February 2026 Payment Claims: Sorting Fact From Fiction on IRS Deposits, Refunds, and Tariff Dividends is one of the most searched financial topics in the United States right now. From Oklahoma to California, folks are asking the same question: “Is the IRS sending out a new $2,000 payment?” Social media videos are stacking up millions of views, and group chats are lighting up with screenshots of bank deposits labeled “IRS TREAS 310.” Let’s slow it down and walk through this carefully.

I’ve worked in tax advisory and financial literacy outreach for years, especially in Native and rural communities where clear information matters. When it comes to federal payments, confusion spreads faster than wildfire on dry prairie grass. So today, we’re breaking this down in plain, everyday language — simple enough for a 10-year-old to understand, but thorough enough for tax professionals, CPAs, and financial planners who need verified, sourced facts.

Table of Contents

February 2026 Payment Claims

February 2026 Payment Claims — Sorting Fact From Fiction on IRS Deposits, Refunds, and Tariff Dividends ultimately comes down to verified facts. There is no new federal stimulus payment. The proposed $2,000 tariff dividend has not been enacted into law. Most February deposits are simply standard 2025 tax refunds processed by the IRS. Always rely on official government sources, verify deposits through IRS tools, and approach viral claims with caution and informed judgment.

| Topic | What’s Actually Happening |

|---|---|

| New Federal Stimulus (Feb 2026) | No new stimulus approved by Congress |

| $2,000 “Tariff Dividend” | Proposal discussed publicly, not enacted into law |

| IRS Direct Deposits | Mostly 2025 federal tax refunds |

| Average Refund Timeline | About 21 days for e-file with direct deposit |

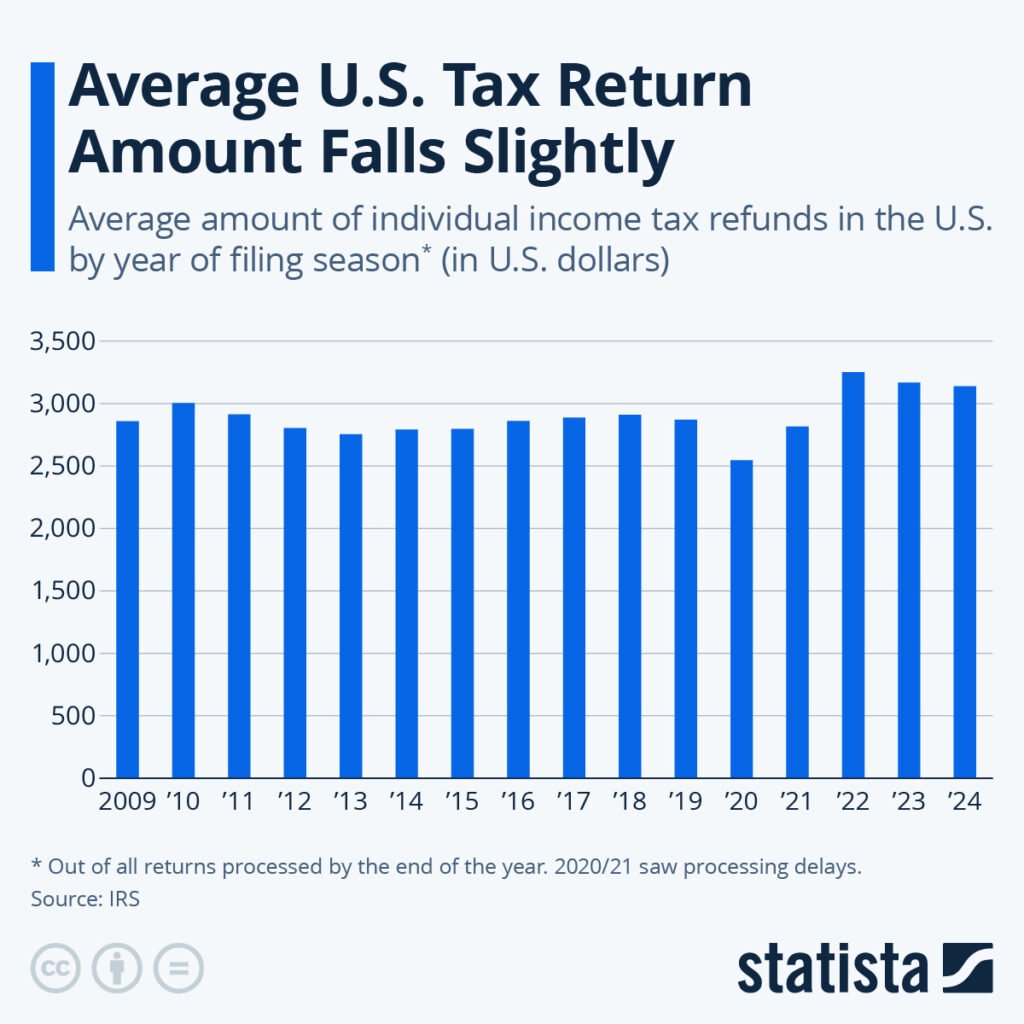

| Refund Average (Recent Years) | Around $3,000 average federal refund |

| Scam Warning | IRS does not call, text, or email for payments |

What Is Really Happening With February 2026 Payment Claims?

