IRS Tax Refund 2026: The IRS Tax Refund 2026 Step-By-Step Tracking Guide, Payment Dates, and Timeline is a topic millions of Americans search for every January through April. Whether you’re relying on your refund to catch up on bills, pay down debt, or save for a big purchase, understanding how the IRS handles refunds can take a lot of stress out of tax season. As a tax professional who has supported thousands of filers, this guide breaks down everything you need to know in simple, conversational language while still offering deep, professional insights.

Most taxpayers receive a refund each year, and according to the Internal Revenue Service (Internal Revenue Service), over 75% of Americans get money back. In the 2025 filing season, the average refund was $3,011. For many households, that’s a significant financial boost, so naturally, understanding the refund process matters. This article walks you through how refunds work in 2026, how to track your refund step-by-step, what delays to watch out for, and how to get your refund as fast as possible — with examples, real IRS data, and updated timelines.

Table of Contents

IRS Tax Refund 2026

The IRS Tax Refund 2026 Step-By-Step Tracking Guide, Payment Dates, and Timeline is designed to give you a clear, professional understanding of how refunds work — without confusing jargon or complicated explanations. The more informed you are, the smoother your tax season will be. E-file early, choose direct deposit, track your refund daily using IRS tools, and double-check your information to avoid unnecessary delays. With millions of Americans waiting for refunds each year, staying ahead of the process is your best advantage. If you follow the guidance in this article, you’ll understand exactly how the IRS processes refunds and what steps to take to get your money as fast as possible.

| Topic | Summary |

|---|---|

| IRS Filing Season Opens | January 26, 2026 |

| Deadline to File | April 15, 2026 |

| Fastest Refund Method | E-file + Direct Deposit (~21 days) |

| Refund Tracking Tool | https://www.irs.gov/refunds |

| IRS2Go Mobile App | https://www.irs.gov/news/irs2goapp |

| Average Refund (Last Season) | $3,011 (IRS.gov statistics) |

| Required Hold for EITC & ACTC Refunds | Early March 2026 |

| Typical Refund for E-File Return | 2–3 weeks |

| Paper Filing Refund Time | 6–10+ weeks |

| Official IRS Website | https://www.irs.gov |

Understanding the IRS Tax Refund Process in 2026

To fully understand the refund timeline, think of your tax return like a multi-step verification system. The IRS doesn’t just take your numbers and send money; your return goes through layers of security, fraud checks, and data matching.

When you file, your return is reviewed using automated systems that match your reported income to employer W-2s, 1099s, Social Security data, and previously filed returns. If anything appears inconsistent, your refund may be delayed for manual review. That’s why accuracy on your tax return matters more than speed.

The IRS processes over 160 million tax filings annually, so even small mistakes or processing spikes can cause backlogs. Understanding how long each stage takes is key to setting realistic expectations.

