Highest $5,181 Social Security Benefit: Social Security is the cornerstone of retirement planning for millions of Americans. But while many people focus on just getting benefits, few realize there’s a way to unlock the maximum payout possible — $5,181 per month in 2026. Let’s be real: that number isn’t handed out like Halloween candy. It takes strategy, years of hard work, and some serious patience. But if you’re planning your future or helping clients make sense of retirement math, you’ll want to know how to hit that top tier. This article breaks down what it takes to get the highest Social Security benefit in 2026, why most people fall short, and how to get as close to that number as possible — even if you’re not quite there yet.

Table of Contents

Highest $5,181 Social Security Benefit

Getting that juicy $5,181 Social Security check in 2026 isn’t luck — it’s the result of years of strategic earnings, smart planning, and patience. Most Americans won’t hit the maximum, but understanding the rules can help you maximize whatever benefit you qualify for. Whether you’re 30 years from retirement or already mapping out next year, now is the time to take control.

| Topic | Details |

|---|---|

| Max Monthly Benefit (2026, Age 70) | $5,181 |

| Full Retirement Age (FRA) Benefit | ~$4,152 |

| Claiming at Age 62 | ~$2,969 |

| Years of Earnings Needed | 35 years of high earnings |

| 2026 COLA | 2.8% |

| 2026 Taxable Wage Base | $184,500 |

| Spousal & Survivor Benefits | Available under qualifying conditions |

| Official Info | ssa.gov |

Understanding the Highest $5,181 Social Security Benefit in 2026

To receive the maximum Social Security retirement benefit, you must meet three strict criteria:

- Earn the maximum taxable income for 35 years

- Delay benefits until age 70

- Have consistent employment records with no gaps or low-earning years

These conditions are rare — most Americans don’t hit all three. But understanding them can help you optimize your benefit even if you fall short of the maximum.

1. Earn the Social Security Taxable Maximum for 35 Years

Let’s start with earnings. Each year, there’s a Social Security taxable wage base — the cap on income that gets taxed for Social Security. In 2026, that cap is $184,500.

To earn the highest possible benefit, you’d need to earn at least that much for 35 separate years. That’s because Social Security calculates your benefit using your average indexed monthly earnings (AIME) based on your top 35 earning years, adjusted for inflation.

If you earn less than that in some years, or if you didn’t work all 35, your average drops — and so does your benefit.

Example: If you worked 30 years at high income and 5 years at low income, those 5 low years pull your average down — significantly.

If you worked fewer than 35 years, the missing years are filled in with zeros, which drag your AIME even lower. That’s why staying in the workforce longer — even with modest earnings — can boost your retirement check.

2. Delay Claiming Until Age 70

Timing is everything.

Here’s what the maximum benefit looks like based on your claiming age in 2026:

| Claiming Age | Maximum Monthly Benefit |

|---|---|

| 62 (early retirement) | ~$2,969 |

| Full Retirement Age (66–67) | ~$4,152 |

| 70 (maximum payout) | $5,181 |

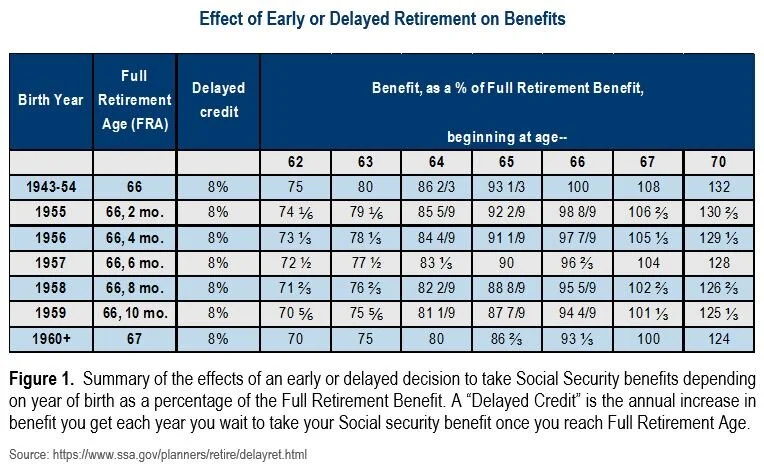

If you claim before your full retirement age (FRA) — which is between 66 and 67 depending on your birth year — your monthly benefit gets permanently reduced.