Let’s start with the basics.

The Internal Revenue Service began processing 2025 federal income tax returns in January 2026. Every year, millions of Americans file early to get refunds quickly. When those refunds hit bank accounts, they often show up as:

“IRS TREAS 310 TAX REF”

That’s not a secret code for stimulus money. It simply means the U.S. Treasury issued a tax refund.

According to official IRS data, the average federal refund in recent filing seasons has hovered around $2,800–$3,200. That number alone explains why people are seeing deposits close to $2,000 or more and assuming something special is happening.

But it’s just regular tax season doing what it does every year.

Is There a New Federal Stimulus Check in February 2026?

No.

There is currently no new stimulus payment authorized by the U.S. Congress. Any nationwide payment program would require:

- A bill introduced and passed by Congress

- Presidential approval

- Budget allocation

- IRS administrative rollout

If a stimulus check were approved, it would dominate national headlines and appear on official IRS.gov announcements. As of now, no such law exists.

What About the $2,000 “Tariff Dividend” Proposal?

Here’s where social media added fuel to the fire.

Former President Donald Trump discussed the concept of a “tariff dividend,” suggesting that tariff revenues collected on imports could potentially be redistributed to American citizens.

That idea is political commentary and proposal — not enacted federal policy.

To understand why this matters, we need to talk about tariffs.

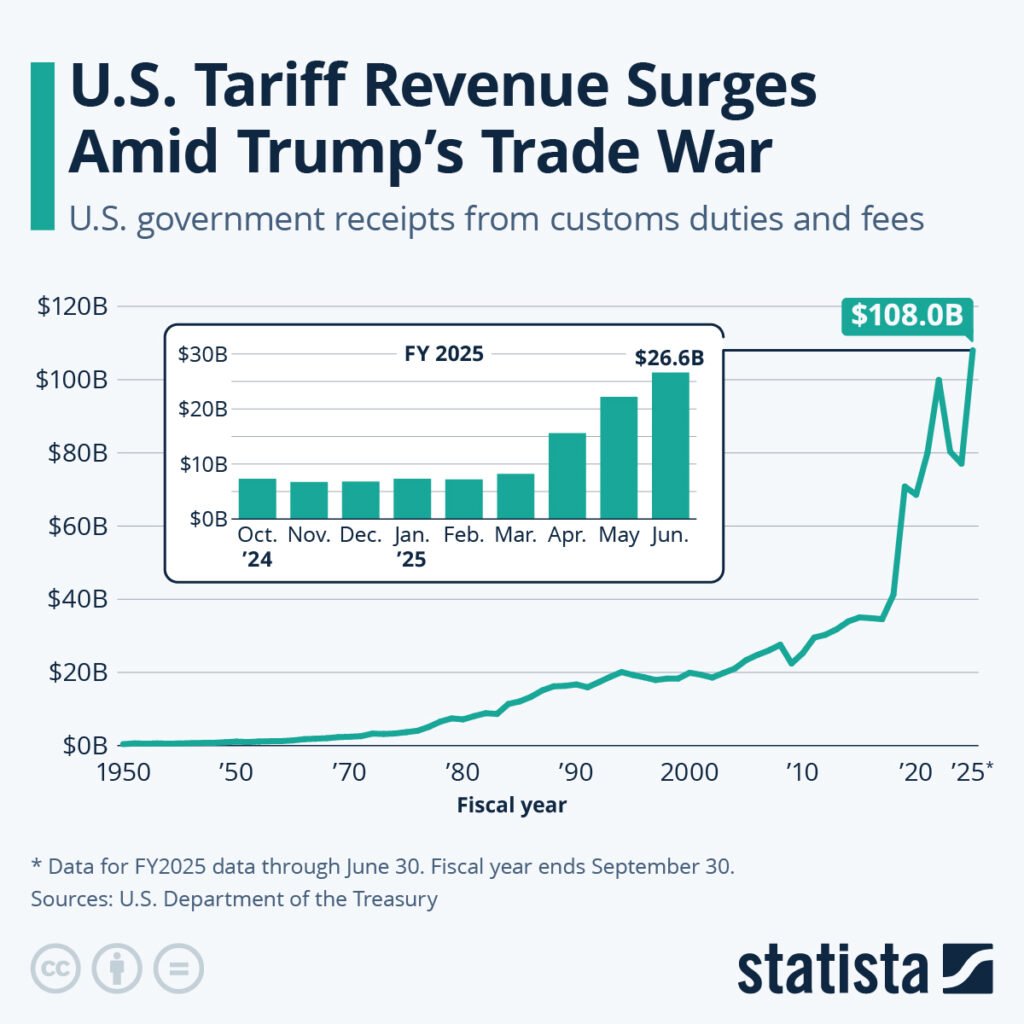

Tariffs are taxes on imported goods. According to U.S. Treasury fiscal data, the federal government collected approximately $80 billion in customs duties in recent fiscal years.