IRS Tax Refund Status Stages Explained

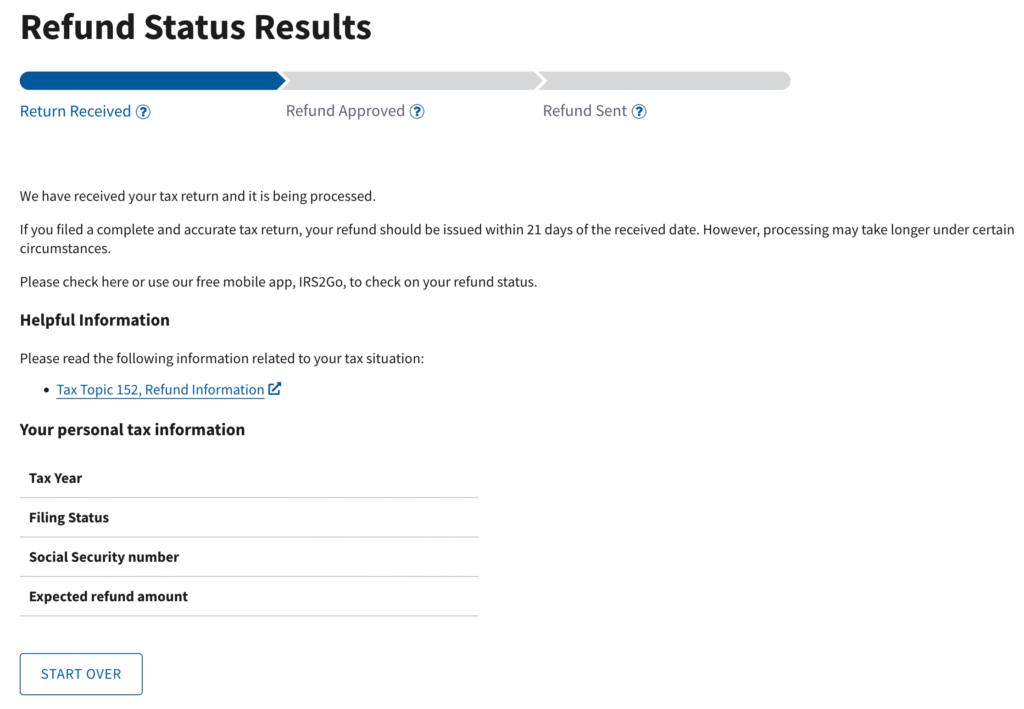

The Where’s My Refund? tool shows three main stages:

Return Received

This means the IRS has your return and it’s in the processing queue. Electronic returns are usually marked received within 24 hours. Paper returns can take weeks.

Refund Approved

Your refund amount has been verified and approved. This is when you know money is officially coming your way.

Refund Sent

The IRS sends your refund to your bank or issues a check. Direct deposit typically arrives within 1–5 days after this status appears.

These statuses update only once every 24 hours, so checking more often won’t provide new information.

Step-by-Step Guide to Tracking Your IRS Tax Refund 2026

Step 1: File Your Tax Return

E-file is the fastest way. Paper returns move your refund months behind.

Step 2: IRS Accepts Your Return

E-file acceptance happens within 24–48 hours. Paper returns can take several weeks to be logged into the system.

Step 3: Track Your Refund on the IRS Website

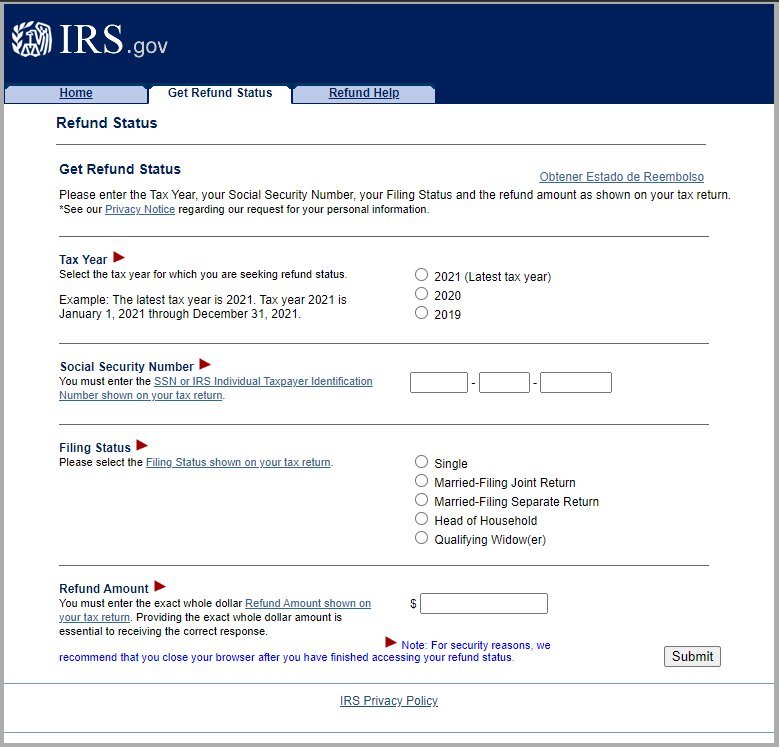

Visit https://www.irs.gov/refunds and enter your Social Security number, filing status, and exact refund amount.

Step 4: Use the IRS2Go Mobile App

A reliable companion to the online tool, available on Apple and Android devices.

Step 5: Check Your Bank Account

Most direct deposits arrive within a few days of the “Refund Sent” status.

