The Full Retirement Age Update to U.S. Social Security has reached a milestone, setting the standard age for full benefits at 67 for people born in 1960 or later. The shift, finalized in 2026 after decades of phased implementation, affects future retirees nationwide and is reshaping retirement planning, benefit claiming strategies, and long-term federal budget projections.

Table of Contents

Full Retirement Age Update

| Key Fact | Detail |

|---|---|

| New retirement benchmark | Full benefits now at age 67 for those born 1960+ |

| Early claiming still allowed | Benefits can begin at 62 but are permanently reduced |

| Health coverage unchanged | Medicare eligibility remains age 65 |

| Delayed credits | Waiting until 70 increases monthly payments |

The Full Retirement Age Update completes a reform first enacted more than forty years ago. Its real effect will unfold gradually, influencing retirement timing, labor markets, and household finances for decades. As Munnell noted, retirement planning now depends less on a single age milestone and more on personal longevity, health, and savings decisions.

Background: Why the Full Retirement Age Update Happened

The retirement benchmark was not always 67. For decades, Americans commonly received full Social Security benefits at 65, a figure chosen in 1935 when the program was created during the Great Depression. At that time, average life expectancy at birth was around 61 years for men and 65 for women, meaning many workers did not collect benefits for long.

Congress changed the structure in the Social Security Amendments of 1983, a bipartisan reform negotiated under President Ronald Reagan. The reform sought to prevent insolvency as demographic patterns shifted and the Baby Boomer generation aged.

According to the Social Security Administration (SSA), lawmakers gradually raised the retirement age to reflect longer life spans and declining worker-to-retiree ratios.

“People are living significantly longer than when the program began,” said Kathleen Romig, director of Social Security and disability policy at the Center on Budget and Policy Priorities. “The increase was meant to improve program sustainability without directly cutting nominal benefits.”

How the Full Retirement Age Update Changes Benefits

Full retirement age (FRA) is the point at which a worker can claim 100% of their earned Social Security benefit. It does not determine when a person must stop working. Instead, it determines how the benefit formula applies.

Claiming early: age 62

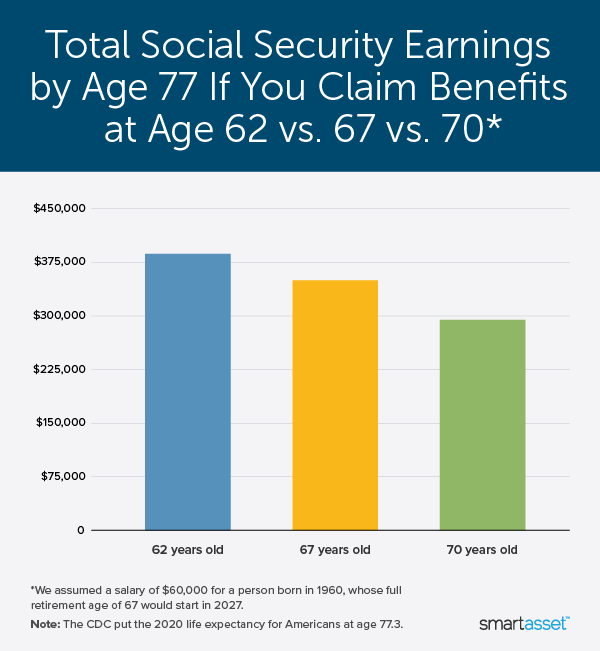

Americans can still begin receiving benefits at 62. However, the SSA reports monthly payments may be reduced by roughly 25% to 30% compared with full benefits.

Claiming at 67

Under the Full Retirement Age Update, this is now the standard age for full benefits.

Delaying to 70

Workers who wait beyond 67 receive delayed retirement credits of about 8% annually until age 70.

Financial economists often describe the system as actuarially balanced. The government spreads payments over a longer period if a retiree claims early and concentrates them into higher monthly payments if they claim later.

Effects on Workers and Retirement Planning

The policy is influencing employment patterns. Americans increasingly work later into life.

The U.S. Bureau of Labor Statistics reports the share of Americans aged 65 to 74 participating in the labor force has more than doubled since the 1980s. Analysts attribute part of this trend to Social Security rules and improved health among older adults.

Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College, said retirement decisions now require more financial planning.

“The full retirement age matters because it changes incentives,” Munnell said. “Workers must consider longevity, savings rates, and when to claim benefits more carefully than previous generations.”

Generational Impact: Who Is Affected Most

The Full Retirement Age Update does not affect all Americans equally.

Most affected groups

- Late Baby Boomers (born 1960–1964)

- Generation X workers

- Workers with limited private retirement savings

Least affected

- Current retirees already receiving benefits

- Individuals born before 1954

Younger workers may feel the impact most strongly because they must plan for both longer lifespans and uncertain future policy changes.

The Pew Research Center reports many Americans expect Social Security to remain a major retirement income source, but confidence in future benefit levels has declined among younger generations.

Medicare Gap and Income Decisions

One important rule remains unchanged: Medicare eligibility begins at 65. The gap between Medicare eligibility and the new full retirement age creates a planning challenge.

