Initial 2027 Social Security COLA: When it comes to Social Security benefits, the Cost-of-Living Adjustment (COLA) plays a crucial role in ensuring that retirees, disabled workers, and others receiving benefits don’t fall behind due to inflation. The COLA is an automatic increase in Social Security benefits designed to keep pace with the rising cost of living. As we look toward 2027, early projections suggest that this adjustment might be a little more modest compared to the past few years, leaving many wondering what to expect. Let’s dive into the 2027 Social Security COLA outlook, providing you with valuable insights and a roadmap for understanding this important change.

Table of Contents

Initial 2027 Social Security COLA

The 2027 Social Security COLA outlook signals a modest increase compared to the larger hikes seen in recent years. While early projections suggest a 2.5% adjustment, inflation trends in 2025 and 2026 will ultimately shape the final number. Social Security recipients should stay informed about the COLA process and make sure they’re prepared for whatever increase comes their way. Stay ahead of the game by reviewing your budget, considering extra income sources, and consulting with financial experts to ensure you’re making the most of your benefits.

| Topic | Details |

|---|---|

| COLA Increase for 2027 | Early projections suggest a 2.5% COLA increase for 2027, lower than recent years. |

| Inflation Impact | Inflation trends in 2025 and 2026 are expected to affect the COLA increase. |

| Official Announcement | The official COLA for 2027 will be announced in October 2026, based on inflation data. |

| Social Security Beneficiaries | 65 million Americans receive Social Security benefits, with adjustments for inflation every year. |

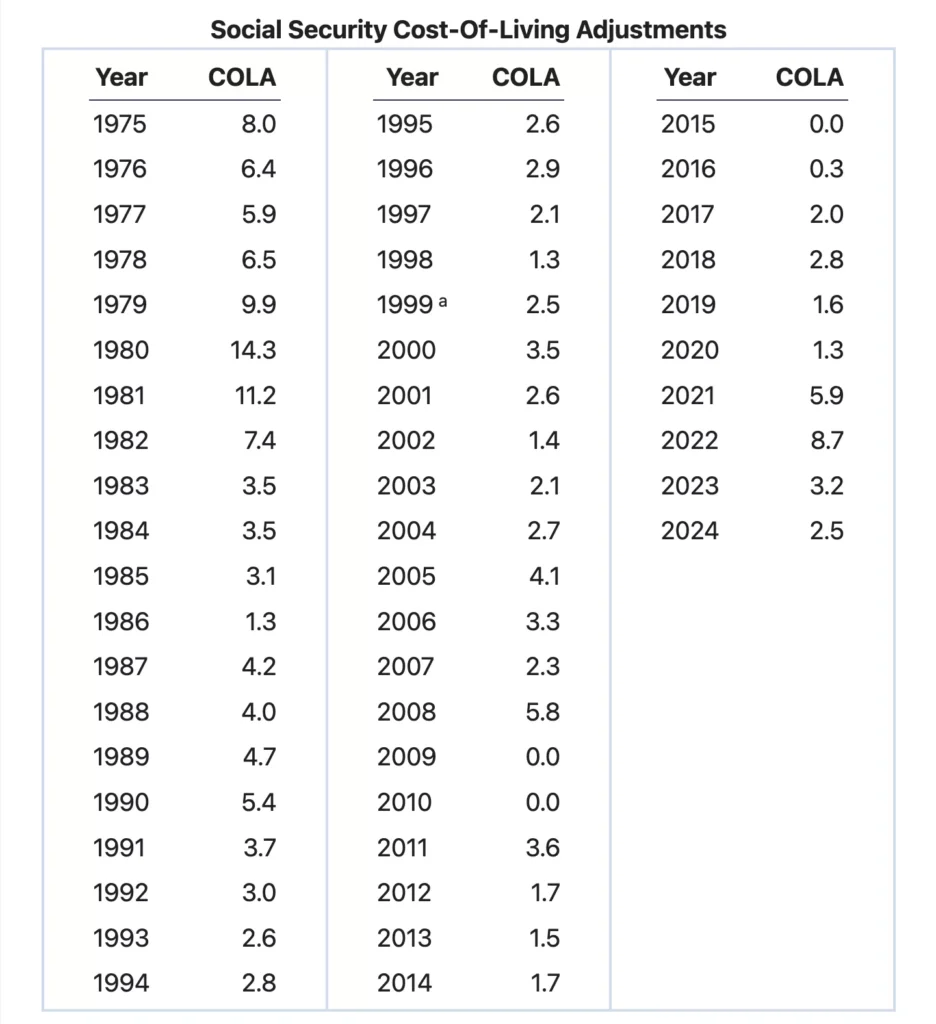

| Historical Context | 2022 saw a 5.9% COLA, while 2023 had an impressive 8.7% increase due to high inflation. |

| Where to Check Official Info | For up-to-date info, visit the Social Security Administration. |

The Basics: What is Social Security COLA?

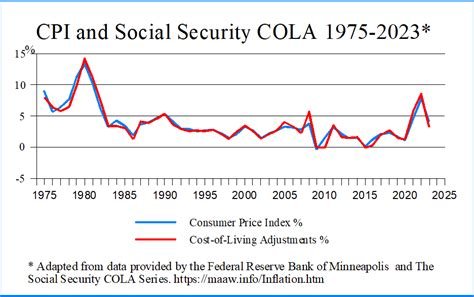

Before we dive into 2027, let’s make sure we’re all on the same page. Social Security COLA is an automatic adjustment made to Social Security benefits to help recipients keep up with inflation. It’s calculated based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures the change in the price of goods and services like food, transportation, and healthcare. The Social Security Administration (SSA) makes this adjustment annually, typically in October for the following year.

