If you recently opened your benefit statement and noticed a bigger monthly deposit, you’re not alone. The Social Security Administration Fairness Law has quietly increased payments for many retirees, especially former public workers.

The Social Security Administration Fairness Law was designed to correct long-standing reductions that affected teachers, police officers, and other government employees who split their careers between public service and private employment. For many households, the extra money has provided real relief at a time when everyday expenses keep rising. But not long after the excitement, confusion began. Some retirees started receiving tax notices or saw their Medicare deductions increase. The higher payment was real, yet the financial picture became more complicated. Many beneficiaries discovered that their increased income pushed them into taxable territory even though their lifestyle had not changed much. What felt like a raise suddenly came with strings attached.

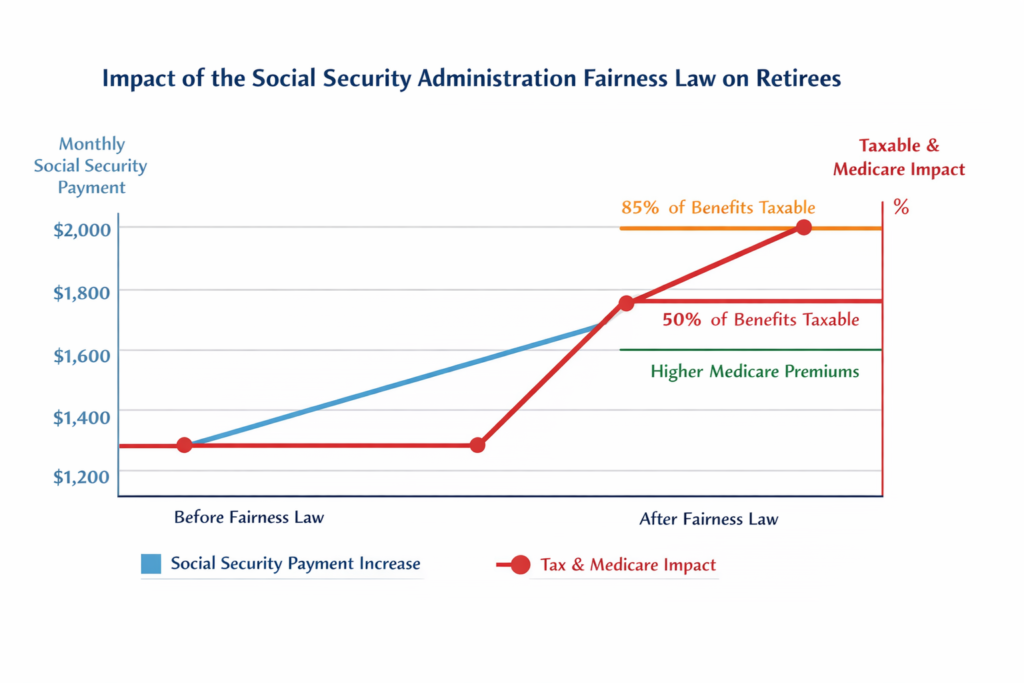

The Social Security Administration Fairness Law payments restored benefits that had previously been reduced by pension offset rules. In simple terms, people who worked in certain public jobs and also paid into Social Security during other parts of their careers were no longer penalized as heavily. Monthly checks increased. However, the same increase also raised something called provisional income. This is the formula used by the IRS to decide whether Social Security benefits become taxable. Once income crosses certain limits, up to 50 percent and sometimes 85 percent of benefits can be counted as taxable income. Many retirees never owed taxes on their benefits before, so the change came as a surprise. Understanding how this works helps retirees keep control of their finances and avoid unexpected bills.

Table of Contents

Social Security Administration Fairness Law

| Key Provision | What Changed | Who Benefits | Possible Tax Effect | What Retirees Should Watch |

|---|---|---|---|---|

| Pension offset adjustments | Reduction rules eased | Public-sector retirees | Higher taxable income | Review tax withholding |

| Monthly payment increase | Larger checks | Teachers, police, city workers | Benefits may become taxable | Estimate yearly income |

| Income calculation | Benefits included in provisional income | Married and single retirees | Higher tax bracket | Plan withdrawals carefully |

| Medicare impact | Income affects premiums | Middle-income retirees | Premium surcharge possible | Monitor Medicare deductions |

| Filing requirement | More retirees must file taxes | First-time taxpayers | Unexpected tax bill | Consider tax guidance |

The payment increase is good news. It helps retirees handle rising costs and provides more financial breathing room. But it also shows how interconnected retirement income really is. Social Security, pensions, savings withdrawals, and Medicare all influence each other. Understanding those connections is essential. A higher benefit is not just a larger payment. It is a financial event that affects taxes and healthcare costs. etirees who plan early can enjoy the added income with confidence. Those who ignore the tax side may face unpleasant surprises. The goal is simple. Keep as much of the benefit as possible while staying prepared for the rules that come with it.

