Retirement doesn’t look the way it did 20 or 30 years ago. People are living longer, healthcare costs keep rising, and many retirees simply don’t want to sit still after decades of working. A lot of them still have energy, skills, and experience they enjoy using. The real concern is money.

The moment someone claims retirement benefits they start worrying that earning even a small paycheck will cause those payments to disappear. The good news is that Early Retirees Can Earn More from Side Work Without Losing Benefits when they understand the system properly. There is a widespread belief that Social Security punishes retirees who keep working. That belief stops many people from accepting flexible jobs or small business opportunities that could improve their financial comfort. In reality, Early Retirees Can Earn More from Side Work Without Losing Benefits because the rules were designed to support gradual retirement rather than force people into a strict stop-working lifestyle. Once you understand earnings limits, full retirement age, and how adjustments actually work, part-time income becomes a helpful financial tool instead of a threat.

Many retirees today combine retirement income with light work such as consulting, tutoring, selling crafts online, bookkeeping, remote customer support, or seasonal retail. The retirement system recognizes that not everyone wants a sudden career cutoff. Instead, it allows people to transition slowly. Before full retirement age there are earnings limits but exceeding them does not cancel benefits permanently. Payments may be temporarily held back, yet they are recalculated later. This means retirees can cover rising living expenses, protect savings, and still maintain long-term financial security. With a little planning, even a few hours of work per week can make retirement significantly more comfortable.

Table of Contents

Earn More from Side Work Without Losing Benefits

| Key Factor | What It Means for Early Retirees | Why It Matters |

|---|---|---|

| Earnings Limit Before Full Retirement Age | Benefits may be temporarily reduced if income exceeds the annual threshold | Prevents overpayment but does not permanently remove benefits |

| Year You Reach Full Retirement Age | A higher earnings limit applies | Allows significantly more income |

| After Full Retirement Age | No earnings cap | Retirees can earn unlimited income |

| Withheld Benefits | Payments delayed, not lost | Monthly payments may increase later |

| Income That Counts | Wages and self-employment income | Helps retirees plan work hours |

| Income That Does Not Count | Investments, pensions, withdrawals | Allows multiple income streams |

| Future Recalculation | Benefit amount adjusted at full retirement age | Long-term increase in monthly checks |

Modern retirement is no longer a permanent stop. It is a gradual shift into a more flexible lifestyle. The system allows retirees to earn income, protect savings, and still receive benefits. The key is understanding the rules rather than avoiding work out of fear. Earnings limits only apply before full retirement age and withheld payments return through future adjustments. Careful planning makes part-time income a powerful tool.

Understanding The Earnings Test

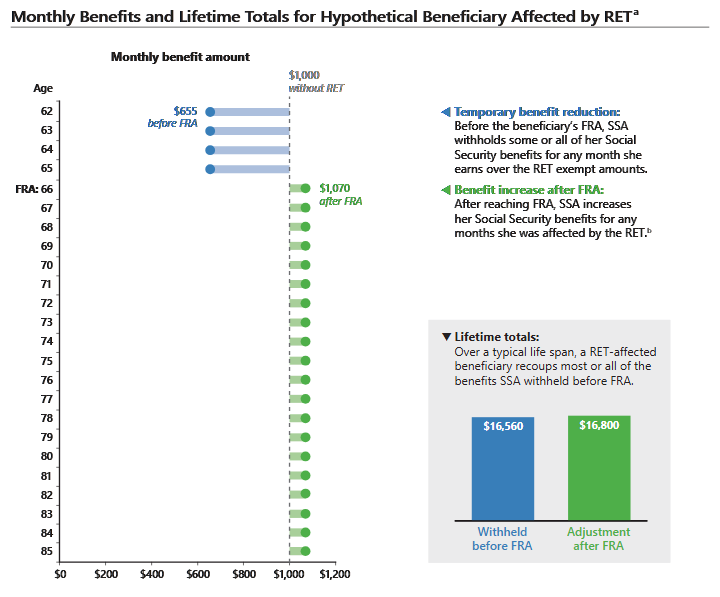

- The earnings test is the rule that worries retirees the most. When someone claims Social Security before reaching full retirement age and earns more than the annual limit, part of the benefit is withheld. This sounds harsh, but the details matter.

- Think of it as postponed payments rather than a penalty. Social Security tracks the months benefits were withheld. After you reach full retirement age, your payment is recalculated to compensate for those missed months. Because of this, Early Retirees Can Earn More from Side Work Without Losing Benefits in the long run. Many retirees later discover their monthly check actually rises slightly because they worked while receiving early benefits.

- This is one of the biggest misunderstandings in retirement planning. The system does not punish work. It simply adjusts timing.