So, why is this important? Well, retirees and those with disabilities often rely on Social Security as their primary source of income. If the cost of living rises, but their benefits stay the same, they could lose purchasing power. COLA is there to prevent that from happening.

Initial 2027 Social Security COLA Projections: A Modest Increase?

The 2027 Social Security COLA outlook is shaping up to be a little more modest compared to the huge jumps we saw in recent years. For example, 2023 saw an 8.7% COLA, the largest increase in four decades, thanks to sky-high inflation. However, 2027 is expected to see an adjustment closer to 2.5%.

But why the smaller increase? The primary driver is inflation. While prices for goods and services rose dramatically in 2021 and 2022, inflation has slowed somewhat in 2025 and 2026. With inflation leveling off, the COLA adjustment is also expected to reflect a more moderate pace.

While these early projections suggest a 2.5% increase, it’s important to note that the final COLA is based on data from the third quarter of the calendar year. This means that the actual COLA won’t be confirmed until October 2026, when the CPI-W figures for July, August, and September are released.

Key Factors Affecting 2027 COLA

Inflation Trends: The biggest factor affecting COLA is inflation. Inflation rates in 2025 and 2026 will largely determine the final COLA for 2027. According to economists, inflation has slowed, so we can expect a more modest increase in benefits.

In 2021, inflation surged due to various global factors like supply chain disruptions and a rebound in consumer demand after the pandemic. That led to higher prices for many goods, especially gas, food, and housing. By 2023, inflation remained elevated, triggering a record-breaking 8.7% COLA for beneficiaries. However, in 2025, inflation slowed as the Federal Reserve raised interest rates to cool down the economy. If this trend continues, COLA will likely reflect these lower inflation rates, resulting in a more modest 2027 increase.

CPI-W Changes: The COLA is directly tied to changes in the CPI-W. If prices for essentials like gas, healthcare, and food rise significantly, the COLA will increase. Conversely, if inflation remains tame, the adjustment will be smaller. In recent years, key drivers like housing and gas prices have seen more stabilization, with supply chains recovering, particularly in the automotive industry.

The Federal Reserve’s actions to combat inflation by raising interest rates have also helped to keep the cost of borrowing and spending in check, potentially leading to slower inflation and a more modest COLA. However, if there are unforeseen spikes in consumer demand or energy costs, the 2027 COLA might still be higher than projected.

Federal Reserve Actions: The Federal Reserve has been working to control inflation by raising interest rates. This has led to slower inflation, and if this trend continues, COLA may not need to increase dramatically. For example, in 2024, the Federal Reserve’s interest rate hikes have curbed inflation, keeping the COLA forecast lower for the following years.

Initial 2027 Social Security COLA vs. Recent Years: A Comparison

To give you some perspective, let’s look at the recent COLA history:

- 2022: A 5.9% COLA was announced, which was a big boost after inflation soared in 2021. The adjustment helped retirees keep up with increasing prices, particularly in food and fuel.

- 2023: A 8.7% COLA was granted, marking one of the largest increases in decades, driven by surging inflation.

- 2024: The 2024 COLA was 3.2%, a slight decrease compared to the previous years but still helping to address rising living costs.

- 2025: This year saw a 3.0% COLA, following trends of easing inflation.

As we move into 2027, we’re seeing a cooling down of inflation compared to the previous years. That’s why the 2.5% COLA increase forecast makes sense—though it’s still early, and there’s a chance it could change.

When Will You See the COLA Adjustment?

Once the October 2026 announcement is made, the 2027 COLA will take effect starting in January 2027. This means that Social Security recipients will start seeing higher checks in the first quarter of 2027.

Social Security benefits are paid monthly, so a modest increase could be significant over time. For someone receiving $1,500 a month, a 2.5% COLA would result in an extra $37.50 per month—which can help cover rising expenses, even if it’s not as large a boost as in the past.

How Can You Prepare for a Modest COLA?

If you’re a Social Security recipient, here are a few ways you can plan for the 2027 COLA and the possibility of a more modest increase:

- Review Your Budget: If your COLA increase is smaller than expected, you may need to adjust your spending. Review your budget and consider areas where you can cut back if inflation continues to eat into your purchasing power. Prioritize needs over wants, especially if gas and food prices rise.

- Consider Extra Income Sources: Depending on your situation, it might make sense to consider supplementing your Social Security benefits with extra income—whether through part-time work, side gigs, or investments. Online freelancing, tutoring, or even remote customer service jobs can provide flexibility for retirees.

- Monitor Inflation Trends: Keep an eye on inflation and its impact on the COLA. The U.S. Bureau of Labor Statistics releases monthly inflation data that can give you an early sense of what’s to come. For example, gas prices and housing costs are key contributors to inflation, and they can directly impact your budget.

- Consult with a Financial Planner: A financial planner can help you adjust your retirement plan and budget based on the COLA forecast and other financial considerations. They can also help ensure that your investment strategy is aligned with your needs as you age.

- Consider Downsizing or Relocating: If the COLA increase is lower than expected and your living expenses are rising, it may be worth considering downsizing your home or relocating to a more affordable area. Many retirees are choosing to move to states with lower taxes and living costs, which can offset the impact of smaller COLA increases.

- Maximize Your Savings: Although Social Security is a primary source of income, it is often not enough to cover all retirement expenses. Consider contributing to additional savings or retirement accounts, like IRAs, 401(k)s, or even a Roth IRA. The more you save during your working years, the less dependent you’ll be on Social Security COLA increases.

Social Security Releases 2026 Payment Schedule — Find Your Deposit Week

Social Security Promises Major Service Upgrades — What Millions Will Experience First

Five Big Social Security Changes Rolling Out in 2026 — What to Expect