Social Security Releases 2026 Payment Schedule: The 2026 Social Security payment schedule is now available, and millions of Americans are tuning in to see when their next check will arrive. Whether you receive retirement benefits, disability (SSDI), survivor benefits, or Supplemental Security Income (SSI), it’s critical to know your deposit week to plan ahead financially. Understanding the timing of these payments can help avoid overdraft fees, late bills, and general financial stress — especially for retirees, caregivers, and those managing fixed incomes.

Table of Contents

Social Security Releases 2026 Payment Schedule

The 2026 Social Security payment schedule isn’t just about knowing dates — it’s about empowerment, peace of mind, and financial security. Whether you’re a retiree, disabled worker, survivor, or professional advisor, understanding when those checks arrive is vital.

| Feature | Details |

|---|---|

| Who Gets Paid | Social Security Retirement, SSDI, Survivor, SSI |

| Payment Dates | Based on birthdate or pre-1997 status |

| Main Groups | 1st–10th: 2nd Wednesday11th–20th: 3rd Wednesday21st–31st: 4th Wednesday |

| Pre-May 1997 Recipients | Paid on the 3rd of each month |

| SSI Recipients | Paid on the 1st of each month (early if it’s a weekend/holiday) |

| Direct Deposit Recommended | Yes, for faster, safer access |

| 2026 COLA Estimate | Pending — announced Oct 2025 |

| Official Payment Schedule (PDF) | SSA Calendar 2026 |

How the Social Security Releases 2026 Payment Schedule Works?

The Social Security Administration (SSA) uses a staggered payment system to avoid overwhelming banking systems. Your birth date determines which Wednesday of the month you get paid:

- Birthdays 1–10: Second Wednesday

- Birthdays 11–20: Third Wednesday

- Birthdays 21–31: Fourth Wednesday

If you started collecting benefits before May 1997, you receive your payment on the 3rd of the month, regardless of your birth date.

SSI Payments: Early Birds Get Paid Sooner

SSI (Supplemental Security Income) helps those with limited income and resources. These payments typically land on the 1st of each month, but there’s a catch — when the 1st is a weekend or holiday, you get paid early.

For example:

- January 2026 SSI check hits December 31, 2025

- November’s SSI comes on October 30, 2026

These early deposits are common and completely normal — not a mistake or bonus.

Full Social Security Releases 2026 Payment Schedule

| Month | SSI Date | Pre-1997 (3rd) | 1st–10th | 11th–20th | 21st–31st |

|---|---|---|---|---|---|

| January | Dec 31, 2025 | Jan 2 | Jan 14 | Jan 21 | Jan 28 |

| February | Jan 30 | Feb 3 | Feb 11 | Feb 18 | Feb 25 |

| March | Mar 2 | Mar 3 | Mar 11 | Mar 18 | Mar 25 |

| April | Apr 1 | Apr 3 | Apr 8 | Apr 15 | Apr 22 |

| May | May 1 | May 1 | May 13 | May 20 | May 27 |

| June | May 29 | Jun 3 | Jun 10 | Jun 17 | Jun 24 |

| July | Jul 1 | Jul 2 | Jul 8 | Jul 15 | Jul 22 |

| August | Aug 1 | Aug 3 | Aug 12 | Aug 19 | Aug 26 |

| September | Sep 1 | Sep 3 | Sep 9 | Sep 16 | Sep 23 |

| October | Oct 1 | Oct 2 | Oct 14 | Oct 21 | Oct 28 |

| November | Oct 30 | Nov 3 | Nov 10 | Nov 18 | Nov 25 |

| December | Dec 1 | Dec 3 | Dec 9 | Dec 16 | Dec 23 |

| Bonus: Jan 2027 | Dec 31, 2026 | — | — | — | — |

Understanding Social Security: What Each Benefit Means

Retirement Benefits

For workers aged 62 and older, retirement benefits provide partial to full income based on your earnings history. Full retirement age is currently between 66 and 67, depending on your birth year.

Disability Insurance (SSDI)

This benefit supports people unable to work due to a qualifying disability. SSDI recipients may also become eligible for Medicare after 24 months.

Survivor Benefits

Widows, widowers, and dependents of deceased workers may be eligible for monthly survivor payments, helping families maintain stability during a loss.

SSI

Unlike SSDI, SSI is need-based. It’s not tied to your work history. Instead, it’s for individuals 65+, blind, or disabled with limited income and resources.