Full Retirement Age Matters

Full retirement age is a major milestone. For most people today, it falls between 66 and 67 depending on birth year. Once you reach it, everything changes.

The earnings test disappears completely. You can earn as much as you want and your benefits continue without reduction.

- At that point you can work full time

- start a business

- return to your former profession

- take consulting contracts

This is exactly why financial planners often suggest flexible retirement strategies. A person might claim benefits early for stability, then increase work hours later. That approach demonstrates how Early Retirees Can Earn More from Side Work Without Losing Benefits while maintaining long-term income security.

What Counts as Side Work Income

Social Security does not treat every dollar equally. Only earned income counts toward the earnings limit.

This includes:

- wages from a job

- self-employment income

- freelance payments

- contract or consulting income

However, many common retirement income sources do not count:

- dividends from investments

- interest income

- pension payments

- withdrawals from retirement accounts

- most rental income

This difference is extremely important. A retiree can combine investment income with part-time work and still remain within the limits. That is another reason Early Retirees Can Earn More from Side Work Without Losing Benefits when they structure income wisely.

Why Benefits Are Not Actually Lost

- The phrase benefit reduction causes unnecessary panic. In practice, the system works more like a delayed payout plan.

- When benefits are withheld due to earnings above the limit, Social Security records how many months of payments were held. Later, once you reach full retirement age, your benefit is recalculated as if you had claimed later.

- This means your future monthly payment increases. Over a long retirement, the additional payments often make up for the earlier reductions. In other words, the money comes back gradually over time. Understanding this single rule changes how people view retirement work. It proves again that Early Retirees Can Earn More From Side Work Without Losing Benefits without harming their financial future.

Taxes And Medicare Considerations

Working during retirement can affect taxes. When total income rises above certain levels, a portion of Social Security benefits becomes taxable. This does not mean working is a mistake. It simply means planning is necessary. Medicare premiums may also increase slightly for higher-income retirees. These increases happen gradually and rarely outweigh the benefits of earning additional income. Spreading work earnings across the year instead of receiving one large payment often helps control taxes. With proper planning, retirees still benefit financially, showing once again that Early Retirees Can Earn More From Side Work Without Losing Benefits even after considering taxes.

Smart Strategies to Maximize Retirement Income

Retirees are becoming more creative with side work. The goal is flexibility, not stress.

- Flexible freelance work is popular because hours can be adjusted easily. If earnings approach the limit, retirees simply reduce workload for a few months.

- Seasonal work is another smart method. Many retirees work during holidays, tax season, or tourism months and rest the rest of the year.

- Payment timing can also help. If a large contract payment risks exceeding the annual earnings limit, delaying it until the year full retirement age is reached removes the restriction entirely.

- Investment income plays a supporting role. Dividends and interest can cover baseline expenses while part-time work pays for extras like travel or hobbies. This practical combination is why Early Retirees Can Earn More from Side Work Without Losing Benefits in real life, not just theory.

Common Mistakes Early Retirees Make

- Many retirees limit themselves unnecessarily because of incorrect assumptions.

- Some believe any job cancels benefits. Others think withheld payments disappear forever. Some claim benefits early without learning the earnings rules. Many ignore tax planning entirely.

- These mistakes often cost more money than the earnings test itself. With accurate information, retirees can make better decisions and maintain higher lifetime income.

The Psychological Benefit of Working

- Financial security is only part of the story. Retirement can bring unexpected emotional challenges. After leaving a long career, many people lose routine, social interaction, and a sense of purpose.

- Part-time work restores structure. Even a few hours a week creates connection and mental engagement. Studies in recent years show retirees who stay active in work or volunteering report higher satisfaction and lower stress.

- Earning money also reduces anxiety about spending savings. Instead of worrying about every purchase, retirees feel freedom again. That emotional benefit alone explains why Early Retirees Can Earn More From Side Work Without Losing Benefits while improving quality of life.

For many households, the difference between a tight retirement and a comfortable one is a small steady side income. Once retirees realize they can work safely, they often gain both financial and personal freedom. Retirement is not about doing nothing. It is about choosing how to spend your time. And with the right strategy, working a little can make the retirement years more secure, active, and enjoyable.

FAQs About Earn More from Side Work Without Losing Benefits

1. Will Social Security stop if I work after claiming early benefits

No. Payments may be temporarily reduced if earnings exceed limits, but they are recalculated later.

2. How much can I earn without affecting benefits

The government sets an annual earnings limit before full retirement age. Staying near that level helps avoid temporary reductions.

3. Does freelance or self-employment income count

Yes. Any earned income from active work is included in the earnings test.

4. Are withheld benefits permanently lost

No. They are returned through higher monthly payments after full retirement age.