Proposal to Add $200 a Month to Social Security: Support Grows for a Proposal to Add $200 a Month to Social Security is not just another political headline—it’s a real conversation affecting millions of American households. Across the United States, from small rural towns to big cities like Chicago, Dallas, and Los Angeles, seniors are watching their budgets tighten. An extra $200 per month may not sound life-changing to some, but for retirees living on fixed incomes, it can mean the difference between comfort and constant stress. As a professional who has worked in retirement planning and public benefits education for more than a decade, I’ve sat across kitchen tables and heard the same concerns: grocery bills climbing, medical co-pays stacking up, rent increases hitting hard. Folks say it plainly—“Everything costs more.” This proposal is being discussed because many lawmakers recognize that reality. And when policy meets real-life experience, that’s when change becomes possible.

Table of Contents

Proposal to Add $200 a Month to Social Security

Support Grows for a Proposal to Add $200 a Month to Social Security because inflation has placed measurable pressure on fixed-income households. While the proposal is temporary and still pending approval, it reflects a broader national effort to address economic realities facing retirees and disabled Americans. Understanding the facts—through official sources like the Social Security Administration, Congressional Budget Office, and IRS—helps Americans separate reliable information from online rumors. Whether this proposal passes or not, staying informed and planning responsibly remains the smartest move.

| Category | Details |

|---|---|

| Proposal Name | Social Security Emergency Inflation Relief Act |

| Proposed Increase | $200 per month |

| Duration | 6 months (Temporary) |

| Total Potential Benefit | Up to $1,200 per recipient |

| Estimated Beneficiaries | Over 66 million Americans |

| Current Average Retirement Benefit | About $1,907/month (2024 SSA data) |

| In Addition To | Annual Cost-of-Living Adjustment (COLA) |

| Official Source | https://www.ssa.gov |

What Is the Proposal to Add $200 a Month to Social Security?

The proposal, often referred to as the Social Security Emergency Inflation Relief Act, aims to provide a temporary $200 monthly increase to Social Security recipients. Lawmakers backing the measure argue that inflation has eroded purchasing power for seniors and disabled Americans.

According to the Social Security Administration (SSA), more than 66 million Americans receive Social Security benefits. These include:

- Retired workers

- Disabled workers (SSDI)

- Supplemental Security Income (SSI) recipients

- Survivors and dependents

An additional $200 per month would raise that average to roughly $2,107 during the relief period—an increase of about 10.5%.

Why Inflation Is Driving This Conversation?

To understand the support behind this proposal, you have to look at inflation.

According to the U.S. Bureau of Labor Statistics (BLS):

- Grocery prices have increased significantly since 2020.

- Housing costs remain elevated nationwide.

- Healthcare expenses continue rising faster than general inflation in some sectors.

While Social Security includes an annual Cost-of-Living Adjustment (COLA), that adjustment is calculated using the CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers). Some advocacy groups argue this measure does not fully reflect senior spending patterns, particularly healthcare.

For example, older Americans typically spend a higher percentage of their income on:

- Prescription drugs

- Medical equipment

- Medicare premiums

- Long-term care

These expenses can outpace general inflation. That’s why some lawmakers say the standard COLA formula doesn’t always keep up with real-world costs for retirees.

Who Would Qualify for the Proposal to Add $200 a Month to Social Security?

If passed, the proposal would apply broadly to individuals receiving:

- Social Security retirement benefits

- Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

- Certain veterans’ benefits

- Railroad Retirement benefits

According to SSA statistics:

- About 49 million retired workers receive benefits.

- Roughly 8 million disabled workers receive SSDI.

- Around 7.5 million Americans receive SSI.

Combined, that’s a substantial portion of the population relying on these programs for basic living expenses.

How the Legislative Process Works?

Before anyone sees an extra dollar, the proposal must move through Congress. Here’s how that process works in plain language:

First, the bill must pass the U.S. Senate.

Second, it must pass the U.S. House of Representatives.

Third, the President must sign it into law.

Until those steps are completed, the proposal remains under consideration.

How Payments Would Be Delivered?

If approved, the additional $200 would likely:

- Be automatically added to existing monthly payments

- Require no new application

- Follow the same payment schedule beneficiaries already receive

Recipients would not need to reapply or file special paperwork. That’s important because confusion around benefit changes can sometimes open the door to scams. The SSA never charges fees for benefit adjustments.

If you receive suspicious calls about “early access” or “special registration,” report them immediately to the SSA Office of Inspector General.