If you wait until age 70, you earn delayed retirement credits that increase your benefit by 8% for each year you delay past FRA. After age 70, there are no more increases for waiting — so that’s your best possible payout.

Note: Delaying can mean tens of thousands more in lifetime income, especially if you live into your 80s or 90s.

3. Work for 35+ Years (With Few or No Low-Income Gaps)

Social Security rewards longevity in the workforce. The 35-year rule means if you worked:

- 40 years → Only your top 35 count (great!)

- 25 years → 10 zeros get averaged in (ouch!)

Even if you didn’t hit the wage cap, working longer at higher-than-average wages can still give your benefit a serious bump.

For example, replacing a $0 year with a $60,000 earning year later in your career will increase your average, resulting in a higher monthly check.

4. Understand the Impact of Spousal and Survivor Benefits

Even if you didn’t earn enough to qualify for the maximum on your own, you might be eligible through your spouse:

- Spousal benefits can be up to 50% of your spouse’s full retirement benefit

- Survivor benefits can reach 100% of the deceased spouse’s benefit, depending on the survivor’s age at claiming

Example: If your spouse was earning the max and passed away, and you delay until age 70, you could receive close to $5,181/month as a surviving spouse.

You must have been married for at least 10 years (if divorced) or still married at the time of death to qualify.

5. Don’t Ignore Taxes on Highest $5,181 Social Security Benefit

Surprise: Social Security benefits can be taxed.

If your combined income (adjusted gross income + nontaxable interest + half your SS benefits) exceeds certain thresholds, part of your benefit becomes taxable:

| Filing Status | 50% Taxable If Income Above | 85% Taxable If Income Above |

|---|---|---|

| Single | $25,000 | $34,000 |

| Married Filing Jointly | $32,000 | $44,000 |

So, if you’re also pulling income from a 401(k), IRA, or job, you might be paying taxes on part of your Social Security.

Pro Tip: Work with a tax advisor to consider Roth conversions, municipal bonds, or withdrawal timing to lower your taxable income in retirement.

6. Don’t Forget About Lifetime Payout vs. Monthly Benefit

There’s a difference between getting the biggest check and getting the most total money over time.

Let’s compare:

| Scenario | Monthly Benefit | Lifetime Income (if you live to 85) |

|---|---|---|

| Claim at 62 | $2,969 | ~$853,920 |

| Claim at FRA (67) | $4,152 | ~$892,608 |

| Claim at 70 | $5,181 | ~$931,620 |

Assumes retirement at each age and living to 85. You get fewer checks if you delay, but more per check. So it becomes a longevity gamble.

If you expect to live into your 80s or beyond, delaying often wins out.

7. Mistakes That Can Cost You Thousands

Here are common slip-ups folks make that leave money on the table:

- Claiming too early without considering long-term impact

- Not working a full 35 years

- Forgetting to check their earnings history

- Assuming spousal benefits are automatic (you have to apply)

- Not factoring in taxes on benefits

- Not coordinating benefits with other income sources (401(k), IRAs, etc.)

Avoid these, and you’re already ahead of the game.

8. Can Working Past 70 Still Boost Your Benefit?

Once you hit 70, your benefit no longer increases by delaying — but if you’re still working and earning more than in earlier years, those higher earnings can replace lower ones in your 35-year record.

So yes — your benefit can still increase slightly if your new earnings are higher than past ones.

Five Big Social Security Changes Rolling Out in 2026 — What to Expect

Social Security Releases 2026 Payment Schedule — Find Your Deposit Week

The Truth Behind the Rumored $200 Social Security Boost in 2026