The latest Not All States Are Retirement-Friendly rankings comparing U.S. retirement conditions show a widening divide between affordable states with strong healthcare and high-cost states once seen as ideal retirement destinations. Nationwide analyses released in 2025–2026 found taxes, medical access, and housing affordability now outweigh warm climate in determining where Americans choose to retire.

Table of Contents

Not All States Are Retirement-Friendly

| Key Fact | Detail/Statistic |

|---|---|

| Top-ranked state | Wyoming ranked highest overall for retirees |

| Major factor | Healthcare access and affordability now primary drivers |

| High-cost challenge | Hawaii and California consistently near the bottom |

Researchers expect retirement migration to continue as the U.S. population ages and regional housing costs remain uneven. Future rankings will likely focus even more heavily on healthcare availability and long-term affordability, factors analysts say increasingly define where Americans choose to spend their later years.

What the Not All States Are Retirement-Friendly Rankings Measure

The Not All States Are Retirement-Friendly comparisons draw from multiple independent retirement studies conducted by financial researchers, insurance analysts, and policy institutes. While scoring formulas vary, most evaluate four major categories:

- affordability and cost of living for retirees

- quality and access to healthcare

- safety and environment

- community and lifestyle support

Demographic changes are central to the shift. The U.S. Census Bureau reports Americans aged 65 and older now account for over 17% of the population, and the share is projected to exceed 20% by 2034. The aging of the large baby-boomer generation is reshaping housing markets, tax bases, and healthcare demand nationwide.

“Retirement planning today is no longer about leisure alone,” said a senior retirement policy analyst cited in several national studies. “It is about managing medical costs and preserving savings for decades, not years.”

The Top 5 States for Retirees

According to recent national rankings that combine affordability, healthcare availability, and safety, these states consistently scored highest:

- Wyoming

- Florida

- South Dakota

- Colorado

- Minnesota

Why They Ranked Highly

Low taxes:

Wyoming and South Dakota have no state income tax. Many retirees keep their Social Security and pension income untaxed, which improves long-term financial stability.

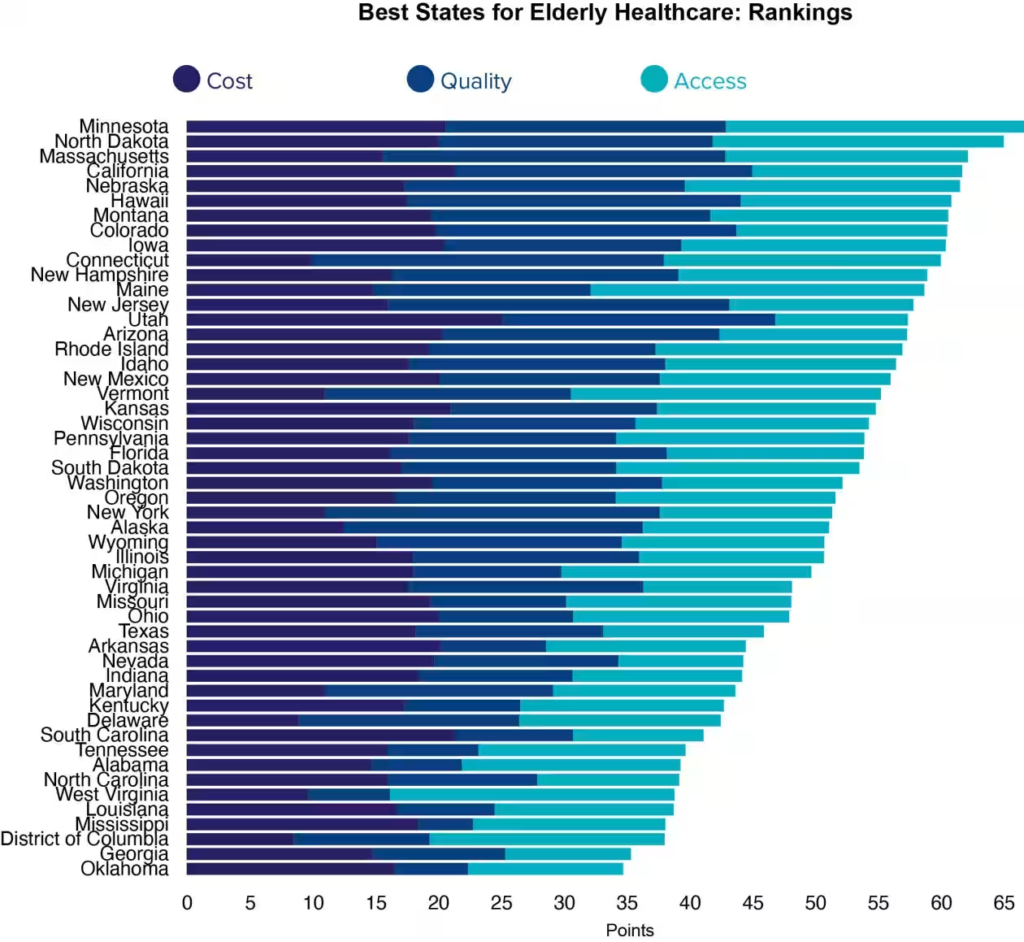

Healthcare strength:

Minnesota ranked highly due to hospital quality and physician availability. Colorado also scored strongly in preventive care access and active-lifestyle infrastructure.