Difference Between COLA and the Proposed Increase

The annual Cost-of-Living Adjustment (COLA) is a permanent adjustment to Social Security benefits. It’s based on inflation data.

The proposed $200 increase would be:

- Temporary

- A flat dollar amount

- Intended as emergency relief

For example:

If COLA increases benefits by 3%, someone receiving $1,900 per month would see an increase of about $57.

The proposed $200 is separate and significantly larger in short-term impact.

Financial Impact on Households

Let’s talk real numbers.

Consider a retiree receiving $1,850 per month. Their expenses might look like:

- Rent: $1,100

- Groceries: $400

- Utilities: $200

- Medications: $150

- Miscellaneous: $200

That’s $2,050 in monthly expenses—already above their benefit.

An extra $200 would reduce that gap substantially.

For low-income beneficiaries, even modest increases improve financial security and reduce reliance on credit cards or family support.

What Economists and Policy Experts Are Saying?

Economists have mixed views.

Supporters argue the increase would:

- Boost consumer spending

- Reduce financial strain for seniors

- Provide targeted relief during economic pressure

Critics point out concerns about:

- Federal deficit impact

- Long-term sustainability

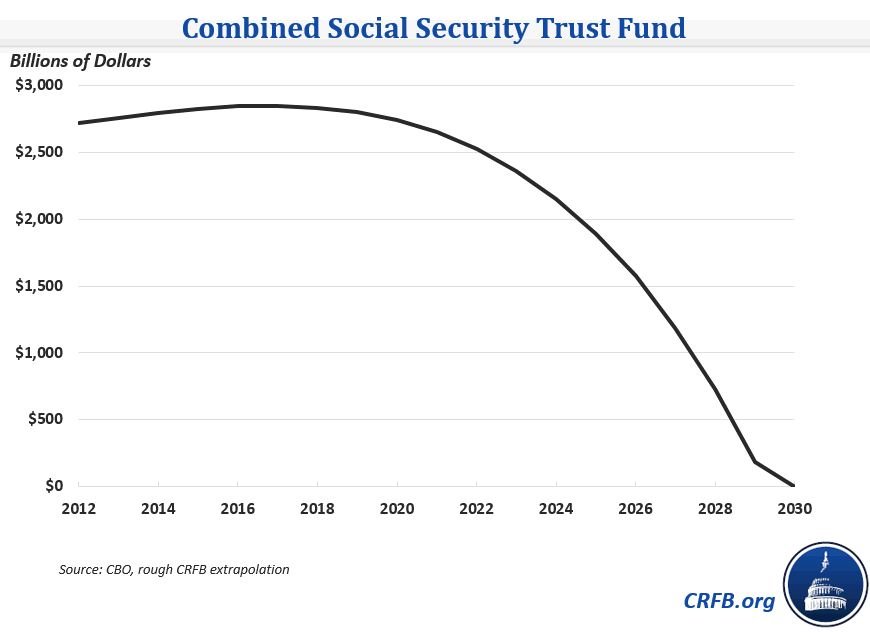

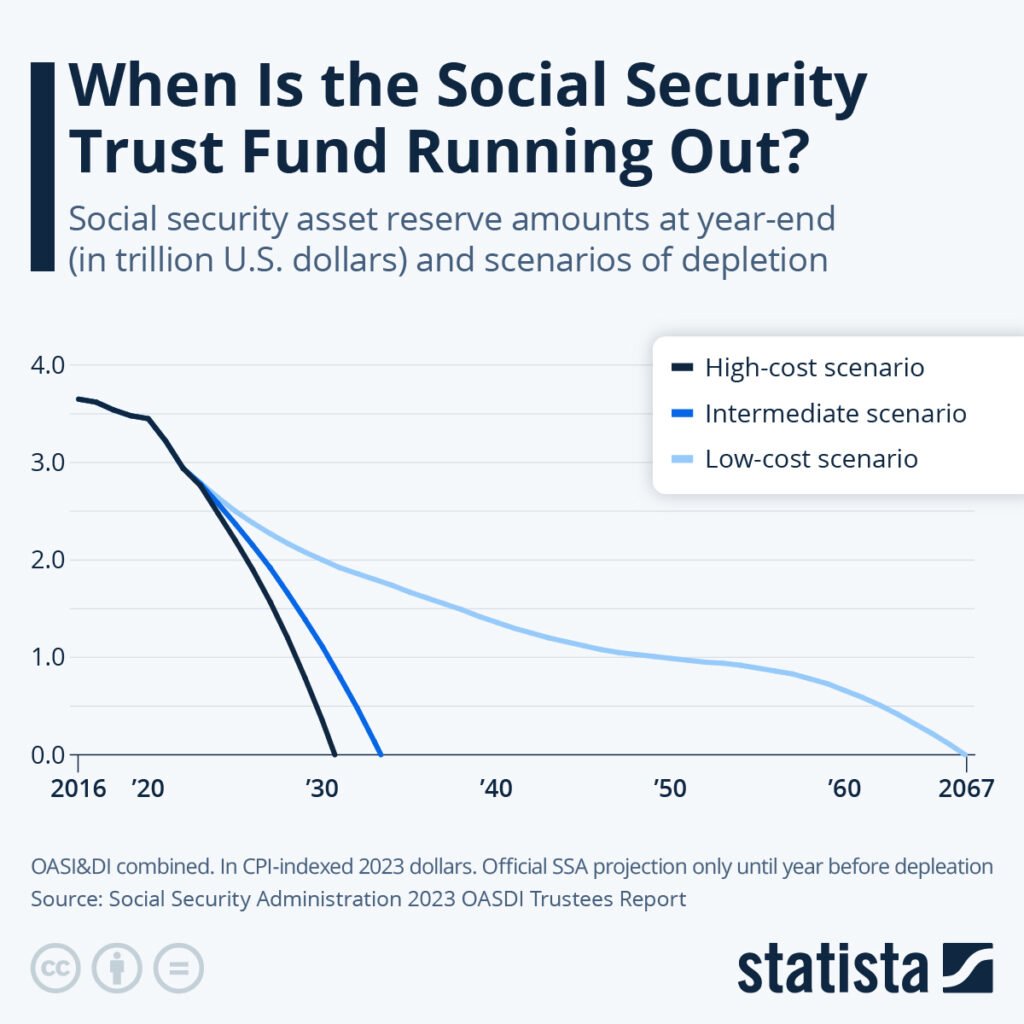

- Social Security Trust Fund projections

According to the Congressional Budget Office (CBO), the Social Security trust funds are projected to face funding shortfalls in the mid-2030s without reform.

Importantly, Social Security is not disappearing, but adjustments may be needed over time to maintain full benefits.

Broader Social Security Reform Discussions

The $200 proposal exists within a larger debate about the future of Social Security.

Some reform ideas include:

- Raising or eliminating the payroll tax cap

- Gradually increasing retirement age

- Adjusting benefit formulas

- Expanding benefits permanently

Each option carries trade-offs. Policymakers must balance fiscal responsibility with social protection.

