For many households, SSI Changes are more than a headline — they directly affect rent payments, grocery budgets, and access to basic needs. Supplemental Security Income supports older adults and people with disabilities who live on limited income, so even minor adjustments can feel major. When SSI Changes are announced each year, recipients usually wonder whether their monthly check will increase, whether eligibility rules will shift, and whether paperwork will become more complicated.

The reality is that most updates follow predictable patterns tied to inflation, federal budgeting, and administrative reviews. Understanding how the program works makes the news far less stressful. If you know what the Social Security Administration reviews and why, you can protect your payments, avoid overpayment notices, and plan your expenses with more confidence throughout the year.

Table of Contents

Upcoming SSI Changes

Each year, SSI Changes involve more than just a benefit increase. The Social Security Administration adjusts the Federal Benefit Rate using inflation data, modifies payment calendars, and expands verification procedures. Many recipients assume SSI Changes only bring higher payments, but they also bring compliance checks, reporting reminders, and eligibility reviews. Knowing how SSI Changes work helps beneficiaries prepare for redeterminations, maintain accurate records, and avoid payment suspensions. By staying organized and responding quickly to SSA notices, recipients can ensure uninterrupted financial assistance while adapting their monthly budgets to updated benefit amounts.

Overview of Key SSI Information

| Category | Key Details |

|---|---|

| Program Purpose | Monthly financial support for elderly, blind, or disabled individuals with limited income |

| Average Federal Payment | Around $943 monthly (individual) and $1,415 (couple) before adjustments |

| Payment Timing | Issued on the 1st of each month or earlier if weekend/holiday |

| COLA Adjustment | Annual inflation-based increase |

| Resource Limits | $2,000 individual / $3,000 couple |

| Reporting Rules | Income and living arrangement changes must be reported |

| Eligibility Reviews | Periodic SSA redetermination checks |

| Additional Benefits | Some states provide extra monthly supplements |

Cost-of-Living Adjustment (COLA) and Monthly Benefits

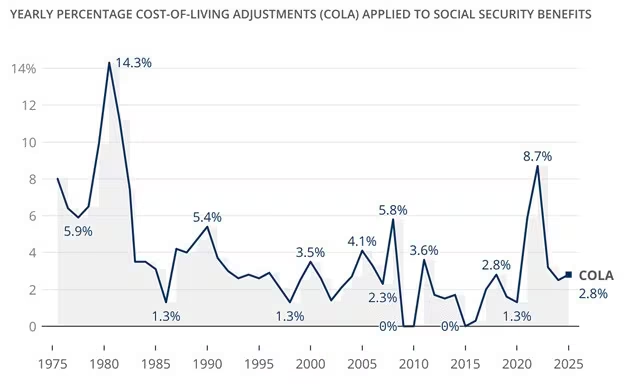

One of the most talked-about parts of SSI Changes is the cost-of-living adjustment (COLA). Inflation affects everyday expenses — groceries, transportation, utilities, and prescriptions — and without COLA increases, benefits would gradually lose value.

The SSA calculates the increase using national consumer price data. When prices rise, benefits increase automatically. Recipients do not need to reapply or submit paperwork.

However, there is an important detail many people overlook. A higher SSI payment can affect other assistance programs such as SNAP benefits or housing assistance. Your total support usually continues, but the distribution between programs may shift.