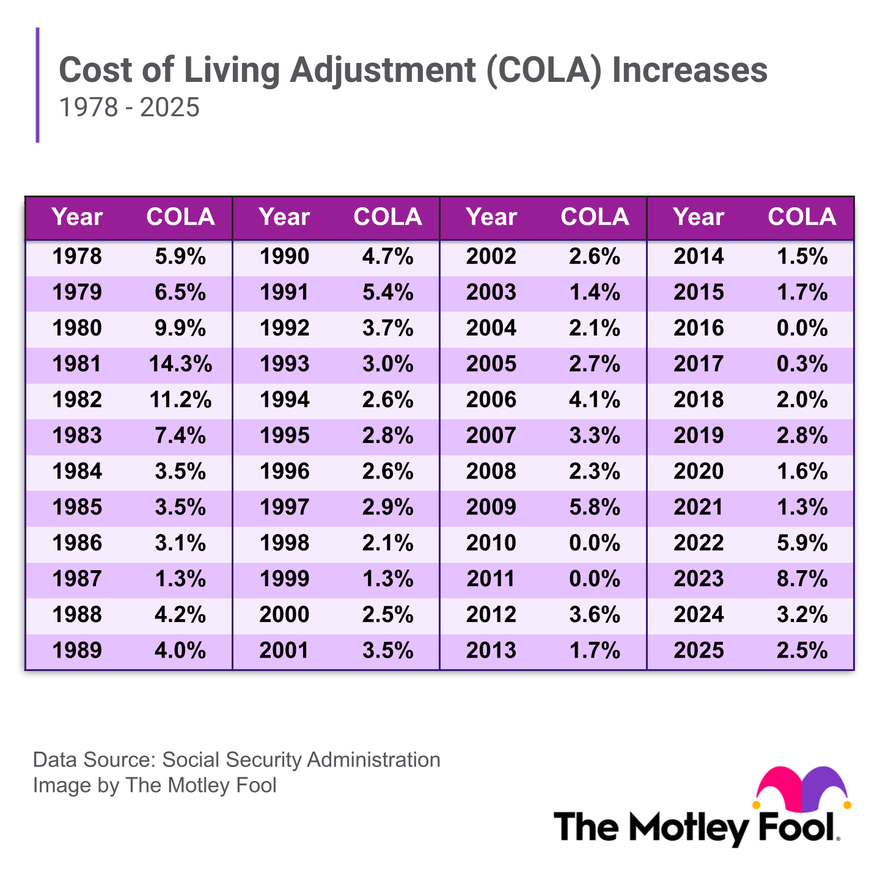

COLA in 2026: What’s Changing?

The Cost-of-Living Adjustment (COLA) helps Social Security keep pace with inflation. It’s calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Although the final number won’t be announced until October 2025, many analysts are predicting a COLA of 2.5% to 3.2% for 2026, due to stabilizing inflation trends.

The COLA will increase all Social Security benefit types: retirement, SSDI, SSI, and survivor.

What to Do If Your Social Security Release 2026 Payment Is Late?

If your deposit doesn’t arrive on time:

- Wait 3 full business days

- Log into mySSA.gov to confirm the deposit date

- Contact your bank

- Still missing? Call SSA at 1-800-772-1213

Most delays are due to banking errors, holidays, or updated account details. Always update your bank info through your mySSA account to prevent missed payments.

Real-Life Example: Maria’s Story

Maria, a 72-year-old retiree from New Mexico, was confused when she didn’t see her check on February 1st. After calling her bank, she found out that the 1st fell on a Saturday, so her SSI check had already arrived on Jan 30.

That’s why checking the official schedule in advance helps — it avoids stress and lets you plan better.

Updating Your Info: Direct Deposit, Address, or Bank

Want to switch banks or move to a new place? Here’s how:

To update:

- Visit mySSA.gov

- Log in with your username and password

- Go to “My Profile” > “Update Direct Deposit” or “Change Address”

- Follow the prompts and verify via text or email

Tip: Updates made after the 15th of the month might not apply until the next month’s payment.

Strategies to Maximize Your Social Security Benefits

Even if you’re already receiving benefits, it pays to know how to maximize your income:

- Delay retirement until age 70 for full benefits

- Coordinate spousal benefits if married

- Track your earnings record yearly to fix errors

- Consider tax implications if you’re working while receiving benefits

Why This Calendar Matters for Professionals?

Financial Advisors

Clients depend on accurate payout timing for cash flow and budget planning. Knowing these deposit weeks allows professionals to prevent overdraft risks and recommend proper investment strategies.

Caregivers & Nurses

In-home caregivers often manage multiple benefit recipients. Having a clear grasp of when funds are available can simplify caregiving duties and improve service quality.

HR and Payroll Managers

Educating employees approaching retirement helps ensure smoother transitions. Incorporating this calendar into internal resources like newsletters or exit materials boosts employee satisfaction and planning readiness.

The Truth Behind the Rumored $200 Social Security Boost in 2026

Could You Retire Comfortably in Your State? Social Security Payments Compared

A New Social Security Bill Could Add $200 a Month in 2026 — Here’s Why It’s Gaining Support