Housing affordability:

Home prices in these states remain closer to national averages compared with coastal states, allowing retirees to buy property without exhausting savings.

Florida’s position remains notable. Although healthcare rankings are average, the absence of state income tax and an established senior support network — including assisted-living communities and medical specialists — helped its score.

Economists say affordability drives retirement migration trends. A university housing researcher reviewing interstate movement data noted, “Retirees are responding to long-term financial math. Living costs over 20–30 years matter more than temperature.”

The Bottom 5 States for Retirement

Across several independent studies, the lowest-ranking states were:

- Hawaii

- California

- Massachusetts

- New York

- Alaska

Why Popular Destinations Ranked Poorly

The primary reason was economic pressure.

High housing prices, insurance costs, and property taxes significantly affect people living on fixed retirement incomes. In Hawaii and California, median home values in many communities exceed $700,000, according to housing market estimates reviewed by financial analysts.

Healthcare access also affects rankings. Remote areas in Alaska, for example, may require long travel distances to reach hospitals or specialists.

Additionally, many northeastern states impose retirement tax policies that include partial taxation of pensions and investment income. For retirees dependent on savings withdrawals, taxation reduces annual spending power.

Why Weather Is No Longer the Main Factor

For decades, retirees moved primarily to warm southern states. Analysts say that pattern is changing due to three major factors:

Rising Healthcare Needs

Medical expenses increase sharply after age 70. States with hospital networks and geriatric specialists rank higher in retirement evaluations.

Housing Costs

Even retirees who own homes face insurance premiums, maintenance, and property taxes. In expensive areas, these costs can exceed monthly rental expenses in lower-cost states.

Tax Burden

States vary widely in retirement taxation. Some exempt Social Security benefits entirely, while others tax pension income or capital gains.

“Retirement decisions are increasingly actuarial,” said a financial planner interviewed for national retirement surveys. “People calculate where their savings will last the longest.”

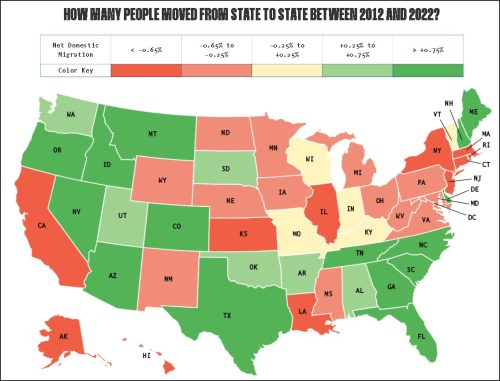

Retirement Migration Trends

Population data shows a steady shift from the Northeast and West Coast toward the Mountain West and parts of the Southeast. States such as Wyoming, Tennessee, and the Carolinas have gained retirees in recent years.

The trend accelerated after inflation increases from 2021 through 2024 raised food, housing, and insurance costs. Retirees, who often cannot increase income, are especially sensitive to rising expenses.

Financial Planning Implications

Financial advisors say relocation decisions often determine whether retirement savings last.

Key financial factors retirees now evaluate include:

- property taxes

- healthcare premiums

- prescription drug coverage

- home insurance

- transportation costs

Long-term care costs are also critical. Assisted-living and nursing care can exceed $90,000 annually in some regions, according to insurance industry estimates. States with lower care costs can significantly extend retirement savings.

Community and Quality-of-Life Considerations

Despite economic rankings, non-financial factors still matter. Surveys consistently show retirees prioritize:

- proximity to family

- safety

- community engagement

- transportation access

- walkability

Small college towns and mid-size cities often score well because they offer healthcare facilities, cultural activities, and lower housing prices. Urban planners describe these as “age-friendly communities,” designed with accessible sidewalks, transit, and medical services.

Broader Economic Impact

The movement of retirees influences local economies.

States gaining retirees see:

- growth in healthcare employment

- increased home construction

- higher demand for local services

States losing retirees may face reduced consumer spending and tax revenue. Economists say the redistribution of older residents could reshape regional economic development over the next two decades.

What Experts Say to Future Retirees

Financial planners caution that rankings are only a starting point.

Important considerations include:

- access to preferred doctors

- disaster risks such as hurricanes or wildfires

- social networks and family support

- future tax law changes

“Choosing a retirement location is effectively a multi-decade financial commitment,” said a certified retirement advisor quoted in planning studies. “Healthcare costs, not entertainment expenses, determine financial stability in old age.”

FAQ

What is the most important factor in choosing a retirement state?

Affordability and healthcare access now rank above weather and recreation.

Why do expensive states rank low?

High housing costs, insurance, and taxes reduce purchasing power for retirees living on fixed incomes.

Are Americans actually moving after retirement?

Yes. Population data shows consistent movement from high-cost coastal states to lower-cost interior states.

Do taxes matter more than climate?

In most studies, yes. Retirement tax policies significantly affect how long savings last.