Payment Dates and Early Deposits

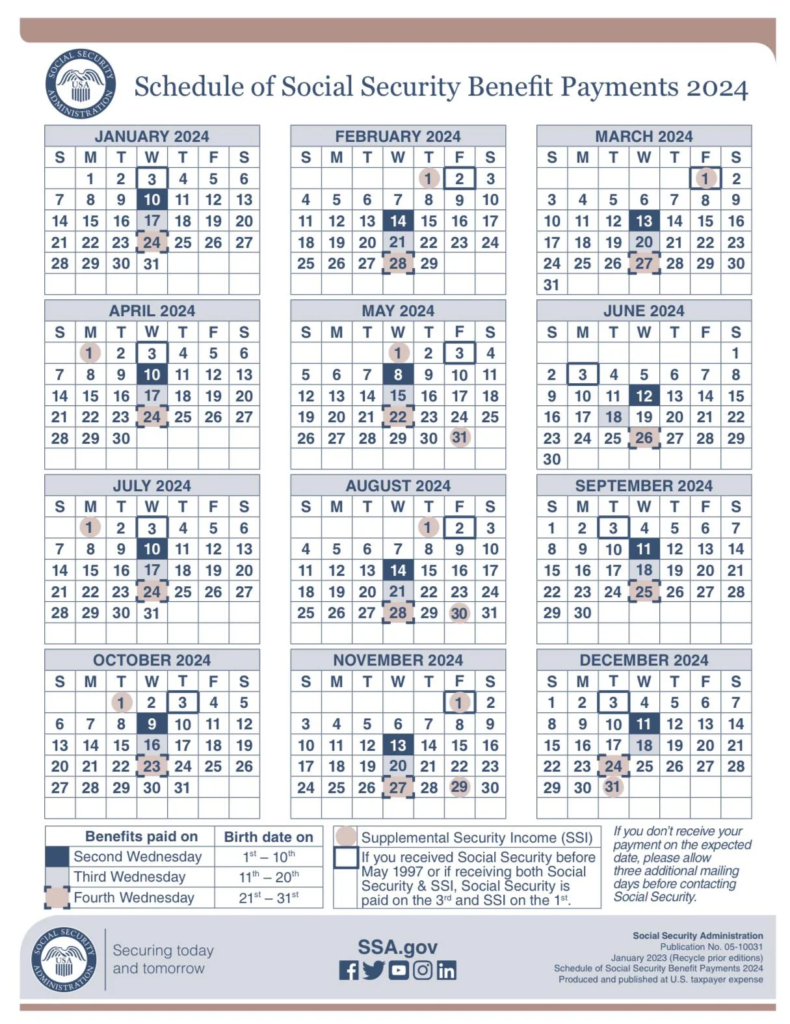

Payment timing is another area impacted by SSI Changes. Normally, SSI is paid on the first day of the month. But when the first falls on a weekend or federal holiday, payments are issued early.

This causes confusion every year. Recipients sometimes believe they received a bonus or extra benefit. In reality, the following month simply arrives early.

For example:

• If the 1st is Sunday → payment arrives Friday

• If the 1st is a holiday → payment arrives the business day before

Direct deposit is strongly recommended because funds arrive faster and safely. Paper checks can be delayed due to mail delivery problems or weather conditions.

Income Reporting Rules

Because SSI is a need-based program, reporting income is essential. One of the most important SSI Changes reminders is compliance reporting.

You must report:

• Wages from a job

• Self-employment income

• Financial support from others

• Marriage or divorce

• Moving to a new home

The biggest financial problem recipients face is not losing eligibility — it is overpayments. An overpayment happens when SSA pays more than allowed due to outdated information. Months later, recipients receive a repayment bill.

Timely reporting prevents this situation entirely.

Resource Limits and Eligibility Reviews

SSI Changes also include periodic redetermination reviews. The SSA checks whether your income and assets remain within program limits.

Current resource limits:

- $2,000 for individuals

- $3,000 for couples

Countable resources:

• Cash and bank balances

• Stocks and investments

• Extra vehicles

Non-countable resources:

• Primary home

• One vehicle

• Personal belongings

Responding quickly to review notices prevents benefit interruptions.

State Supplement Payments

In addition to federal SSI, some states provide a monthly supplemental payment. These payments vary widely depending on living arrangements and state policies.

If you move, you must notify SSA immediately. A relocation may increase or reduce your total payment amount.

Overpayments and Appeals

Overpayments are common but manageable. They usually occur due to delayed income reporting or administrative delays.

You can:

- Request reconsideration

- Request a waiver

- Arrange a payment plan

Responding quickly often reduces repayment.

How Recipients Can Prepare

Preparation is the best protection against problems caused by SSI Changes.

Simple steps:

• Keep bank records

• Track income monthly

• Report changes immediately

• Read SSA letters carefully

• Maintain a basic budget

These habits significantly reduce payment interruptions.

New Technology and Online SSA Accounts

A newer development connected to SSI Changes is the increased use of online Social Security accounts. The SSA now encourages recipients to manage benefits digitally.

Through an online account, you can:

• Check payment history

• Update direct deposit

• Report wages

• View official notices

• Download benefit verification letters

This reduces phone wait times and helps recipients handle paperwork faster. Many overpayment cases occur because mail notices were missed — online access solves that problem.

How SSI Works With Medicaid and SNAP

SSI eligibility often automatically qualifies recipients for Medicaid health coverage in many states. That means doctor visits, hospital care, and medications may be covered.

Food assistance programs also coordinate with SSI. When SSI Changes increase payments, SNAP benefits may slightly adjust. This is normal and does not mean assistance stops.

The programs are designed to work together, not replace one another.

Housing Assistance and SSI

Housing is usually the largest expense for SSI recipients. Many beneficiaries combine SSI with housing assistance programs such as Section 8 vouchers or public housing.

Landlords and housing authorities often request proof of SSI income. The SSA benefit verification letter — available online — satisfies this requirement.

Because rent in subsidized housing is tied to income, a COLA increase may slightly raise rent but typically still keeps housing affordable.

Common Mistakes That Reduce Benefits

Understanding SSI Changes also means knowing what mistakes to avoid.

Frequent issues:

• Not reporting a roommate

• Failing to report part-time work

• Holding too much in savings

• Ignoring SSA mail

• Accepting large cash gifts

Even small financial gifts can affect eligibility because SSI measures available support. Keeping records protects you.

Final Thoughts

SSI Changes may seem complicated at first, but they follow clear rules. Benefit increases protect purchasing power, reporting rules protect fairness, and eligibility reviews ensure aid reaches those who qualify.

For millions of Americans, SSI is essential income. Staying informed, organized, and proactive ensures uninterrupted benefits and financial stability. When recipients understand the system, they rarely face payment problems and can focus on daily living rather than administrative stress.

FAQs About Upcoming SSI Changes

1. Will SSI payments increase every year?

Usually yes. Most years include a cost-of-living adjustment based on inflation.

2. Why did I receive two payments in one month?

The next month’s payment was issued early because the first fell on a weekend or holiday.

3. Can I work while receiving SSI?

Yes. You can work, but your payment amount may be reduced depending on earnings.

4. What happens if I save too much money?

If countable resources exceed $2,000 (individual) or $3,000 (couple), payments may pause until balances drop.

5. How quickly should I report changes?

Within 10 days after the end of the month in which the change occurred.