The IRS signals exceptionally large tax refunds this filing season, with millions of Americans expected to receive bigger checks after tax law changes, delayed payroll adjustments, and expanded credits led many workers to overpay federal taxes during the year, according to government officials and independent analysts.

Table of Contents

IRS Signals Exceptionally Large Tax Refunds This Year

| Key Fact | Detail |

|---|---|

| Average refund increase | $800–$1,200 above last year |

| Main driver | Outdated withholding tables |

| Most affected groups | Families, tipped workers, middle-income earners |

| Filing impact | E-filed returns process faster |

While larger refunds may provide short-term relief for households under financial strain, tax experts stress that they reflect timing issues rather than new income. As withholding systems adjust, refund sizes are expected to return closer to historical norms.

Why the IRS Signals Exceptionally Large Tax Refunds

At its core, a tax refund represents an overpayment. This year, the scale of those overpayments is unusually large.

According to the Internal Revenue Service, multiple tax provisions were adjusted after payroll withholding tables had already been finalized. Employers, required by law to follow existing guidance, continued withholding at higher rates even as many taxpayers’ final liabilities declined.

“This filing season reflects a timing mismatch,” said Mark Luscombe, a principal analyst at Wolters Kluwer Tax & Accounting. “The tax rules changed, but withholding systems didn’t adjust quickly enough.”

The Withholding Lag: How Paychecks Fell Behind Policy

Most U.S. employers rely on IRS-issued withholding tables to calculate federal income tax deductions. These tables are typically updated once per year and embedded into payroll software.

In this case, tax changes were enacted after the annual update cycle. Employers were not authorized to revise calculations independently, according to Treasury guidance.

As a result, millions of workers paid federal income taxes based on outdated assumptions for most of the year.

A Structural Issue, Not an Error

Tax officials stress that this was not a mistake or miscalculation, but a procedural constraint.

“The system worked as designed,” a Treasury official said. “It just wasn’t designed for mid-cycle policy shifts of this scale.”

Expanded Credits and Deductions Drive Refund Growth

Several expanded or adjusted credits significantly reduced final tax bills.

These include changes affecting families with children, workers earning income from tips or overtime, and certain middle-income households. Because many of these credits are refundable, they can increase refunds even if a taxpayer’s total liability is already low.

According to the nonpartisan Tax Policy Center, refundable credits are among the most powerful tools in the tax code for increasing refunds.

