Maximum $5,181 Social Security Benefit: If you’re approaching retirement—or just thinking ahead—you’ve probably wondered how much you could really get from Social Security. Well, here’s the headline: The maximum Social Security benefit in 2026 is $5,181 per month for those who delay claiming until age 70. That’s $62,172 per year, adjusted annually for inflation through COLA (Cost of Living Adjustments). But let’s not kid ourselves—getting that max isn’t easy. It requires years of strategic planning, high lifetime earnings, and smart timing. In this guide, you’ll learn exactly:

- What determines your Social Security benefit

- How the maximum monthly benefit is calculated

- Realistic strategies to increase your check

- Why most Americans won’t qualify for the max (and what they can do instead)

- How to use official tools to estimate your benefit

Whether you’re just starting your career or already drawing near to retirement, this article will give you a clear roadmap to make the most of your Social Security income.

Table of Contents

Maximum $5,181 Social Security Benefit

The $5,181 monthly Social Security benefit in 2026 represents the top-tier payout—and getting there is no small feat. It takes consistent high earnings, 35+ years of work, and delaying benefits until age 70. Most people won’t qualify for the maximum, but don’t let that stop you. With smart strategies, diligent planning, and good timing, you can significantly increase your own benefit, even if you don’t hit the top number. Start by checking your earnings record and thinking seriously about when you’ll claim benefits. The more you know, the better your retirement will look.

| Topic | Details |

|---|---|

| Maximum Monthly Benefit in 2026 | $5,181/month if claimed at age 70 |

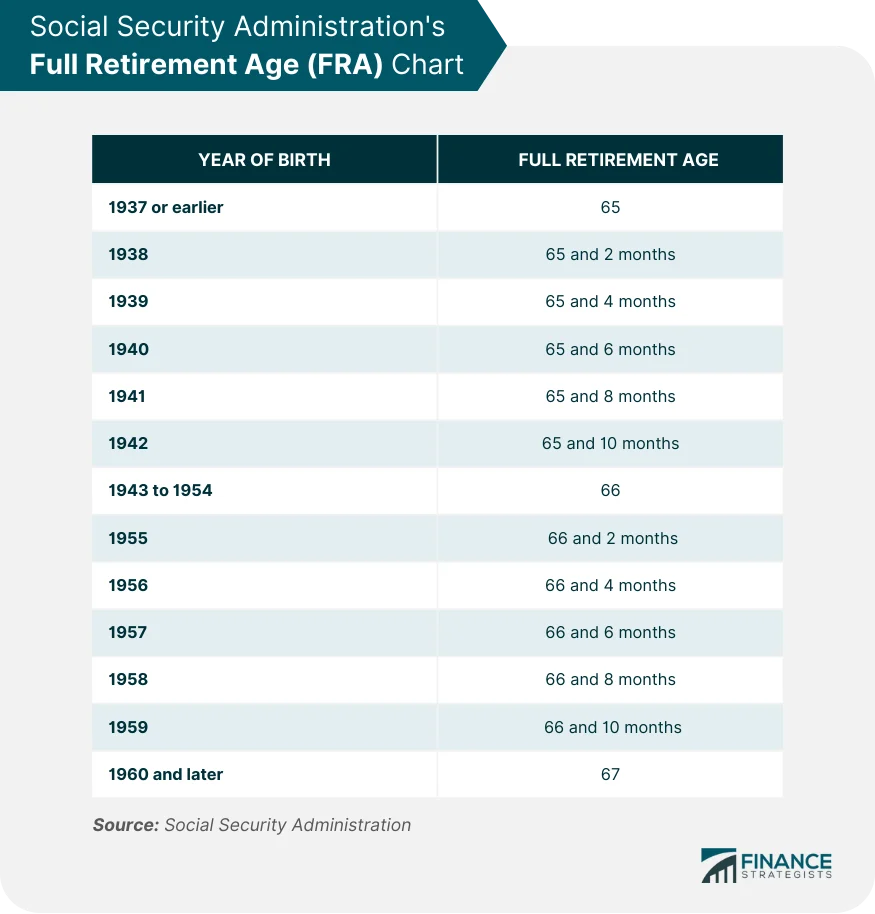

| Full Retirement Age (FRA) | 66–67 depending on birth year |

| Minimum Age to Claim | 62 (with permanent reduction in benefits) |

| Taxable Earnings Cap (2026) | $184,500 — income above this isn’t taxed for Social Security |

| Years Needed for Max Benefit | 35 years of earnings at or above taxable cap |

| Delayed Retirement Credits | ~8% increase in benefit for each year delayed after FRA (until age 70) |

| Estimation Tool | SSA Retirement Estimator |

Understanding the Maximum $5,181 Social Security Benefit

Let’s start with a basic but crucial distinction:

- The maximum benefit is not a standard payout.

- It’s the highest amount the Social Security Administration (SSA) will pay based on the formula that rewards high earnings and delayed claiming.

According to the SSA, in 2026 the maximum monthly retirement benefit is $5,181. But that only applies if:

- You wait until age 70 to claim benefits

- You earned the Social Security taxable maximum (or close to it) for 35 years

Anything less than that? Your benefit will be lower.

How Social Security Benefits Are Calculated?

Understanding how your check is calculated can help you optimize your working years and timing.

1. Average Indexed Monthly Earnings (AIME)

The SSA uses your highest 35 years of earnings, adjusted for inflation, to calculate your AIME. If you don’t have 35 years of work, zeros are averaged in, which drags down your benefit.