Workers who retire before 65 must purchase private health insurance. Those who retire at 65 but wait until 67 to claim benefits must rely on savings for income.

Financial planners say this gap influences decisions about retirement timing, particularly for middle-income households.

Before reaching full retirement age, Social Security imposes an earnings test. Benefits are temporarily reduced if income exceeds set limits. After FRA, these limits disappear, allowing retirees to work without penalty.

Fiscal Pressures Behind the Policy

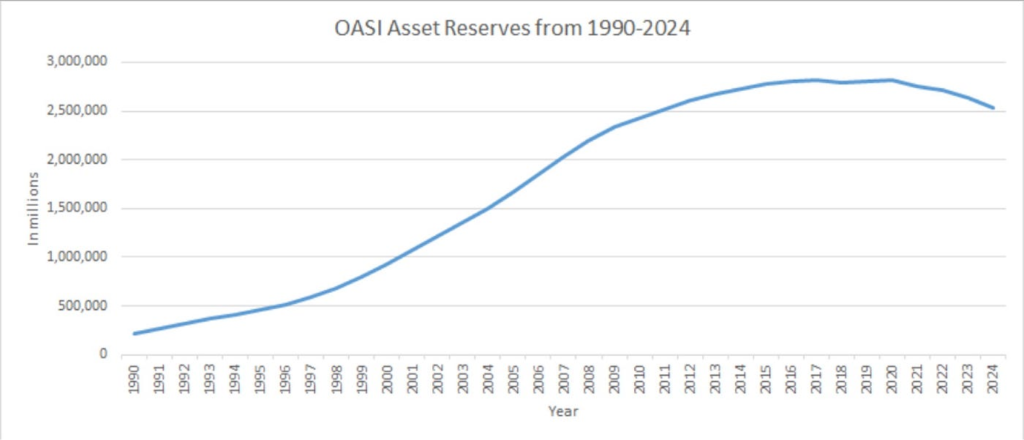

The Congressional Budget Office (CBO) projects that Social Security faces long-term financing challenges as the population ages.

In 1960, roughly five workers supported each retiree. Today, there are about three. By 2035, projections suggest the ratio could fall closer to two workers per beneficiary.

The Full Retirement Age Update was intended to slow spending growth rather than reduce payments outright.

However, debate continues.

Labor economists note physically demanding occupations — construction, manufacturing, and service jobs — may struggle with delayed retirement expectations.

“It functions differently across income groups,” Romig said. “Higher-income workers can delay retirement more easily than manual laborers.”

Comparison With Other Countries

The United States is not alone in raising retirement ages.

Many developed economies have implemented similar changes due to aging populations:

- United Kingdom: retirement age rising to 67 by 2028

- Germany: gradually increasing to 67

- France: recently increased from 62 to 64 after widespread protests

- Japan: encouraging employment beyond 65

International organizations such as the Organisation for Economic Co-operation and Development (OECD) note population aging is one of the defining fiscal challenges of the 21st century.

The Full Retirement Age Update reflects a global trend rather than a uniquely American policy shift.

Retirement Savings and the Role of 401(k) Plans

Another major factor shaping the impact of the Full Retirement Age Update is the decline of traditional pensions.

Private sector defined-benefit pensions have largely been replaced by defined-contribution plans such as 401(k)s. These depend on personal savings and investment returns.

The Federal Reserve’s Survey of Consumer Finances shows many households have limited retirement savings. For many retirees, Social Security represents more than half of total income.

Financial advisers say the new rules increase the importance of saving early and consistently.

Future Proposals and Ongoing Debate

The Full Retirement Age Update may not be the final change. Policymakers are considering options to strengthen Social Security finances, including:

- raising payroll taxes

- modifying benefits for higher earners

- increasing the retirement age further

Advocates caution that raising the retirement age again could disproportionately affect lower-income workers.

Meanwhile, retirement experts emphasize planning flexibility.

“Social Security remains the foundation of retirement income,” Munnell said. “But future retirees should view it as one part of a broader strategy including savings, investments, and continued work if possible.”

Practical Implications for Individuals

Financial planners suggest several strategies in response to the Full Retirement Age Update:

1. Delayed claiming

Waiting until 70 may significantly increase lifetime benefits.

2. Bridge savings

Savings can cover the gap between retirement and benefit eligibility.

3. Part-time work

Flexible employment allows workers to delay claiming while maintaining income.

4. Spousal coordination

Married couples can optimize benefits by coordinating claim timing.

FAQs About Full Retirement Age Update

What is full retirement age?

The age at which a worker receives 100 percent of earned Social Security benefits — now 67 for people born in 1960 or later.

Can I still retire at 62?

Yes, but benefits are permanently reduced.

Does Medicare also move to 67?

No. Medicare eligibility remains 65.

Will benefits increase if I wait past 67?

Yes. Payments grow annually until age 70.

Is Social Security running out?

Not immediately. According to federal projections, the trust fund could pay most benefits for decades, though reforms may be needed later.