The New Senior Tax Exemption Raises Questions About Who Benefits policy has quickly become one of the most discussed financial updates affecting retirees this year. At first glance, it sounds like a straightforward relief measure.

Older citizens pay less tax, keep more of their money, and gain a little breathing room in retirement. With prices for food, utilities, and healthcare steadily climbing in 2025 and 2026, any form of tax relief feels important. Still, once people began reading the actual rules, the New Senior Tax Exemption Raises Questions About Who Benefits conversation started gaining momentum. Many retirees believed the benefit would automatically apply once they reached retirement age. Instead, eligibility depends on income levels, savings withdrawals, and sometimes housing status. Financial planners are now advising seniors to review their tax situation before assuming they qualify. The benefit is real, but it does not apply equally to everyone, and understanding the details matters more than ever.

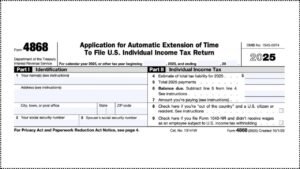

The Senior Tax Exemption is a tax deduction designed for citizens above a specific age, typically between 60 and 65. The goal is to help retirees living on fixed income sources such as pensions, social security payments, and retirement savings. Governments introduced this type of relief because earning opportunities usually decline after retirement. However, the New Senior Tax Exemption Raises Questions About Who Benefits because qualification depends heavily on taxable income. Some seniors receive full relief, others partial, and some none at all. Withdrawals from retirement accounts, part time income, and investment earnings can all affect eligibility, which is why many retirees now need financial planning before filing taxes.

Table of Contents

New Senior Tax Exemption Raises Questions About Who Benefits

| Key Feature | Details |

|---|---|

| Eligible Age | 60 to 65 years and above |

| Type Of Relief | Income tax deduction and possible property tax reduction |

| Income Limit | Full benefit below threshold and reduced above it |

| Maximum Deduction | Fixed amount deducted from taxable income |

| Property Requirement | Often applies to primary residence owners |

| Implementation Year | Effective from the current financial year |

| Phase Out Rule | Higher earners receive reduced benefit |

| Policy Purpose | Reduce financial pressure on retirees |

| Public Concern | Unequal benefit distribution |

Who Qualifies For The Exemption

- One major reason the New Senior Tax Exemption Raises Questions About Who Benefits is the qualification criteria. Age alone does not guarantee eligibility. Seniors must also meet income and residency conditions.

- Retirees living mainly on pension payments or government retirement benefits usually qualify without much difficulty. The situation becomes complicated for seniors who earn interest from savings, dividends from investments, or rental income. Even a small amount of additional income can move them above the eligibility threshold.

- This is where frustration appears. A retiree may not feel financially secure in everyday life but still lose eligibility because taxable income looks higher on paper. The difference between actual financial comfort and taxable income explains why so many retirees are confused.

Income Limits And Phase Out Rules

The policy uses a phased reduction. Seniors below a specific annual income receive the full deduction. Once income crosses the limit, the relief decreases gradually and eventually disappears. Income calculations usually include pension income, interest earnings, dividend payments, rental income, and retirement account withdrawals. Retirement withdrawals are the biggest surprise for many people. Seniors who carefully saved throughout their working life now find that withdrawing their own savings increases taxable income. Because of this, disciplined savers may lose the benefit. This is one of the biggest reasons the New Senior Tax Exemption Raises Questions About Who Benefits continues to be widely debated.

Property Owners Vs Renters

- Housing status plays a significant role in how helpful the policy actually is. Many versions of the exemption include property tax reductions for homeowners.

- Seniors who own a house can receive meaningful annual savings. Renters, however, often receive little or no equivalent relief.

- This difference has created a noticeable imbalance. In expensive cities, retirees who rent often spend a larger portion of their income on housing yet benefit less from the tax break. The New Senior Tax Exemption Raises Questions About Who Benefits particularly in urban areas where home ownership is already difficult.

Winners And Losers

- After reviewing the structure of the policy, financial analysts have identified clear groups that benefit the most.

- Biggest beneficiaries include homeowners with moderate pension income, retirees living in lower cost areas, and seniors who rely mainly on fixed pension payments.

- Limited beneficiaries include renters, retirees withdrawing savings, and seniors working part time.

- Working retirees are especially affected. Many older adults continue working because living costs are rising. Even small earnings can push them above the eligibility line, reducing or eliminating the tax relief.

Impact On Government Revenue

- Tax reductions always affect government income. Authorities support the policy by arguing that helping seniors reduces dependence on welfare programs and medical subsidies.

- However, economists warn about long term balance. When governments collect less tax from retirees, they may recover revenue through other taxes such as consumption or payroll taxes. This can shift the financial burden to younger working populations.

- Because of this, the New Senior Tax Exemption Raises Questions About Who Benefits not only among retirees but also among economists studying generational fairness.

Economic Effects

Retirees usually spend locally rather than saving extra money. When seniors receive tax relief, they tend to spend on groceries, medicines, utilities, and local services. This type of spending supports neighborhood businesses and service providers. Recent spending patterns show older households contribute significantly to local service economies. Even modest tax savings can improve local economic activity. However, if only a limited group receives relief, the broader economic impact remains smaller than expected.

Concerns About Fairness

- The public debate has shifted from generosity to fairness. Many retirees believe the policy is well intentioned but uneven in practice.

- The most common concerns include retirement savings being counted as income, renters receiving little benefit, and working seniors losing eligibility.

- These issues reinforce why the New Senior Tax Exemption Raises Questions About Who Benefits. Instead of helping all retirees, the policy appears to favor specific financial situations.

What Retirees Should Do

Retirees should not assume automatic qualification. Careful planning is now essential. They should review annual taxable income, plan withdrawal timing, consult a tax advisor, understand property tax rules, and track updated income thresholds. Even small financial adjustments can determine whether someone receives full benefits or none at all.

The Bigger Picture

- Retirement has changed significantly over the past two decades. People live longer, depend less on single pensions, and rely more on multiple income sources such as savings and part time work.

- Policies designed for older retirement models are struggling to match modern realities. The New Senior Tax Exemption Raises Questions About Who Benefits because it highlights the gap between traditional assumptions and current financial behavior.

- The policy will certainly help some retirees. For others, especially middle income seniors, the relief may be limited. The real impact will become clearer after several tax seasons, when retirees see whether their yearly expenses actually improve.

FAQs About New Senior Tax Exemption Raises Questions About Who Benefits

What Is the Purpose of The Senior Tax Exemption

The purpose is to reduce the tax burden on retirees who rely on fixed income and help them manage increasing living and healthcare expenses.

Does Every Senior Automatically Qualify

No. Eligibility depends on income limits, taxable earnings, and sometimes housing status.

Do Retirement Withdrawals Affect Eligibility

Yes. Withdrawals from retirement accounts are usually counted as taxable income and may reduce or remove eligibility.

Are Renters Eligible for The Same Relief as Homeowners

Often renters receive limited benefit because property tax reductions mainly apply to homeowners.