Five Big Social Security Changes: If you rely on Social Security — or plan to in the near future — 2026 is a year to watch. From benefit boosts to updated tax rules and retirement benchmarks, the Social Security Administration (SSA) is rolling out five big changes that affect retirees, workers, and families alike.

These aren’t just tweaks in fine print — they’ll impact how much you receive, how much you can earn, and how long your money needs to last. So whether you’re a retiree on a fixed income, a worker close to retiring, or someone helping family navigate these waters, understanding what’s changing in 2026 is vital. Let’s walk through it in plain, friendly language — no fluff, just facts, examples, and real advice.

Table of Contents

Five Big Social Security Changes

The five big Social Security changes in 2026 are more than just numbers — they affect your income, your work life, your healthcare costs, and your long-term financial security. Here’s what to do next:

- Review your Social Security statement.

- Know your full retirement age.

- Factor in Medicare premiums.

- Think beyond Social Security with personal retirement planning.

With inflation, healthcare costs, and retirement ages evolving, staying informed and proactive is the smartest move you can make.

| Topic | 2026 Figures & Facts | Why It Matters |

|---|---|---|

| COLA Increase | 2.8% raise to benefits | More money in monthly checks starting January. |

| Average Monthly Benefit | Approx. $2,071 | About $56 more per month on average. |

| Taxable Earnings Cap | $184,500 | More income taxed for Social Security. |

| Earnings Limits (Under FRA) | $24,480 annually | Work more before penalties hit. |

| Earnings Limits (In Year of FRA) | $65,160 | Higher earnings allowed before benefit offsets. |

| Medicare Part B Premiums | $202.90/month | Higher health costs can cut into COLA gains. |

| Full Retirement Age (FRA) | 67 (final schedule) | Age for full benefits finalized in 2026. |

| Official SSA Information | https://www.ssa.gov/cola/ | Use official tools to check benefits and eligibility. |

1. COLA: Cost-of-Living Adjustment Brings a Raise

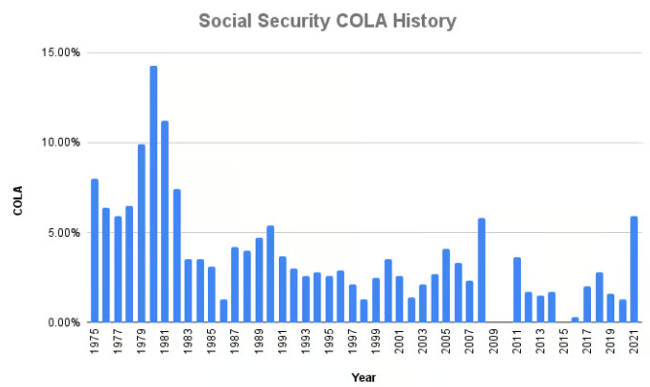

Each year, Social Security checks get a tune-up to match inflation. That’s called a Cost-of-Living Adjustment (COLA). In 2026, benefits will rise by 2.8%.

That might sound modest, but it matters — especially for retirees living on fixed incomes.

Example:

If you’re receiving $2,000/month in 2025, your new benefit will be about $2,056 starting January 2026.

Why this is big: Prices for food, rent, and utilities keep creeping up. COLA ensures that your benefit doesn’t lose buying power over time. The adjustment is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — the same index used by the government to measure inflation trends.

But here’s the catch: COLA doesn’t always fully keep up with “real-world” inflation, especially when health care or housing costs outpace general inflation.

So yes, you’ll get a little more — but you’ll need to watch where it goes.

2. Work More, Lose Less: Higher Earnings Limits for Early Retirees

If you collect Social Security before your full retirement age (FRA) and continue to work, there’s a cap on how much you can earn before your benefits are reduced. In 2026, that cap is going up.

- Under FRA: You can earn up to $24,480 a year without losing benefits.

- In the year you reach FRA: You can earn up to $65,160.