Now here’s the math:

- U.S. population: ~333 million people

- $2,000 per person would cost over $600 billion

Tariff revenue alone does not currently generate enough to fund that level of nationwide payment without additional legislative restructuring and major budget adjustments.

Additionally, any revenue redistribution program would require:

- Congressional authorization

- Budget scoring from the Congressional Budget Office (CBO)

- Implementation guidelines from Treasury

- IRS distribution systems updates

That process takes months — often years — not days.

There has been no ruling from the Supreme Court of the United States requiring such payments.

So at this time, the so-called “tariff dividend” is a proposal, not a payout.

Why People Are Confused: The Psychology of Refund Season

Let’s talk real-life America for a minute.

Inflation has squeezed families. Housing costs remain high. Grocery bills are no joke. Student loan repayments restarted. When folks hear about possible relief, they lean in fast.

Now add these factors:

- Refunds hitting in late January and February

- Deposits around $2,000–$3,000

- Viral TikTok and YouTube claims

- Political speeches being clipped and reposted

You get confusion.

The truth is simpler: most February deposits are standard federal income tax refunds.

Breaking Down How February 2026 Payment Claims Actually Work

Step 1: You Earn Income

Employers withhold federal taxes from your paycheck.

Step 2: You File a Tax Return

When you file Form 1040, you report:

- Income

- Deductions

- Credits

- Taxes already paid

Step 3: IRS Calculates Overpayment

If you paid more than you owed, you get a refund.

That’s your money coming back.

What Makes Refunds Larger?

Here are common contributors:

1. Earned Income Tax Credit (EITC)

The EITC supports low-to-moderate income workers. According to IRS statistics, over 30 million workers claim this credit annually.

Refund amounts can exceed $2,500 depending on income and number of children.

2. Child Tax Credit (CTC)

The Child Tax Credit can significantly increase refunds. For qualifying children, families may receive up to $2,000 per child, depending on income limits.

3. Education Credits

The American Opportunity Tax Credit (AOTC) can provide up to $2,500 per eligible student.

4. Overwithholding

Some taxpayers intentionally withhold extra taxes throughout the year, resulting in larger refunds.

Professional Guidance: What CPAs and Advisors Should Be Doing

For tax professionals and financial advisors, this rumor cycle presents an opportunity.

1. Communicate Early and Often

Send client updates clarifying:

- No federal stimulus is active

- Refund timelines are normal

- Tariff proposals are not law

2. Encourage IRS Online Account Setup

Clients can register at:

https://www.irs.gov/payments/your-online-account

This improves transparency and reduces misinformation.

3. Educate on Financial Planning

Rather than viewing refunds as surprise bonuses, help clients:

- Build emergency savings

- Pay down high-interest debt

- Invest in retirement accounts

Professional credibility is built on clarity.

How to Verify Your February 2026 Payment Claims?

If money hit your account, here’s the checklist.

Step 1: Use “Where’s My Refund?”

https://www.irs.gov/refunds

You’ll need:

- Social Security Number

- Filing status

- Exact refund amount

Step 2: Review Your Filed Return

Check Line 35a on Form 1040.

Step 3: Match Deposit Amount

If it matches, that’s your refund.

If it doesn’t, log into your IRS Online Account.

Tax Scams Are Increasing During Filing Season

According to the IRS annual “Dirty Dozen” scam list, impersonation schemes spike during tax season.

The IRS clearly states:

They do NOT:

- Demand payment over the phone

- Threaten arrest

- Send texts asking for banking details

- Initiate contact through social media

If something feels off, it probably is.

Could a Stimulus Program Happen Later in 2026?

In theory, yes — if Congress passes legislation.

But here’s how that would unfold:

- Bill introduction

- Committee review

- House and Senate votes

- Presidential signature

- Treasury allocation

- IRS system programming

Each stage is public and trackable.

Nothing about that process is secret.

Broader Economic Context

From a macroeconomic standpoint, distributing large stimulus checks requires:

- Fiscal capacity

- Inflation risk analysis

- Debt impact review

- Federal Reserve considerations

During the COVID-19 pandemic, stimulus checks were part of emergency economic packages totaling trillions of dollars.

Currently, no comparable emergency legislation is in motion.

Early Data Shows Average IRS Refunds Are Rising This Tax Season

IRS Tax Refund 2026 Step By Step Tracking Guide Payment Dates And Timeline

$1000 Average Tax Refund Confirmed For 2026 What Taxpayers Should Expect

Practical Advice for Households

Let’s bring this home.

If you received a refund:

- Build a 3–6 month emergency fund.

- Pay down high-interest credit cards.

- Consider Roth IRA contributions.

- Set aside money for next year’s taxes if self-employed.

Refunds are not “free money.” They are overpayments returned.

Financial stability grows from planning, not surprises.