Professionals in retirement planning are watching these discussions closely, as potential reforms impact long-term projections for clients.

Practical Advice for Beneficiaries

If you receive Social Security benefits, here’s what you should do:

First, stay informed through official sources like SSA.gov.

Second, log into your “my Social Security” account regularly.

Verify:

- Direct deposit details

- Address information

- Current benefit amount

Third, avoid scams. The Federal Trade Commission reports that government impersonation scams cost Americans billions annually.

Fourth, plan conservatively. Until legislation passes, do not adjust your budget expecting the additional funds.

Professional Perspective on Planning

As someone who advises retirees, I encourage clients to treat legislative proposals as possibilities—not guarantees. Financial plans should be built on confirmed income, not proposed income.

However, if the $200 increase is approved, it could:

- Improve short-term liquidity

- Reduce debt accumulation

- Provide breathing room for healthcare costs

Advisors should model both scenarios—approval and non-approval—to maintain responsible planning.

Social Security Releases 2026 Payment Schedule — Find Your Deposit Week

The Truth Behind the Rumored $200 Social Security Boost in 2026

It’s Official: U.S. Issues Urgent Warning to Airlines Over Surging SpaceX Debris Threat

Why This Matters for America’s Seniors?

For millions of Americans, Social Security is their primary source of income. According to SSA data, about 40% of beneficiaries rely on Social Security for at least half of their income.

That statistic alone shows how sensitive households are to changes in benefit levels.

An extra $200 per month is not about luxury vacations or fancy dinners. It’s about:

- Paying heating bills in winter

- Filling prescriptions on time

- Keeping up with rent increases

In many communities, especially rural areas and Native American reservations, Social Security plays an even larger economic role. It stabilizes households and supports local economies.