Go over those limits, and SSA will withhold $1 for every $2 you earn over the first threshold, or $1 for every $3 in the second bracket.

Good news: Once you hit your FRA, there are no earnings limits at all — work as much as you want and collect full benefits.

Tip for workers: If you’re working part-time or consulting, you may now be able to earn more without triggering benefit reductions. That’s especially helpful for folks in their early 60s balancing income and early retirement.

3. More of Your Paycheck Will Be Taxed: New Earnings Cap

The maximum amount of income subject to Social Security payroll taxes is going up to $184,500 in 2026 — an increase from $176,100 in 2025.

That means:

- Employees pay 6.2% on wages up to the cap.

- Employers match that 6.2%.

- Self-employed workers pay 12.4% on those earnings.

Why it matters: If you earn more than $184,500, you’re likely seeing a larger total tax bill, although your future benefits may rise accordingly because your highest 35 earning years are used to calculate your payout.

It’s part of the government’s effort to keep the program solvent — and it also plays a role in funding future COLAs and benefit levels.

4. It Takes More to Earn Work Credits

To qualify for Social Security retirement or disability benefits, you need to earn “credits” based on your work history.

In 2026, you’ll need to earn $1,890 to receive one credit.

Since you can earn up to four credits a year, that’s $7,560 minimum in annual earnings to collect the max credits for 2026.

Why it matters: If you’re just starting your career, working part-time, or living with a disability, this number determines how quickly you become eligible for Social Security.

Most people need 40 credits (roughly 10 years of work) to qualify for retirement benefits.

5. Medicare Premiums Are Rising Too

Here’s the part many forget: Medicare Part B premiums are automatically deducted from most Social Security checks.

In 2026, the base premium for Part B will be about $202.90/month, up from $185 in 2025.

So while your Social Security check may grow due to the COLA increase, your take-home benefit might feel smaller once Medicare costs are taken out.

Also important: If you earn more than $103,000 as an individual (or $206,000 for couples), you’ll pay a higher premium tier under IRMAA (Income-Related Monthly Adjustment Amount).

6. Full Retirement Age (FRA) Reaches 67 — and Stays There

The FRA is the age at which you can claim full benefits — without early penalties. In 2026, the FRA finalizes at age 67 for people born in 1960 or later.

This marks the last stage of a gradual change started decades ago when the FRA was 65.

So what?

- Claim at 62, and you take a 30% cut.

- Claim at 67, and you get full benefits.

- Wait until 70, and you can increase your benefit by 8% per year (up to 24%).

Pro tip: For many people, waiting beyond FRA — especially if you expect to live past 80 — can be financially smart.

7A Win for Public Workers: Repeal of Windfall Elimination Provision (WEP)

In 2025, Congress repealed the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) rules.

These previously reduced Social Security benefits for certain public workers who also had pensions — like teachers, police officers, and firefighters.

With the repeal officially rolling into 2026 benefits, many public-sector retirees will now receive the full benefits they earned from other jobs.

This is a major financial boost for thousands of workers who were penalized under old rules, especially those with mixed private/public sector work histories.

Five Big Social Security Changes Bigger Picture

Now, let’s talk about the elephant in the room: Is Social Security running out of money?

Not quite — but here’s the reality:

- According to the latest Trustees Report, the Social Security trust fund will only be able to pay full benefits until 2034 if no changes are made.

- After that, benefits would drop to about 80% of promised payouts unless new legislation is passed.

This makes 2026 — and the years following — crucial for reform, planning, and personal savings.

Advice from pros: Don’t assume Social Security will vanish, but also don’t rely on it as your only retirement income. Supplement with 401(k)s, IRAs, Roth accounts, and other investments.

The Truth Behind the Rumored $200 Social Security Boost in 2026

Could You Retire Comfortably in Your State? Social Security Payments Compared

Government Reverses Course on Social Security Paper Checks After Weeks of Warnings