2. Primary Insurance Amount (PIA)

Your AIME is plugged into a three-tier formula using bend points (thresholds that change annually with wage inflation):

As of 2026 (approximate numbers for illustration):

- 90% of the first $1,174 of AIME

- 32% of the next $6,021

- 15% of AIME over $7,195 (up to the taxable max)

These percentages are added together to get your PIA, which is the monthly amount you’d receive at your full retirement age (FRA).

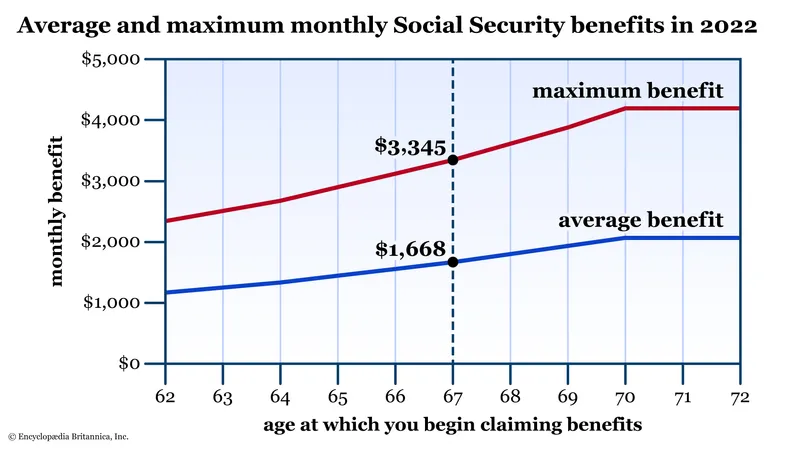

3. Adjustments Based on Claiming Age

- Claim at 62 → ~30% reduction

- Claim at FRA (66–67) → Full PIA

- Wait until 70 → ~24% increase via Delayed Retirement Credits

Every year you delay after FRA adds ~8% to your benefit.

What You Need to Do to Get the Maximum $5,181 Social Security Benefit?

Let’s break it down into clear steps.

Step 1: Work for At Least 35 Years

If you work less than 35 years, those missing years count as zeros. That alone can reduce your benefit by hundreds per month.

Even if you worked in low-wage jobs early in your career, you can still replace low-earning years with higher-income years later to increase your AIME.

Step 2: Earn the Maximum Taxable Income Each Year

To be eligible for the maximum benefit, you must earn at least the Social Security taxable wage base every year for 35 years.

Here are some past caps:

- 2024: $168,600

- 2025: ~$174,000 (estimated)

- 2026: $184,500

Only wages up to this limit are subject to Social Security payroll tax (6.2%). Any income earned above it does not increase your benefit.

Step 3: Delay Claiming Benefits Until Age 70

This is the single most powerful strategy you can control. Waiting until 70 lets you build up delayed retirement credits (DRCs), increasing your monthly benefit by about 8% for each year beyond your FRA.

Let’s compare:

| Claiming Age | Approx. Monthly Benefit (2026) |

|---|---|

| 62 | $2,969 |

| 67 (FRA) | $4,152 |

| 70 | $5,181 |

Delaying until 70 can increase your lifetime payout, especially if you live into your late 80s or beyond.

Why Most People Won’t Get the Maximum $5,181 Social Security Benefit?

Let’s be real—it’s tough.

According to SSA data:

- The average Social Security retirement benefit is only around $1,900/month as of early 2026.

- Less than 6% of recipients receive more than $3,500/month.

Why?

1. Most Americans Don’t Earn Enough

Very few workers earn at or above the taxable wage cap consistently for 35 years. According to the U.S. Census Bureau, median household income in 2023 was about $75,000, far below the max.

2. Most Claim Early

Roughly 1 in 3 Americans claim benefits at age 62, leading to permanently reduced payments. Many people simply need the money and can’t afford to wait.

3. Career Interruptions and Life Events

People may:

- Take time off to raise children

- Experience layoffs or illness

- Shift to part-time or gig work

All of these can cause gaps in earnings and reduce your lifetime average.

Real-Life Example: Can You Reach the Max?

Let’s say “John” is a high-income earner who:

- Made $200,000+ annually for 35 years

- Never had a break in his career

- Waited until 70 to claim Social Security

Yes, John would likely qualify for the $5,181/month benefit.

Now, “Samantha” is a nurse who:

- Earned $80,000/year for 30 years

- Took 5 years off to raise kids

- Claimed benefits at 67

Her monthly check may be around $2,800–$3,200, depending on her full earnings history.

Extra Tips to Boost Your Benefit (Even if You Can’t Reach the Max)

1. Work Longer Than 35 Years

Replacing lower-earning years with higher-income years—even just a few—can improve your AIME. That’s an easy win if you’re healthy and able to keep working.

2. Use Spousal Strategies

Married? Consider strategies like:

- Spousal benefits (up to 50% of your spouse’s FRA benefit)

- Survivor benefits (up to 100% of deceased spouse’s benefit)

- Claim and suspend (for maximizing the higher-earning spouse’s benefit)

3. Monitor Your SSA Record

Errors in your SSA earnings history can seriously hurt your benefits. Log into My Social Security and verify your reported income every year.

4. Consider Part-Time Work in Retirement

If you haven’t reached FRA yet, your benefits could be temporarily reduced if your income exceeds the earnings limit. In 2026, that limit is about $22,320/year for early claimants. Once you hit FRA, there’s no limit on what you can earn.

Social Security Releases 2026 Payment Schedule — Find Your Deposit Week

Five Big Social Security Changes Rolling Out in 2026 — What to Expect

The Truth Behind the Rumored $200 Social Security Boost in 2026