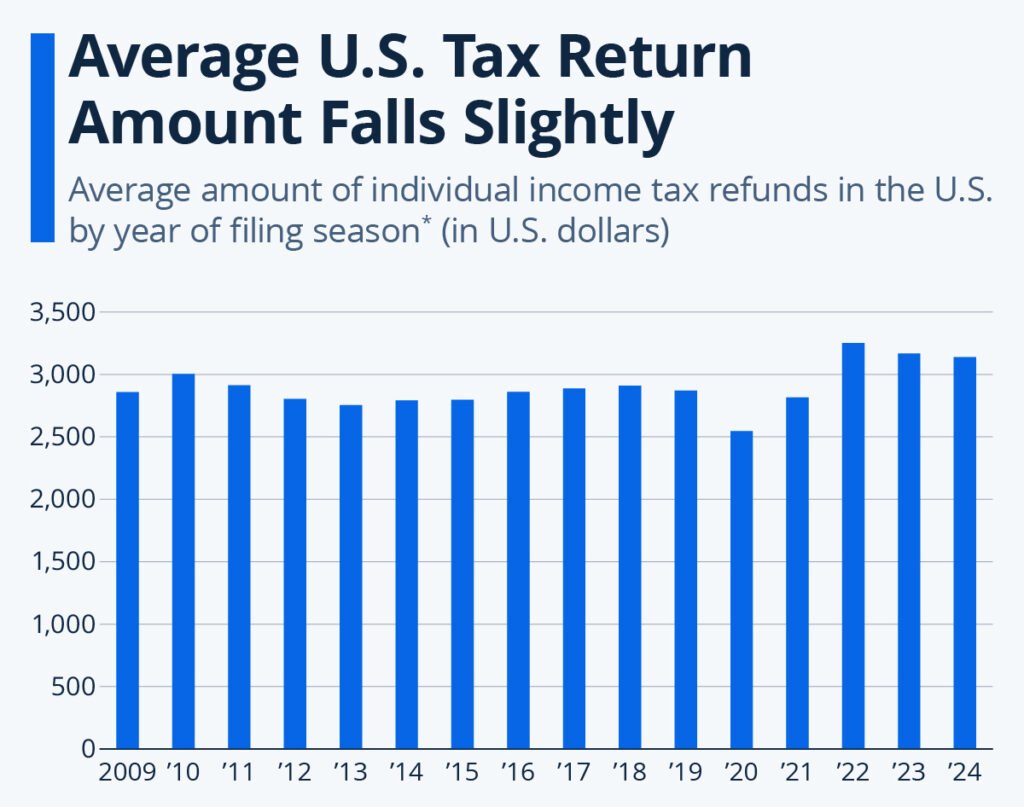

How This Year Compares With Past Refund Seasons

Historically, average federal tax refunds fluctuate within a relatively narrow range, adjusting for inflation.

Exceptions occurred during the COVID-19 pandemic, when temporary credits and stimulus-linked provisions sharply increased refund sizes for many households.

Tax analysts note that the current increase is structurally different.

“This isn’t a one-time emergency program,” said Erica York, senior economist at the Tax Foundation. “It’s a reflection of how withholding interacts with permanent or semi-permanent policy changes.”

Who Benefits Most — and Who Benefits Least

Data from the Tax Policy Center suggests households earning between $40,000 and $100,000 are among the biggest beneficiaries. These taxpayers often have steady withholding, qualify for multiple credits, and were least likely to adjust W-4 forms midyear.

Families with children also stand out, particularly those eligible for expanded credits.

Higher Earners See Smaller Relative Increases

Higher-income households often adjust withholding more frequently or rely less on refundable credits. As a result, their refunds tend to change less dramatically.

Lower-income households may see smaller refunds if they had little or no federal income tax withheld in the first place.

Regional Differences in Refund Size

Refund amounts can vary significantly by state.

States with higher concentrations of tipped workers, seasonal employment, or dual-income households may see larger average refunds. Conversely, states with higher rates of self-employment may see less impact, since those taxpayers typically manage quarterly estimated payments.

Tax professionals caution against assuming uniform outcomes nationwide.

Processing Times and IRS Capacity

Larger Refunds, Familiar Constraints

Despite higher expected payouts, refund timing remains uneven.

The IRS continues to operate with fewer employees than before the pandemic, according to the Treasury Inspector General for Tax Administration. While automation has improved, manual reviews remain necessary for certain returns.

Electronic filing with direct deposit remains the fastest option. Paper returns, by contrast, may take weeks longer.

The Behavioral Side: Why Americans Like Big Refunds

Economists often criticize large refunds as inefficient. Yet many taxpayers prefer them.

Behavioral economists describe refunds as a form of “forced savings.” For households that struggle to set money aside, a large refund functions as a lump-sum financial reset.

Surveys from the Federal Reserve show most Americans use refunds to pay down debt, cover overdue bills, or build emergency savings rather than discretionary spending.

Are Large Refunds a Sign of a Healthy Tax System?

Some economists argue that large refunds indicate systemic inefficiency.

“A well-calibrated system would result in smaller refunds and higher take-home pay throughout the year,” said York of the Tax Foundation.

Others say refunds play a stabilizing role, particularly during periods of economic uncertainty.

“The refund acts as a financial shock absorber,” said Luscombe. “It’s not ideal, but it’s not harmful either.”

Official IRS Guidance

IRS Commissioner Danny Werfel said the agency is prepared for elevated refund volumes but urged taxpayers to review withholding after filing.

“Our message is simple,” Werfel said during a recent briefing. “File electronically, choose direct deposit, and take time to adjust withholding so next year better reflects your actual tax situation.”

What Taxpayers Can Do Going Forward

The IRS recommends using its online withholding estimator after filing. Updating Form W-4 can reduce over-withholding and increase take-home pay during the year.

Tax professionals also suggest reassessing withholding after major life events such as marriage, childbirth, or job changes.

Policy Outlook: What Happens Next Year?

Treasury officials say withholding tables are expected to fully reflect current law in the next update cycle. If no major policy changes occur, refund sizes should normalize.

However, analysts warn that future legislative changes could repeat the pattern.

“As long as tax policy remains fluid, withholding mismatches will recur,” said York.

FAQs About IRS Signals Exceptionally Large Tax Refunds This Year

Why are refunds higher this year?

Because many taxpayers overpaid due to delayed payroll adjustments and expanded credits.

Does a large refund mean I paid less tax overall?

Not necessarily. It usually means you paid too much during the year.

Can I prevent this next year?

Yes. Updating Form W-4 can reduce over-withholding.

Will refunds stay high in future years?

Only if withholding continues to lag behind policy changes.