Missing a tax deadline can feel stressful, especially if you are still waiting on documents, sorting investment records, or trying to understand deductions. Many taxpayers assume the only options are to rush a return or face penalties. In reality, the IRS provides a simple and completely legal way to buy extra time. By filing Form 4868, you can postpone submitting your return and avoid one of the harshest penalties in the tax system.

An extension is not a loophole or special privilege reserved for businesses or wealthy taxpayers. It is a standard procedure used every year by millions of individuals. Accountants often recommend filing an extension when your financial information is incomplete or uncertain. Filing accurately is far more important than filing quickly, and the IRS would rather receive a correct return in October than a rushed and incorrect one in April.

An IRS tax extension gives individual taxpayers an automatic six-month extension to submit their federal income tax return. The request is made through Form 4868, and approval does not require any explanation. Once accepted, your filing deadline typically moves from April 15 to October 15. However, the extension only applies to filing paperwork — you still must estimate and pay your taxes by the original deadline.

Table of Contents

Form 4868 Explained

| Item | Details |

|---|---|

| Form Name | Application for Automatic Extension of Time to File U.S. Individual Income Tax Return |

| Purpose | Extends filing deadline for individual tax returns |

| Extension Length | About 6 months |

| New Deadline | Usually October 15 |

| Who Can Use It | U.S. individuals (citizens and residents) |

| Reason Required | No explanation needed |

| Payment Due | Still due in April |

| Penalty Protection | Avoids late-filing penalty |

What Form 4868 Is (and What It Isn’t)

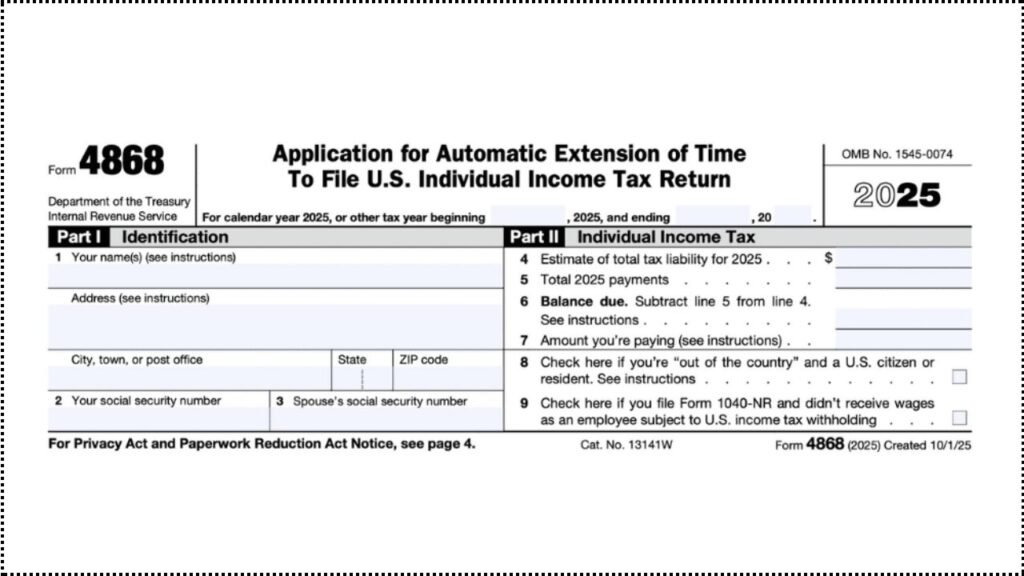

Form 4868 is simply a short request telling the IRS you need more time to file your return. It requires basic identification details and a rough estimate of what you owe. You do not submit your full tax return with it, and you are not required to attach schedules, deductions, or supporting documents.

However, many taxpayers misunderstand its limits. The form postpones paperwork, not tax liability. If you owe money and pay nothing, the IRS will still charge interest and late-payment penalties starting in April.

In other words, it protects you from filing penalties but not from payment penalties.