Step 6: Watch Your Mailbox If You Requested a Check

Paper checks take longer, especially if the U.S. Postal Service experiences delays.

IRS Refund Timeline for 2026

Here’s what most taxpayers can expect:

E-Filed Return + Direct Deposit

Return Accepted: 24–48 hours

Processing Time: 7–10 days

Refund Approval: By week 2

Refund Delivered: Within 21 days

Paper Return

IRS Receipt: 3–4 weeks

Processing: 4–8+ weeks

Refund Delivered: 6–10+ weeks

Refunds with Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC)

Refunds cannot be issued until early March due to the federal PATH Act.

Earliest expected payment window: March 1–10, 2026.

This delay is legally required every year and prevents fraudulent claims.

Federal Refund vs State Refund Timelines

Federal and state refunds are completely separate. Your state return does not impact your IRS refund.

Federal refunds are issued by the IRS.

State refunds are issued by your state tax agency.

Most states take 2–8 weeks to issue refunds, depending on fraud prevention measures.

E-File vs Paper Filing: A Detailed Comparison

| Category | E-File | Paper Filing |

|---|---|---|

| Processing Speed | 2–3 weeks | 6–10+ weeks |

| Accuracy | High (software checks) | More errors possible |

| Refund Method | Direct Deposit | Check or deposit |

| Fraud Screening | Automatic | Manual + automatic |

| Risk of Lost Return | Extremely low | Higher (mail delays) |

| Recommended? | Yes — fastest | Avoid unless necessary |

The IRS strongly prefers e-filed returns because digital processing is more accurate and significantly faster.

Additional Reasons Refunds Get Delayed in 2026

Error or mismatch in your return

Wrong Social Security number, math errors, or mismatched W-2 income slow down verification.

Identity verification issues

You may receive a 5071C or 6331C letter asking you to confirm your identity online.

Bank-related problems

If your direct deposit information is incorrect, the IRS will mail you a check instead.

Amended tax returns

These require manual processing and can take up to 20 weeks.

Fraud filters

The IRS has advanced fraud detection software. If your return triggers alerts, a manual review may occur.

Dependents claimed by someone else

This is extremely common among separated parents or relatives. Only one taxpayer can claim each dependent per year.

New Section: IRS Scam Alerts and Security Tips for 2026

Tax season attracts scammers every year. Knowing what to look for helps protect your refund.

Fake IRS Phone Calls

The IRS will never call you demanding immediate payment or threatening arrest.

Phishing Emails

Refund updates are never sent by email. Delete anything pretending to be the IRS.

Fake Tax Preparers

Avoid preparers who base their fee on the size of your refund or promise “guaranteed” refunds.

Refund Payment Scams

Never share your IRS transcript, refund amount, or bank details with strangers.

Practical Tips to Get Your Refund Faster

File early

The earlier you file, the better chance your return is processed before IRS backlogs.

Use direct deposit

This is hands-down the fastest refund delivery method.

Use the same address and bank account each year

Frequent changes may trigger identity verification.

Double-check your return

Accuracy prevents delays. Tax professionals and software automatically catch mistakes.

Avoid refund anticipation loans

They are costly and often unnecessary.

Keep documentation organized

W-2s, 1099s, Social Security statements, and receipts all matter.

Real-Life Example of a Typical Refund Timeline

Emily, a nurse in Michigan, filed electronically on February 2, 2026.

Her IRS acceptance came through the same day.

Her return moved to “Refund Approved” by February 11.

On February 13, her refund was sent.

She received her direct deposit on February 15.

Total time: 13 days.

This example reflects what many taxpayers experience when filing early and accurately.

Another Example: Refund Delay Explanation

Mark, a truck driver from Georgia, filed on January 30.

His W-2 from his employer had mismatched earnings compared to what he entered.

This triggered a manual review.

Mark didn’t receive his refund until March 20 — nearly seven weeks later.

Accuracy matters more than filing speed.

New IRS Rules Could Change How Millions Claim Tax Benefits in 2026

TSA Is Quietly Changing Airport Security in 2026 — What Travelers Will Notice

IRS Signals Exceptionally Large Tax Refunds This Year — Why Millions Could See Bigger Checks