Who Benefited the Most

- The Social Security Administration Fairness Law mainly helped retirees who spent part of their career in government service but also worked in the private sector. In the past, they faced reductions because of pension rules tied to jobs that did not pay Social Security taxes.

- Those who gained the most include public school teachers, police officers, firefighters, and city employees who later switched careers. Some retirees saw increases of $150 to $400 per month. Over a year, that becomes several thousand dollars, enough to cover insurance premiums, groceries, or rising utility costs.

- For many households living on fixed income, the increase restored a sense of stability. Some retirees even delayed dipping into retirement savings because their monthly budget finally balanced.

Why Taxes Suddenly Increased

- Here is where the confusion began. Social Security benefits are not automatically tax free. The IRS determines taxation using combined income, not just the benefit amount.

- Combined income includes adjusted gross income, tax free interest, and half of Social Security benefits.

- Because the Social Security Administration Fairness Law increased benefit amounts, it also increased this calculation. Even a modest payment boost could push retirees past taxation thresholds. Once the threshold is crossed, a portion of the benefit becomes taxable income.

- This does not mean retirees lose their benefits. It means the government counts part of the benefit when calculating income taxes. For someone who never had to file taxes before, the difference can be shocking.

The Threshold Problem

- The real issue lies in the income limits, which have not changed for decades.

- Single filers may see taxes applied once income exceeds $25,000 and higher taxation above $34,000. Married couples may face taxation above $32,000 and higher levels above $44,000.

- Because inflation has raised pensions and living costs over time, more retirees now cross these limits. The Social Security Administration Fairness Law simply pushed many households over the line for the first time.

- A retiree receiving only a few hundred dollars more each month could suddenly owe federal income tax even though their financial situation feels the same.

Medicare Premium Side Effects

Taxes were not the only surprise. Medicare premiums are also tied to income.

- Medicare reviews income from two years earlier. When income rises because of the Social Security Administration Fairness Law, retirees may enter a higher premium bracket. This system is called Income Related Monthly Adjustment Amount.

- The result is frustrating. A retiree might receive a larger Social Security payment but lose part of it through higher Medicare deductions. Some people noticed their deposit increase only slightly because premiums were automatically deducted.

How The Tax Calculation Works

Consider a simple example.

- A retiree previously received $1,500 per month. After the Social Security Administration Fairness Law, the payment rose to $1,800.

- That equals an extra $3,600 per year.

- Half of that amount counts toward provisional income. Add a pension and a small retirement account withdrawal and the total crosses IRS thresholds. Now a portion of Social Security becomes taxable.

- Many retirees discovered this only after filing taxes, when they received a bill they never expected.

Why Retirees Were Caught Off Guard

Several factors created confusion.

- First, Social Security does not automatically withhold taxes unless you request it. Second, many retirees grew up hearing that Social Security benefits were tax free. Third, the law increased payments but did not clearly explain the tax consequences.

- Because of these reasons, the Social Security Administration Fairness Law improved income but also created financial planning challenges for people who had never needed to think about taxation in retirement.

How To Reduce The Tax Impact

Fortunately, retirees have options.

- You can request voluntary tax withholding from Social Security so taxes are taken out monthly rather than owed all at once. You can also spread withdrawals from retirement accounts across multiple years to keep income below thresholds.

- Another helpful strategy is using Roth retirement accounts, which allow withdrawals without increasing taxable income. Reviewing finances annually and consulting a tax professional can also make a major difference.

- Planning ahead allows retirees to keep more of the additional income provided by the Social Security Administration Fairness Law.

What Retirees Should Do Now

- If your payment increased, take action early rather than waiting for tax season.

- Start by reviewing last year’s tax return. Estimate your total income including pensions, benefits, and withdrawals. Check Medicare deduction notices and adjust tax withholding if necessary.

- Proactive planning prevents large surprise bills. The Social Security Administration Fairness Law is helpful, but only when retirees understand how it fits into the broader financial picture.

The Bigger Picture

The law addressed a long-standing fairness issue. Workers who paid into Social Security during part of their careers now receive closer to what they earned. However, it also exposed a weakness in retirement taxation policy. The income thresholds were written decades ago and have never kept pace with inflation. As living costs rise, more retirees will likely encounter taxation even without major lifestyle changes. In other words, the Social Security Administration Fairness Law fixed one problem while highlighting another.

FAQs on Social Security Administration Fairness Law

1. Will everyone pay taxes after the Social Security Administration Fairness Law

No. Only retirees whose combined income exceeds IRS thresholds will owe taxes.

2. Does 85 percent taxable mean losing 85 percent of benefits

No. It only means that portion is counted when calculating taxable income.

3. Can I request tax withholding from Social Security

Yes. You can request voluntary federal tax withholding so you do not owe a large amount at the end of the year.

4. Why did my Medicare premium increase

Higher income from the Social Security Administration Fairness Law may place you in a higher Medicare premium bracket.