New Deadline After Filing Form 4868

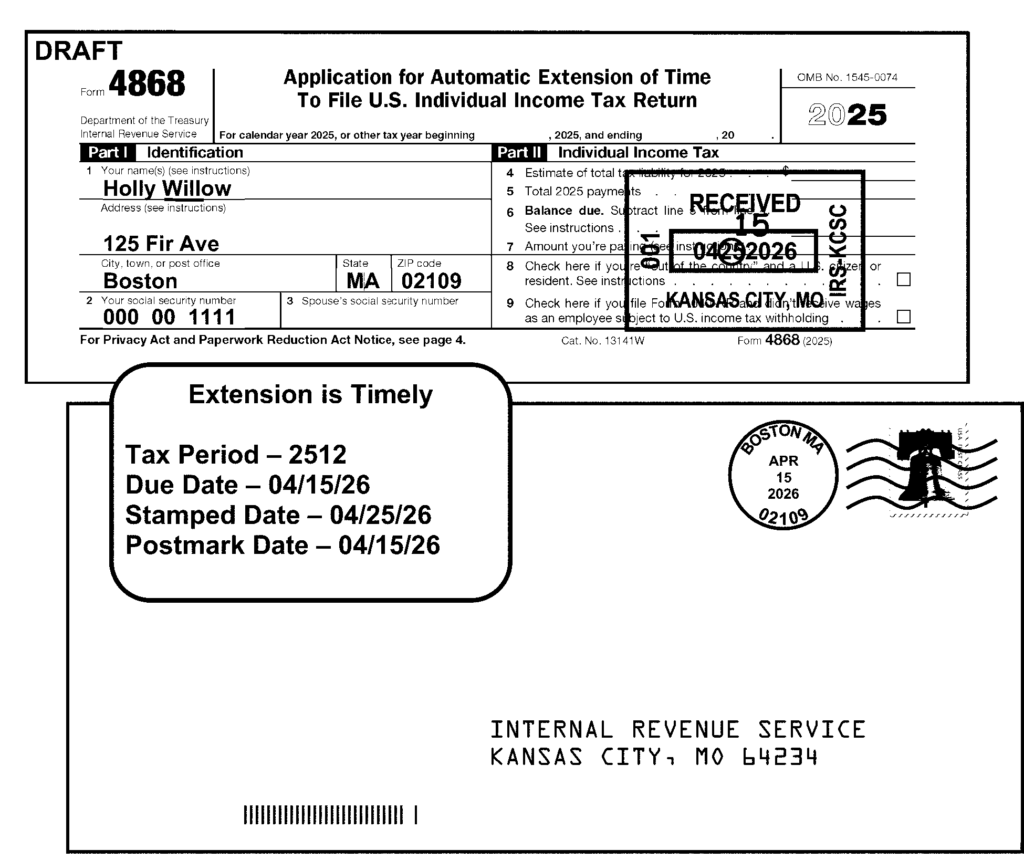

Under normal circumstances, the federal tax return deadline falls on April 15. Once an extension is filed and accepted, the filing deadline moves approximately six months forward.

- Original due date: April 15

- Extended due date: October 15

This additional time allows you to gather financial records, review deductions, and ensure accuracy. It is especially helpful for self-employed individuals, investors, and taxpayers with multiple income sources.

Who Should File It?

Filing an extension makes sense when your tax information is incomplete or uncertain. It is often the safest option when accuracy cannot be guaranteed before the deadline.

Typical situations include:

- Missing W-2 or 1099 forms

- Waiting for partnership or investment statements

- Complicated investment or crypto transactions

- Self-employment income not finalized

- Hiring an accountant late in the season

You never need to justify your request. The IRS automatically grants the extension once Form 4868 is submitted properly.

The Critical Rule Most People Miss

The most important rule is simple: you still have to pay your estimated taxes by April.

Many taxpayers assume the extension delays everything. It does not. The IRS separates filing and payment into two different obligations.

If you file the extension but fail to pay enough:

- Interest begins immediately

- Late-payment penalties apply

However, filing the extension still helps because it avoids the much larger late-filing penalty.

How to File Form 4868 (3 Easy Methods)

1. Online Filing (Recommended)

The fastest method is electronic submission through tax software or an accountant. Approval usually arrives within minutes, and you receive confirmation for your records.

2. Pay Taxes Online

There is a shortcut many people do not realize. If you make an online payment and select “extension” as the reason, the IRS treats the payment itself as your extension request. No separate form is necessary.

3. Mail the Paper Form

You can print and mail Form 4868, but it is the least reliable option because mail delays or lost paperwork could leave you unprotected.

What Information You Need

The form is short and requires minimal details:

- Name and address

- Social Security Number

- Estimated tax owed

- Taxes already paid (withholding or estimated payments)

- Payment amount you are submitting now

No detailed calculations are required — only a reasonable estimate made in good faith.

How to Estimate Your Taxes

Estimating taxes does not require complicated accounting. A practical method is to use last year’s tax return as a starting point.

- Check your previous total tax amount

- Adjust for higher or lower income

- Subtract withholding and estimated payments

- Pay the remaining balance you reasonably expect to owe

You do not have to be perfectly accurate. The goal is to pay close enough to avoid penalties.

Penalties Explained

The IRS has two separate penalties, and confusing them is common.

| Type | What Happens |

|---|---|

| Late filing penalty | Charged when you miss the deadline without an extension |

| Late payment penalty | Charged when taxes are owed but unpaid |

The late-filing penalty is significantly larger than the late-payment penalty. Filing Form 4868 prevents the larger penalty, which is why tax professionals often advise filing it even if you cannot pay the full amount.

Common Myths

Filing an extension increases audit risk

This is false. The IRS does not select audits based on extensions.

Only businesses use extensions

Individuals regularly file Form 4868.

You must provide a reason

No explanation is required.

Special Situations

Some taxpayers automatically receive additional time without filing Form 4868. These include:

- Individuals living outside the United States

- Military personnel in combat zones

- Residents in federally declared disaster areas

Even in these cases, filing the extension can provide extra protection and documentation.

Quick Step-By-Step Checklist

- Estimate what you owe

- Pay as much as you can by April

- Submit Form 4868 electronically

- Keep your confirmation record

- File your full return before October

Bottom Line

Form 4868 is essentially a safeguard. It gives you time to prepare an accurate tax return and shields you from severe filing penalties. Many taxpayers fear requesting an extension, but it is actually a responsible step when financial records are incomplete.

The key point to remember is simple: you are postponing paperwork, not taxes. Pay what you reasonably owe by April, then use the extra months to complete your return carefully. Doing so keeps you compliant, reduces stress, and helps you avoid costly mistakes.