of Americans wait for tax season with a mix of anxiety and anticipation. For many households, the tax refund is one of the largest single payments they receive all year — sometimes used to pay off debt, cover rent, repair a car, or build savings.

Early figures released by the Internal Revenue Service (IRS) suggest that 2026 may bring slightly bigger refunds than people saw at the same point last year. While that sounds like welcome news, the reality behind the numbers is more nuanced than it first appears.

The latest filing-season statistics indicate that early refunds are running higher even though fewer people have filed their returns so far. Financial experts caution that a rising refund average does not automatically mean taxpayers are better off financially. In fact, a larger refund often signals that too much tax was withheld from paychecks during the year. Understanding why these numbers are rising helps taxpayers make smarter financial decisions rather than simply celebrating a bigger payment.

Table of Contents

Average IRS Refunds

Early IRS processing data shows a noticeable increase in average refund amounts during the opening weeks of the filing season. The figures are preliminary, but they provide an early snapshot of how the tax year is shaping up and what taxpayers may expect as more returns are processed.

Overview of Early Tax Season Data

| Category | Current Season (Early Data) | Previous Year (Same Period) |

|---|---|---|

| Average refund | About $2,290 | Lower than current season |

| Direct-deposit refund average | Around $2,388 | Smaller than this year |

| Change in refunds | Roughly 10%–11% higher | — |

| Filing pace | Fewer early returns filed | Higher early filing volume |

| Typical processing time | About 21 days (e-file) | Similar |

The Key Numbers

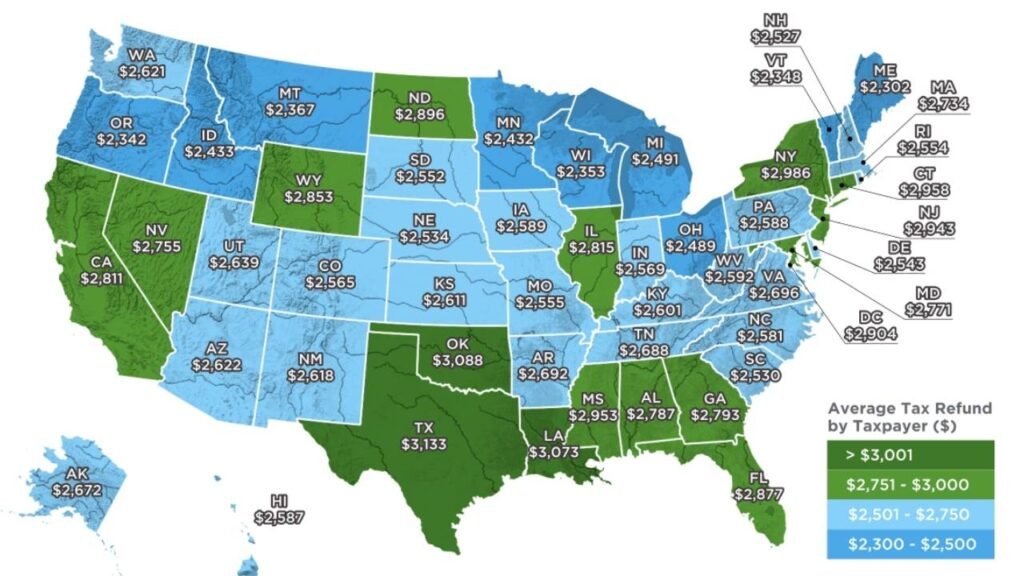

Early filing statistics reveal that the average refund is about $2,290, representing roughly an 11% increase compared with the same point in the prior tax season. Refunds sent via direct deposit are even slightly larger, averaging close to $2,388.

However, these numbers do not reflect the final tax season outcome. The IRS updates the statistics weekly, and averages typically shift as more taxpayers — especially those with complex returns — submit their filings later in the season.

Another important detail: fewer Americans filed returns during the opening weeks this year. That alone can influence the average, because early filers often share similar income profiles.

Why Refunds Are Rising

Several factors are contributing to the increase in refund amounts. The change is not caused by a single policy or one-time event.

1. Tax Credits and Adjustments

Some deductions and credits available to eligible taxpayers are increasing refunds for qualifying households. Families, students, and moderate-income earners tend to benefit the most from refundable credits, which can raise early averages significantly.

2. Paycheck Withholding

The most common reason for a higher refund is simple: workers paid more tax than necessary throughout the year. Employers withhold taxes from each paycheck based on estimates. If too much is withheld, the taxpayer receives the difference back at filing time.

3. Filing Patterns

People expecting refunds often file early, while those who may owe money frequently wait until closer to the deadline. This early-filer group naturally pushes averages higher during the first weeks of the season.

Bigger Refund Does Not Mean More Income

Many taxpayers treat a refund like a bonus, but it is not extra money from the government. A refund is the return of your own earnings that were overpaid in taxes.

Think of it as a delayed paycheck. Instead of receiving that money gradually throughout the year, you allowed the government to hold it temporarily. A large refund can actually signal that monthly cash flow was lower than it needed to be.

Financial planners often suggest adjusting withholding so workers keep more money in each paycheck rather than waiting for a single large payment once a year.

Processing Times and Payment Delivery

The method used to file a tax return plays a major role in how quickly a refund arrives.

E-file with direct deposit: usually about 21 days

Paper return: four weeks or longer in many cases

Some refunds are delayed beyond that timeframe. Returns claiming certain tax credits — particularly family-related credits — often require additional verification and are typically released later in the season, frequently around early March.

Filing early does not always mean receiving the money immediately. The IRS must complete identity checks and fraud prevention procedures before issuing payments.

Why Early Numbers Can Be Misleading

Early tax statistics are useful but incomplete. They represent only a portion of taxpayers and do not yet include:

- Self-employed filers

- Investors reporting capital gains

- Households with complex deductions

- People who file close to the deadline

As these returns enter the system, the average refund usually changes. Historically, refund averages often shift significantly by the end of the filing season.

This is why financial experts warn against assuming that every taxpayer will receive a larger payment this year.

How Taxpayers Should Interpret the Data

Instead of focusing only on the size of a refund, taxpayers should pay attention to overall tax efficiency. A refund should ideally be moderate — not extremely high and not resulting in a large bill owed.

A balanced withholding approach offers advantages:

- More take-home pay during the year

- Less reliance on a lump-sum payment

- Better monthly budgeting

A huge refund may feel satisfying, but it often indicates money that could have been used earlier for bills, savings, or investments.

The Bigger Financial Picture

The early data highlights an important financial lesson: tax refunds reflect planning, not luck. Two people with the same income can receive very different refunds simply because their withholding choices differ.

For many households, the refund still plays a valuable role. It can serve as a forced savings mechanism — a way to accumulate money that might otherwise have been spent. Others use it to build emergency funds or reduce credit card balances.

The key is understanding what the refund represents. It is not additional income but a financial adjustment.

Final Thoughts

Early IRS data confirms that average refunds are currently higher this tax season, but the increase should be interpreted carefully. The rise is influenced by filing patterns, withholding estimates, and tax credits rather than a sudden improvement in personal finances.

As more returns are processed, the numbers will likely change. For taxpayers, the real takeaway is not the size of the refund but what it says about their tax strategy. Reviewing withholding, planning deductions, and understanding credits can help households manage their finances more effectively throughout the year.

In the end, the best outcome is not necessarily the biggest refund — it is paying the right amount of tax in the first place and keeping as much of each paycheck as possible when it matters most: during the year you earn it.